Business

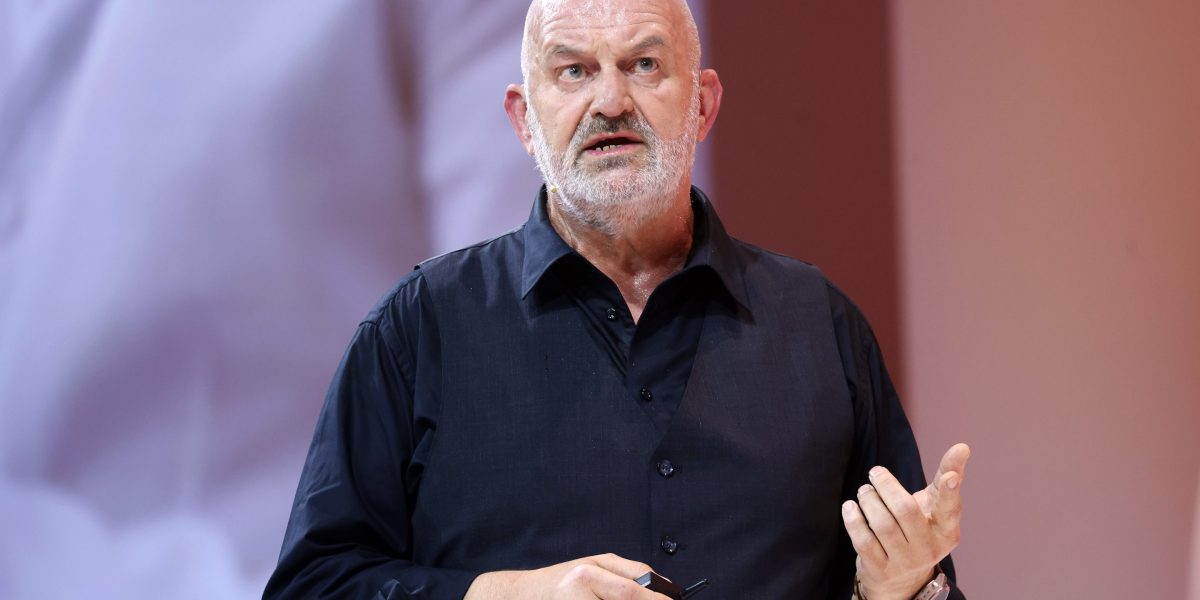

Amazon CTO Werner Vogels’s 2026 tech predictions include the ‘renaissance developer’

Published

2 months agoon

By

Jace Porter

Several years ago, Amazon Chief Technology Officer Werner Vogels began sharing predictions on how technology would likely impact our lives the following year. In the past, he has foreseen the impact of digital technology in sports, of AI assistants in developer productivity, machine learning embedded in production lines, and ‘fem tech’ on women’s health.

As CTO of Amazon (No. 2 on the Fortune 500) since 2005, he occupies a unique perch to see and even shape what’s next. Vogels also has a vested interest, of course, in embracing the technologies that his company creates. In this year’s forecast, Vogels predicts 2026 will be the year in which “interdisciplinary cooperation influences discovery and creation at a pace we haven’t seen since the Renaissance.” He sees technology becoming a force that will reduce loneliness, empower a new breed of developers, accelerate personalized learning, and spawn military technology that will quickly cross over to areas like health care. On a more cautionary note, he warns that breakthroughs in quantum computing will force a shift in how we handle cybersecurity.

Vogels’s 2026 predictions:

- Companionship is redefined for those who need it most

- The dawn of the renaissance developer

- Quantum-safe becomes the only safe

- Defense technology changes the world

- Personalized learning meets infinite curiosity

Vogels spoke with Fortune about the thinking behind this year’s predictions.

This interview has been edited and condensed for clarity.

Going through some of your past predictions, this set feels a little more somber this year. Is that fair to say?

I understand what you mean, but I do find that there is quite a bit of positivity in there. I think that the personalized learning one is a very interesting one. And I do think that the way that developers are going to change is a very positive thing.

You phrase it as the ‘dawn of the renaissance developer.’ What is that?

