The Trump administration has transferred hundreds of immigrants to El Salvador even as a federal judge issued an order temporarily barring the deportations under an 18th century wartime declaration targeting Venezuelan gang members, officials said Sunday. Flights were in the air at the time of the ruling.

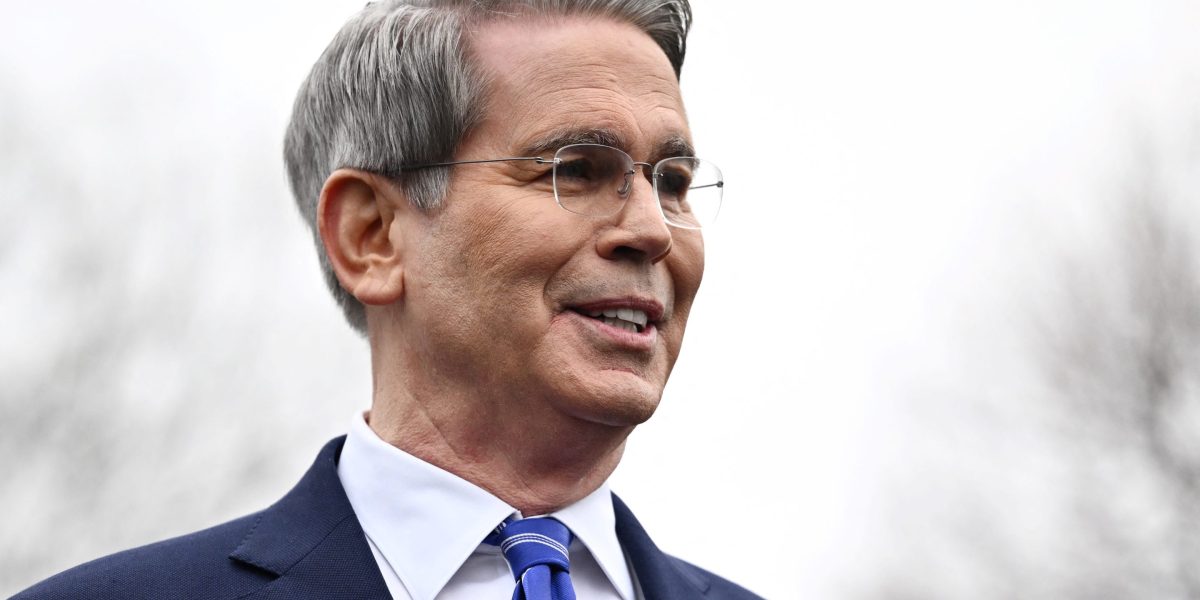

U.S. District Judge James E. Boasberg issued an order Saturday blocking the deportations, but lawyers told him there were already two planes with immigrants in the air — one headed for El Salvador, the other for Honduras. Boasberg verbally ordered the planes be turned around, but they apparently were not and he did not include the directive in his written order.

In a court filing Sunday, the Department of Justice, which has appealed Boasberg’s decision, said the immigrants “had already been removed from U.S. territory” when the written order was issued at 7:26 pm.

Trump’s allies were gleeful over the results.

“Oopsie…Too late,” Salvadoran President Nayib Bukele, who agreed to house about 300 immigrants for a year at a cost of $6 million in his country’s prisons, wrote on the social media site X above an article about Boasberg’s ruling. That post was recirculated by White House communications director Steven Cheung.

Secretary of State Marco Rubio, who negotiated an earlier deal with Bukele to house immigrants, posted on the site: “We sent over 250 alien enemy members of Tren de Aragua which El Salvador has agreed to hold in their very good jails at a fair price that will also save our taxpayer dollars.”

Steve Vladeck, a professor at the Georgetown University Law Center, said that Boasberg’s verbal directive to turn around the planes was not technically part of his final order but that the Trump administration clearly violated the “spirit” of it.

“This just incentivizes future courts to be hyper specific in their orders and not give the government any wiggle room,” Vladeck said.

