A special House Committee empaneled specifically to work on cutting or reducing property taxes advanced all eight proposals it was contemplating, setting the stage for a statewide fight over how far lawmakers should go and how the changes could impact local services.

The Select Committee on Property Taxes, led by Palm City Republican Rep. Toby Overdorf, moved the legislation along party lines, with Republicans pushing the measures through despite their Democratic colleagues’ objections.

Seven of the measures are proposed constitutional amendments that, if placed on the November 2026 ballot, would require 60% voter approval. One would make it harder for localities to increase millage rates while giving newlyweds extra relief.

Overdorf said at the four-hour meeting’s onset Thursday that information the committee had gathered over the past several months has made clear changes are needed.

“Local government property tax is increasing at an unsustainable rate and is causing undue financial burden on Florida’s citizens, homeowners and businesses,” he said. “It is time to put money back in the hands of Floridians.”

City and county officials told lawmakers the losses localities face under the proposals would force painful decisions, including service cuts that may imperil residents.

Treasure Island Fire Chief Tripp Barrs, who was elected President of the state Fire Chiefs Association in July, spoke of a glaring absence of an exception for fire services similar to carve-outs afforded to police and schools in all eight of the measures.

“Without an established alternative funding source, there will be a direct and unavoidable impact on service delivery,” he said, which could include “longer response times (and) possible staffing reductions (that would put) the lives of the citizens unnecessarily at risk.”

Charles Chapman of the Florida League of Cities warned that the proposals would devastate counties and cities in myriad ways. He noted that property taxes are a stable revenue source used to set cities’ credit ratings and any significant reduction would lead to lower credit ratings for them.

“This means cities will face higher interest rates for capital debt financing for infrastructure projects and, in turn, it will cost the taxpayers more for less benefit,” he said. “Without a viable revenue replacement plan, cities will be faced with some very tough choices to fund service.”

One oft-discussed way to replace lost property tax revenues would be to increase sales taxes. But that’s a regressive tax, House Democratic Leader Fentrice Driskell said, and it would disproportionately burden less well-to-do residents, particularly non-homeowners.

“There are fundamental differences in how many of us see this,” she said. “If part of the rationale of these property tax cuts are to help our families who are struggling with affordability, then why would we leave our local governments with options that would include imposing a greater tax burden on those who have the least ability to pay it?”

Republicans argued that local governments have grown beyond reasonable levels, referencing audits CFO Blaise Ingoglia has conducted of local governments that he said found more than $1.5 billion in wasteful spending across nine localities.

Something needs to change, said Rep. Monique Miller, a Palm Bay Republican.

“This is the taxpayers’ money,” she said. “They have the right to decide how it’s spent.”

Overdorf called the proposals “a line in the sand” and that localities “should have concerns about their budgets.”

“We’ve seen sometimes where the budgets may have been bloated,” he told reporters after the meeting. “Budgets may need to be tightened. So, I think that’s a very real concept that we need to be bringing those budgets back together.”

He added, “We will definitely get something on the ballot that will be addressing property taxes and will put money back into the pockets of Floridians.”