The Renaissance came after—what was it?—1000 years of the Dark Ages. The tools that were developed in those days were just incredible and I think that we’re going to see a similar kind of evolution, with more people inventing new technologies but also new applications.

I know loneliness sounds negative, but we’re getting older and the younger generation doesn’t want to take care of their parents so technology can help. Japan has really been inventing in that space.

Japan has been a first mover, given its demographics. As you point out, technology can also cause loneliness. Can it help younger generations, too?

Definitely. Younger people with autism, for example, have trouble touching other people but don’t have any trouble touching a mechanical device. The way that they communicate with that device is way more natural than how they communicate with adults or parents. Given my own background in the medical world, [Vogels previously worked in both health care and academic research, plus a startup, prior to joining Amazon in 2004] I’ve seen in the past how hard it was for kids to talk to a doctor. Having this huggable device with them gives them a lot more confidence to express what they’re feeling.

Amazon has built this little robot [the Amazon Astro] that can take on a lot of tasks but also goes looking through the house for you to ask you if you’ve taken your medicine. There’s a lot of things that go beyond loneliness.

There’s some concern that, with AI therapists or friends, people may find it easier to engage with a machine versus another human being. How do we make sure that technology doesn’t become a substitute for human interaction?

This is not my biggest concern. I’ve seen people prepare themselves before they go to a therapist by talking when there is nobody in the room. We can say whatever you want, and this device won’t judge you. A concern I have is that there may be companies in the future that will use these devices as advertising that suggest to you to buy product X, Y or Z. Given the amount of trust that you put into this device, that’s a big risk. We need to really be aware of that and either try to avoid it or detect it.

We already have advertising in our ambient world, especially with smart homes. Does it really matter if our robots also express some of those things that our fridge, our stove and our phones are already telling us?

I would have a different level of trust with devices that are there to help you with your loneliness or with your disease. I remember a guy in the early stages of dementia who could see that his caregivers were getting frustrated, because he kept asking, ‘What day is it today?’ The moment he got an Alexa, he only needed a sticker on it to say that she’s called Alexa, and he could ask her anything and Alexa would never get annoyed at being asked the same thing 10 times. There’s so much to help those who are suffering.

Do you worry about our ability to connect as human beings?

I have a great trust in humans. We enjoy social contact. I saw Jensen (Huang) recently and he was asked the question: Will AI eventually take over? He said, in some of our jobs, 10 to 20% may go to AI; in some of our jobs, it could be 50% but probably that’s it. As a job taker and as an efficiency tool, absolutely. As a social tool, no. We’re having a conversation, and we’re enjoying that, triggering parts of our brain that normally don’t get triggered. We are social animals.

Let’s move on to your optimism about developers.

The tools won’t take over. It is still our creativity, our understanding of the bigger picture, that will never be taken over by tools. A little task can be completed automatically. Systems consist of hundreds, if not thousands, of tasks. We are going to find new and better ways to design our systems, but there is still a significant human part in there.

There are people like you, who have a deep embedded knowledge of tech, as opposed to people like me, who now think we can vibe code our way to the next big thing, right?

If you want a one- or two-page website with a little database and you’re not terribly concerned about security; what would normally have taken you three weeks, now takes two hours? Absolutely. But that’s not what I want the guys in my bank to do. I want them to be deeply expert, both on the tech side as well as on the financial side, and understand how these things communicate with each other.

When you think of health care or financial systems, tools are strictly controlled through regulatory requirements. If something goes wrong, you can’t come to the regulator and say, ‘That was AI. That was not me.’ As such, I do think that there are things that we’ve done for years and will continue to do them. The fundamental skills for developers shouldn’t disappear.

In the past, we rewarded developers who had one really good skill, let’s say back-end developers. You still need to have this deep background, but you also need to understand what your technology is being used for and that is absolutely a renaissance approach. You need polymorphs like Da Vinci. It’s no longer enough to know one thing, you need to understand in what context this is happening, systems thinking. How do we create feedback loops? How do we make sure that, if you have all these different pieces, we make sure that if something happens here, it doesn’t go down the drain there?

That ties to your prediction about personalized learning-meets-infinite curiosity. People worry about AI users outsourcing their analysis and the sort of systems thinking that you’re advocating for.