The immigrants were deported after Trump’s declaration of the Alien Enemies Act of 1798, which has been used only three times in U.S. history.

The law, invoked during the War of 1812 and World Wars I and II, requires a president to declare the United States is at war, giving him extraordinary powers to detain or remove foreigners who otherwise would have protections under immigration or criminal laws. It was last used to justify the detention of Japanese-American civilians during World War II.

A Justice Department spokesperson on Sunday referred to an earlier statement from Attorney General Pam Bondi blasting Boasberg’s ruling and didn’t immediately answer questions about whether the administration ignored the court’s order.

Venezuela’s government in a statement Sunday rejected the use of Trump’s declaration of the law, characterizing it as evocative of “the darkest episodes in human history, from slavery to the horror of the Nazi concentration camps.”

Tren de Aragua originated in an infamously lawless prison in the central state of Aragua and accompanied an exodus of millions of Venezuelans, the overwhelming majority of whom were seeking better living conditions after their nation’s economy came undone during the past decade. Trump seized on the gang during his campaign to paint misleading pictures of communities that he contended were “taken over” by what were actually a handful of lawbreakers.

The Trump administration has not identified the immigrants deported, provided any evidence they are in fact members of Tren de Aragua or that they committed any crimes in the United States. It also sent two top members of the Salvadoran MS-13 gang to El Salvador who had been arrested in the United States.

Video released by El Salvador’s government Sunday showed men exiting airplanes onto an airport tarmac lined by officers in riot gear. The men, who had their hands and ankles shackled, struggled to walk as officers pushed their heads down to have them bend down at the waist.

The video also showed the men being transported to prison in a large convoy of buses guarded by police and military vehicles and at least one helicopter. The men were shown kneeling on the ground as their heads were shaved before they changed into the prison’s all-white uniform — knee-length shorts, T-shirt, socks and rubber clogs — and placed in cells.

The immigrants were taken to the notorious CECOT facility, the centerpiece of Bukele’s push to pacify his once violence-wracked country through tough police measures and limits on basic rights

The Trump administration said the president actually signed the proclamation contending Tren de Aragua was invading the United States on Friday night but didn’t announce it until Saturday afternoon. Immigration lawyers said that, late Friday, they noticed Venezuelans who otherwise couldn’t be deported under immigration law being moved to Texas for deportation flights. They began to file lawsuits to halt the transfers.

“Basically any Venezuelan citizen in the US may be removed on pretext of belonging to Tren de Aragua, with no chance at defense,” Adam Isacson of the Washington Office for Latin America, a human rights group, warned on X.

The litigation that led to the hold on deportations was filed on behalf of five Venezuelans held in Texas who lawyers said were concerned they’d be falsely accused of being members of the gang. Once the act is invoked, they warned, Trump could simply declare anyone a Tren de Aragua member and remove them from the country.

Boasberg barred those Venezuelans’ deportations Saturday morning when the suit was filed, but only broadened it to all people in federal custody who could be targeted by the act after his afternoon hearing. He noted that the law has never before been used outside of a congressionally declared war and that plaintiffs may successfully argue Trump exceeded his legal authority in invoking it.

The bar on deportations stands for up to 14 days and the immigrants will remain in federal custody during that time. Boasberg has scheduled a hearing Friday to hear additional arguments in the case.

He said he had to act because the immigrants whose deportations may actually violate the U.S. Constitution deserved a chance to have their pleas heard in court.

“Once they’re out of the country,” Boasberg said, “there’s little I could do.”

This story was originally featured on Fortune.com

Source link

Entertainment8 years ago

Entertainment8 years ago

Politics8 years ago

Politics8 years ago

Entertainment8 years ago

Entertainment8 years ago

Entertainment8 years ago

Entertainment8 years ago

Tech8 years ago

Tech8 years ago

Tech8 years ago

Tech8 years ago

Politics8 years ago

Politics8 years ago

Tech8 years ago

Tech8 years ago