I hope that with technology, we can bring more individualized learning to people. Our current educational system is driven towards conformity. Everybody needs to do the same thing. Creativity gets lost. Curiosity. We hammer that out of our children. We have all different interests, different capabilities. You need to educate kids on how to use these tools in order to unleash their potential.

Do you think this is a pivotal year for quantum?

Yes, but not necessarily for the quantum devices itself. We need to realize that bad actors are harvesting our data, not because they can decrypt it already now, but in four or five years they will. Everything you have encrypted now can be decrypted in five years’ time. Amazon has open-sourced technology such that you can encrypt your data so it will be safe on the quantum. The biggest challenge is not the big companies that have CIOs and CTOs and tons of developers, but all the home devices we have. How often have you updated the operating system on your home device? On my TV, never. There are major risks in the future if we do not address the quantum issue of encryption.

I’m curious about your prediction that we’ll see a compressed timeline from battlefield to civilian applications of defense technology. How transformational is that?

There are things in our civil world that would never have reached us if they had not been defense technology first, including the internet, GPS, the EpiPen. Usually it takes years to get the cost reductions and technology to be commercially viable. We’re now seeing a lot more military investment, and we’re seeing some defense companies start to operate more like tech startups than traditional defense contractors.

You’ve been CTO since 2005. How has your role or your mission evolved?

When I joined Amazon 21 years ago, there were different roles for CTOs. There are CTOs that report to the CIO and manage data centers. Startups sometimes have a CTO as their first employee and coder. I actually think CTOs are horrible managers. You should never put a CTO in charge of people.

Why not?

VPs of engineering wake up in the morning, thinking ‘Do I have the best team in the best situation? Can I shield them from all the things that are politics and stuff like that? The CTO thinks about, ‘What’s the next technology that we should be building?’ Actually, that was my role for many years within Amazon. Then you become a technology provider, and then your role changes again. You have to understand how your customers are actually using your technology. What kind of problems are you hearing from five or six different customers that are all the same, and you should be building technology for that.

What are you seeing that excites you?

I travel quite a lot because I like to know not only how the U.S. companies are using us, but how people in the Philippines and elsewhere use us. I’m seeing many young businesses that aren’t interested in becoming unicorns. They’re really interested in solving hard problems, things they saw in their own neighborhoods. In Kenya, for example, sometimes people make enough money for food but don’t have money left for the gas to cook it. So this young business, KOKO Networks, built a sort of ATM machine where you can go with a canister and put in 10 cents worth of gas. That interests me tremendously. How can we solve some of the world’s hardest problems by using technology? Especially in Africa, I’ve met so many motivated engineers that don’t want to come to the U.S.. They don’t want to go work for a large company. They want to solve the problem in their country. I love that. That’s where the real progress lies.

You may like

Business

One Trump proposal meant to prevent ‘nation of renters’ may make homeownership harder, experts say

Published

6 minutes agoon

January 21, 2026By

Jace Porter

President Donald Trump said he is reestablishing the American dream of homeownership, but one of his most recent housing policy proposals may put the dream even more out of reach, experts say.

Speaking Wednesday at the World Economic Forum in Davos, Switzerland, Trump touted his barrage of recent housing policy executive orders, including preventing institutional investors from buying single-family homes and attempting to lower mortgage rates by directing government-controlled mortgage finance firms Fannie Mae and Freddie Mac to purchase $200 billion in mortgage-backed securities.

“It’s just not fair to the public [that] they’re not able to buy a house,” Trump said Wednesday of institutional homebuying. “And I’m calling on Congress to pass that ban into permanent law, and I think they will.” Trump has also asked Congress to cap credit-card interest rates at 10%, which he claimed Wednesday “will help millions of Americans save for a home.”

Trump also spoke directly to Wall Street giants and institutional homebuyers at Davos, saying that “many of you are good friends of mine [and] many of you are supporters,” but “you’ve driven up housing prices by purchasing hundreds of thousands of single family homes.”

“It’s been a great investment for them, often as much as 10% of houses on the market,” Trump said. “You know, the crazy thing is, a person can’t get depreciation on a house, but when a corporation buys it, they get depreciation.”

One policy that went unmentioned during Trump’s Wednesday speech in Davos, and one experts say could carry potentially big risks and do little to address the root causes of high housing costs, is his proposal that would allow Americans tap their 401(k) savings for mortgage down payments, which now averages 19% of a home’s price. The current U.S. median home price is about $428,000, according to Redfin, meaning a down payment could amount to a whopping $81,000. Trump hasn’t put a dollar or percentage figure on the cap for the amount Americans could pull from their 401(k)s to use toward a down payment.

Trump’s final plan on allowing Americans to use their retirement savings for down payments would likely require congressional approval because it may involve changing the tax code. The proposal, announced Friday by Kevin Hassett, director of the National Economic Council, is Trump’s latest attempt to address growing concerns about affordability across the U.S. economy, especially in the housing market, and prevent America from becoming “a nation of renters,” as he said in his address at the World Economic Forum Wednesday.

Benefits of using 401(k) funds for a down payment

Trump’s idea has some benefits. The number of first time homebuyers has fallen to half of what it was about a decade ago, according to data from the National Association of Realtors. In addition, 22% of those who are able to buy their first home are already using either borrowed money or a gift from a friend or relative for their downpayment, according to the NAR.

While Americans can already withdraw up to $10,000 to pay for a home from individual retirement accounts (IRAs) without repaying it before age 59 ½ , this rule doesn’t apply to employer-sponsored 401(k)s, the most common retirement account, unless account holders pay a 10% penalty.

Americans can withdraw money without a penalty from their retirement plans for some exempted purposes such as recovering from a natural disaster and some medical expenses, but still have to pay income taxes on their tax-deferred accounts. These “hardship withdrawals” increased to 4.8% of participants in Vanguard retirement plans in 2024, up from 3.6% in 2023.

Most employer-sponsored 401(k)s also allow Americans to borrow for a limited time from their retirement savings penalty-free before 59 ½, including for a home purchase, as long as they repay the amount borrowed to the account with interest.

Given the limited options for accessing retirement accounts, the president’s proposal could help Americans in need of cash to unlock liquidity for a down payment. This could be especially helpful for those who may struggle to repay an IRA loan, Robert Goldberg, a finance professor at Adelphi University in Garden City, N.Y., told Fortune.

Drawbacks of using 401(k) funds for a down payment

Still, Goldberg warned swapping out the diversified investments of a 401(k) and concentrating a large chunk of their investment into one asset is risky. While some believe home prices always go up, the housing market collapse of 2008 showed this isn’t always the case.

“Imagine home prices drop so much that the home price goes not just down to the mortgage level, but to below the mortgage level, wipes out your equity position,” he said. “You would have lost your equity, your 401(k) equity. Bad outcome.”

Experts say Trump’s proposal also does little to address the supply side of the housing market, which has been largely frozen as homebuyers who bought in at lower interest rates prior to the pandemic have been hesitant to sell, Goldberg said. Giving more people the means to buy homes without adding more supply may inadvertently increase prices and lock more people out of the housing market, instead of making it more affordable, he argued.

“Some people will benefit from [Trump’s plan], but overall it will just be more competition for homes,” Goldberg said.

Yet, Trump’s proposal dealing with retirement savings is especially risky because it makes it easier for Americans to use crucial retirement savings meant for the future for non-retirement uses, said Jake Falcon, a chartered retirement planning counselor and the CEO of Falcon Wealth Advisors.

The median retirement savings for an American between the ages of 45 and 55 was $115,000 as of 2022, according to the Federal Reserve. Yet, this amount may not suffice for everyone, as some experts suggest the average person needs to have saved eight to 10 times their annual salary to retire comfortably.

“People, generally speaking, are more than likely behind, and this will just make them further behind,” Falcon said.

Given the bleak data on American retirement savings, Falcon said the government should make dipping into a retirement account for other uses harder instead of easier.

“Allowing people to raid their 401(k) doesn’t solve the problem,” he said.

Business

‘Let’s not be naive’: Ray Dalio warns the global rule-based order is already ‘gone,’ toppled by America’s debt crisis and raw power

Published

37 minutes agoon

January 21, 2026By

Jace Porter

Bridgewater Associates founder Ray Dalio, speaking to Fortune‘s Kamal Ahmed at the World Economic Forum in Davos, Switzerland, issued a stark warning to global leaders and business executives: Stop pretending the old rules still apply. In a candid assessment of the current geopolitical landscape, Dalio argued the fate of the post-World War II global order—much debated amid President Donald Trump’s pursuit of Greenland and unsettling of the NATO alliance—is a moot point.

“Let’s not be naive and say, ‘Oh, we’re breaking the rule-based system,’” Dalio said. “It’s gone.”

The billionaire founder of the largest hedge fund in history added that as a student of financial history, he pays close attention to the economic cycles of the last 500 years and sees cycles repeat themselves over time.

“And what I learned through that exercise is the same thing happens over and over again,” he said. “And it’s like a movie for me. It’s like watching the same movie happen.”

According to Dalio, five specific forces interact to drive the movie plot forward, with the “money-debt cycle” serving as the MacGuffin that kicks things off. The roots of the current instability, Dalio explained, lie in the monetary decisions made during the past several decades. Since 1971, when the U.S. under President Richard Nixon broke the dollar’s link to gold, Dalio notes, governments have consistently chosen to “print money” rather than allow debt crises to naturally play out. This behavior occurs when debt-service payments rise faster than incomes, squeezing spending. After more than half a century of this, he argued, repeating a consistent warning in his public remarks on the subject, the world is now witnessing a “breakdown of the monetary order,” evidenced by central banks altering their reserves and buying gold.

The previous day, Dalio had said in an appearance on CNBC’s “Squawk Box,” from the sidelines of the annual meeting in Davos, fiat currencies and debt as a storehouse of wealth were “not being held by central banks in the same way” anymore. He pointed to a decoupling in which the U.S. markets have underperformed foreign markets in specific metrics, a trend visible in the changing balance sheets of global central banks.

The core of Dalio’s concern lies in the transition from trade disputes to what he terms “capital wars.” He alluded to how U.S. Treasury bonds were the bedrock of global reserves for decades, but now, Dalio said the sheer supply of debt being produced by the U.S. is colliding with a shrinking global appetite to hold it.

“There’s a supply-demand issue,” Dalio noted, adding “you can’t ignore the possibility that … maybe there’s not the same inclination to buy U.S. debt.”

This reluctance is driven by geopolitical friction. According to Dalio, in times of international conflict, “even allies do not want to hold each other’s debt,” preferring instead to move capital into hard currencies. This shift forces the issuer of the debt to monetize it, a phenomenon Dalio summarized bluntly: “We’re increasingly buying our own money. That’s… the lesson of all this.”

As Dalio was speaking on Monday, markets weathered a global selloff as they digested the revelation that President Donald Trump was demanding U.S. possession of Greenland in revenge for not getting the Nobel Peace Prize in 2025. He had texted the Prime Minister of Norway Jonas Gahr Støre in anger about this, according to confirmed reports over the weekend, even though the Nobel Prize committee is separately operated from the government of Norway. But Dalio’s Tuesday remarks came amid calmer markets, as Trump reiterated his request for Greenland but clarified he would not authorize use of force to acquire it.

This economic instability feeds directly into the collapse of political norms, Dalio told Fortune on Wednesday. He argued the multilateral world order established in 1945—characterized by institutions such as the United Nations and the World Trade Organization—was arguably a “naive system” from the start, as it relied on representation without guaranteed enforcement.

“What happens when the leading power doesn’t want to abide by the vote?” Dalio asked. “Do you really expect that there’s going to be a United Nations vote or a World Court that’s going to resolve these things?”

The result, he argued, is a definitive shift from a multilateral system to a unilateral one. Dalio posited the central question of our time has become: “Who makes the rules, who enforces the rules, and how are you going to deal with that?”

Perhaps the most chilling aspect of Dalio’s analysis is the erosion of legal authority in favor of brute force. “Power matters more” than the law, he told Fortune, noting conflicts are increasingly decided by who controls the military, the police, and the National Guard. This trend is visible not only internationally but within nations, where democracy is threatened by populism and a growing belief the system is corrupt.

When asked if this rupture should strike fear into corporate boards and CEOs who have long relied on stable global rules, Dalio responded ignoring the truth is far more dangerous.

“I think what always scares me is the lack of realism,” he said.

Dalio advised leaders to stop relying on a dissolving rule-based system and instead focus on “jurisdiction questions,” seeking out places where people are “like-minded” and mutually supportive. Whether dealing with international boundaries or domestic regulations, Dalio insists businesses must now face the hard reality the era of assured legal protection is ending.

“Will law prevail?” Dalio asked. “Internationally, everybody is having to deal with that question.”

As confidence in institutions, the law itself, and fiat-denominated debt erodes, Dalio highlighted to CNBC the quiet but significant resurgence of gold. He emphasized gold should not be viewed merely as a speculative asset but as “the second-largest reserve currency” in the world. He noted in the previous year, gold was the “biggest market to move,” and it performed far better than tech stocks as central banks diversified their holdings. JPMorgan CEO Jamie Dimon had similar remarks in an interview with Fortune at the Most Powerful Women conference in October, when he said for the first time in his life, it had become “semi-rational” to have gold in your portfolio.

However, Dalio’s outlook was not entirely defensive. He said he sees the current era as a bifurcation between the decaying monetary order and a “wonderful technological revolution,” echoing Trump’s remarks onstage earlier that day about the “economic miracle” taking place. In that regard, at least, might may end up making right.

This story was originally featured on Fortune.com

Business

Jensen Huang says AI bubble fears are dwarfed by ‘largest infrastructure buildout in human history’

Published

2 hours agoon

January 21, 2026By

Jace Porter

Pushing back against growing skepticism regarding the sustainability of artificial intelligence spending, Nvidia CEO Jensen Huang argued against the mountain backdrop of Davos, Switzerland, that high capital expenditures are not a sign of a financial bubble, but rather evidence of “the largest infrastructure buildout in human history.”

Speaking in conversation with BlackRock CEO Larry Fink, the interim co-chair of the World Economic Forum, Huang detailed an industrial transformation that extends far beyond software code, reshaping global labor markets and driving unprecedented demand for skilled tradespeople. While much of the public debate focuses on the potential for AI to replace white-collar jobs, Huang pointed to an immediate boom in blue-collar employment required to physically construct the new computing economy.

“It’s wonderful that the jobs are related to tradecraft, and we’re going to have plumbers and electricians and construction and steel workers,” Huang said. He noted the urgency to erect “AI factories,” chip plants, and data centers has radically altered the wage landscape for manual labor. “Salaries have gone up, nearly doubled, and so we’re talking about six-figure salaries for people who are building chip factories or computer factories,” Huang said, emphasizing the industry is currently facing a “great shortage” of these workers.

Ford CEO Jim Farley has been warning for months about the labor shortage in what he calls the “essential economy,” exactly the type of jobs mentioned by Huang in Davos. Earlier this month, Farley told Fortune these 95 million jobs are the “backbone of our country,” and he was partnering with local retailer Carhartt to boost workforce development, community building, and “the tools required by the men and women who keep the American Dream alive.”

It’s time we all reinvest in the people who make our world work with their hands,” Farley said.

In October, at Ford’s Pro Accelerate conference, Farley shared that his own son was wrestling with whether to go to college or pursue a career in the trades. The Ford CEO has estimated the shortage at 600,000 in factories and nearly the same in construction.

Huang dismisses bubble fears

Fink brought up the bubble talk for a good reason: Fear of a popping bubble gripped markets for much of the back half of 2025, with luminaries such as Amazon founder Jeff Bezos, Goldman Sachs CEO David Solomon, and, just the previous day in Davos, Microsoft CEO Satya Nadella, warning about the potential for pain. Much of this originated in the underwhelming release of OpenAI’s GPT-5 in August, but also the MIT study that found 95% of generative AI pilots were failing to generate a return on investment. “Permabears” such as Albert Edwards, global strategist at Société Générale, have talked about how there’s likely a bubble brewing—but then again, they always think that.

Huang, whose company became the face of the AI revolution when it blew past $4 trillion in market capitalization (a bar recently reached by Alphabet on the positive release of its Gemini update), tackled these fears in conversation with Fink, arguing the term misdiagnoses the situation. Critics often point to the massive sums being spent by hyperscalers and corporations as unsustainable, but Huang countered the appearance of a bubble happens because “the investments are large … and the investments are large because we have to build the infrastructure necessary for all of the layers of AI above it.”

Huang went deeper on his food metaphor, describing the AI industry as a “five-layer cake” requiring total industrial reinvention, with Nvidia’s chips a particularly crunchy part of the recipe. The bottom layer is energy, followed by chips, cloud infrastructure, and models, with applications sitting at the top. The current wave of spending is focused on the foundational layers—energy and chips—which creates tangible assets rather than speculative vapor. Far from a bubble, he described a new industry being built from the ground up.

“There are trillions of dollars of infrastructure that needs to be built out,” Huang said, noting that the world is currently only “a few 100 billion dollars into it.”

To prove the market is driven by real demand rather than speculation, Huang offered a practical “test” for the bubble theory: the rental price of computing power as seen in the price of Nvidia’s GPU chips.

“If you try to rent an Nvidia GPU these days, it’s so incredibly hard, and the spot price of GPU rentals is going up, not just the latest generation, but two-generation-old GPUs,” he said. This scarcity indicates established companies are shifting their research and development budgets—such as pharmaceutical giant Eli Lilly moving funds from wet labs to AI supercomputing—rather than simply burning venture capital.

Beyond construction and infrastructure, Huang addressed the broader anxiety regarding AI’s impact on human employment. He argued AI ultimately changes the “task” of a job rather than eliminating the “purpose” of the job. Citing radiology as an example, he noted that despite AI diffusing into every aspect of the field over the last decade, the number of radiologists has actually increased. Because AI handles the task of studying scans infinitely faster, doctors can focus on their core purpose: patient diagnosis and care, leading to higher hospital throughput and increased hiring.

Fink reframed the issue, based on Huang’s pushback. “So what I’m hearing is, we’re far from an AI bubble. The question is, are we investing enough?” Fink asked, positing that current spending levels might actually be insufficient to broaden the global economy.

Huang appeared to say: not really. “I think the the opportunity is really quite extraordinary, and everybody ought to get involved. Everybody ought to get engaged. We need more energy,” he said, adding the industry needs more land, power, trade, scale and workers. Huang said the U.S. has lost its workforce population in many ways over the last 20-30 years, “but it’s still incredibly strong,” and in Europe, pointing around him in Switzerland, he saw “an extraordinary opportunity to take advantage of.” He noted 2025 was the largest investment year in venture capital history, with $100 billion invested around the world, mostly on AI natives.”

Huang concluded by emphasizing this infrastructure buildout is global, urging developing nations and Europe to engage in “sovereign AI” by building their own domestic infrastructure. For Europe specifically, he highlighted a “once-in-a-generation opportunity” to leverage its strong industrial base to lead in “physical AI” and robotics, effectively merging the new digital intelligence with traditional manufacturing. Far from a bubble, he seemed to be saying, this is just the beginning.

One Trump proposal meant to prevent ‘nation of renters’ may make homeownership harder, experts say

TMZ Streaming Live, Come Into Our Newsroom and Watch Things Happen!

AI bill of rights legislation clears its first Senate committee stop

Trending

-

Politics8 years ago

Politics8 years agoCongress rolls out ‘Better Deal,’ new economic agenda

-

Entertainment9 years ago

Entertainment9 years agoNew Season 8 Walking Dead trailer flashes forward in time

-

Politics9 years ago

Politics9 years agoPoll: Virginia governor’s race in dead heat

-

Politics9 years ago

Politics9 years agoIllinois’ financial crisis could bring the state to a halt

-

Entertainment9 years ago

Entertainment9 years agoThe final 6 ‘Game of Thrones’ episodes might feel like a full season

-

Entertainment9 years ago

Entertainment9 years agoMeet Superman’s grandfather in new trailer for Krypton

-

Business9 years ago

Business9 years ago6 Stunning new co-working spaces around the globe

-

Tech8 years ago

Tech8 years agoHulu hires Google marketing veteran Kelly Campbell as CMO