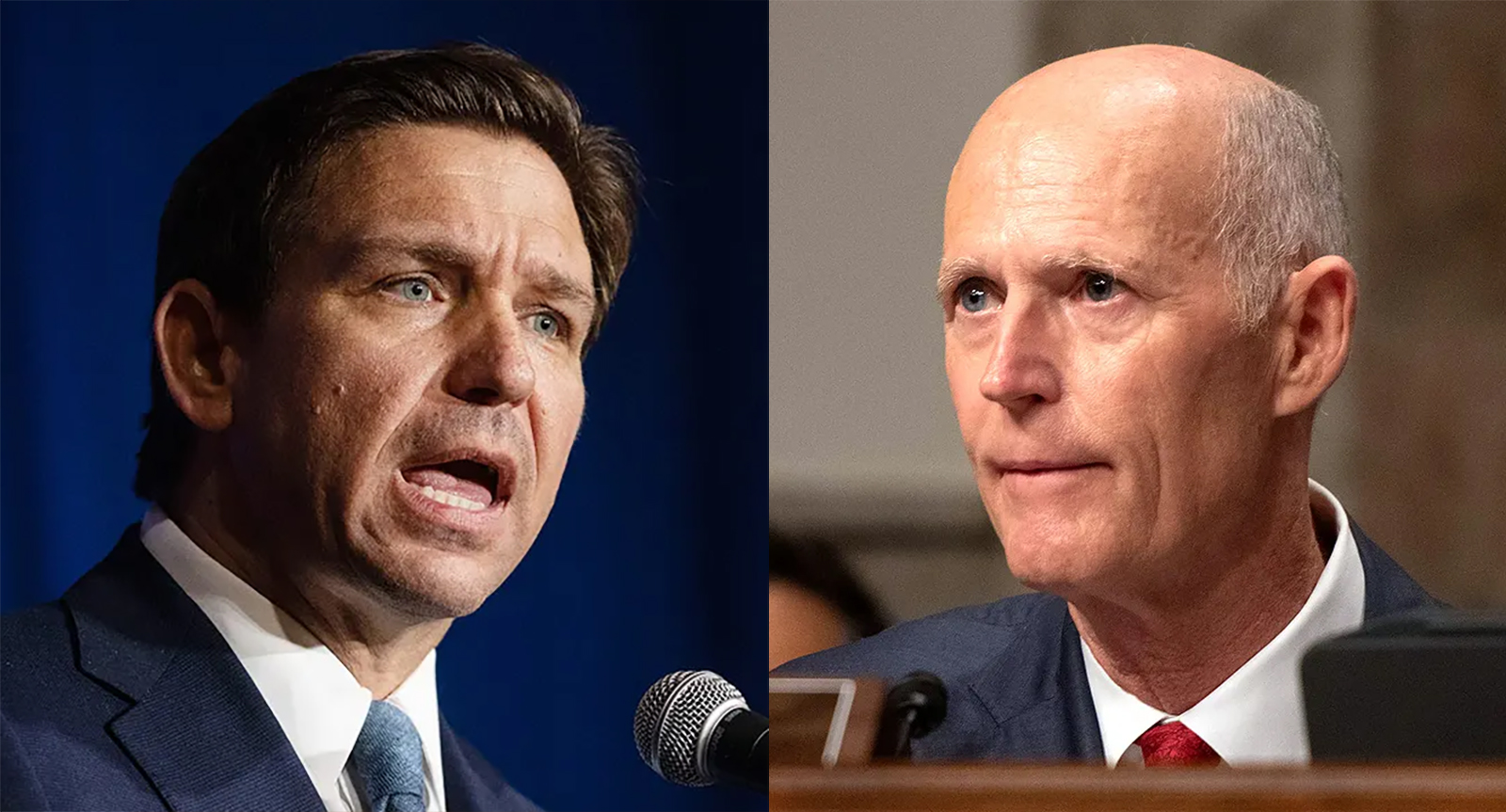

The eight proposals, which Speaker Daniel Perez unveiled in mid-October, have drawn criticism from Gov. Ron DeSantis despite his own push for significant tax cuts. He has bashed the House strategy as overly complicated, saying he favors a single, sweeping amendment that would eliminate all property taxes for homesteads, including school millage.

Former Speaker Paul Renner, who is running to succeed DeSantis, released an alternative plan this week, calling for legislation to force cities and counties to roll back their current rates and limit revenue increases as a proper route to further relief is decided.

Further complicating matters is the fact that no companions to the House proposals have been filed in the Senate.

The proposals include:

— HJR 201 by Rep. Kevin Steele: Eliminates non-school homestead property taxes outright. If approved, homeowners would no longer pay city/county non-school levies on their primary residence.

— HJR 203 by Rep. Monique Miller: Phases out non-school homestead property taxes over 10 years by adding a new $100,000 exemption each year to a homeowner’s non-school tax base. After a decade, the non-school portion on homesteads would be fully exempted.

— HJR 205 by Rep. Juan Porras: Exempts Florida residents over 65 from paying non-school homestead property taxes.

— HJR 207 by Rep. Shane Abbott: Creates a new homestead exemption for non-school taxes equal to 25% of a home’s assessed value. This broad exemption would cut bills for current homeowners and aid first-time buyers entering the market.

— HJR 209 by Rep. Demi Busatta: Establishes a property insurance relief homestead exemption by granting an additional $100,000 non-school exemption to homestead owners who maintain property insurance, linking relief to insured, more resilient homes.

— HJR 211 by Rep. Toby Overdorf: Eliminates the cap on “portability” of Save Our Homes (SOH) benefits, allowing homeowners to transfer their accumulated SOH differential to a new primary residence, even when the replacement home is of lesser value, thereby preserving long-built tax savings.

— HJR 213 by Rep. Griff Griffitts: Slows the growth in the assessed value of non-school homestead property taxes to 3% over three years for homestead property (currently it’s 3% per year) and 15% over three years for non-homestead property (currently at 10% per year).

— HB 215 by Rep. Jon Albert: Makes statutory changes, including requiring a two-thirds vote to increase millage rates and allowing newly married couples to merge their accumulated SOH benefits when establishing a shared household.

HB 215 is the only measure that would not require voter approval. Perez has said the House “does not need to limit itself to one single plan” and that multiple measures could appear on the ballot for voter consideration.

DeSantis has said that such a situation would confuse voters, making it so none of the measures pass.

Jack Cory, a lobbyist representing Jacksonville Beach, warned that based on current millage rates, HJR 213 alone would lead to $1.7 billion in lost services for the first year and $5.2 billion recurring.

If all the proposals were to pass, he said, it would cost — or immediately save taxpayers — $76 billion in lost services in fiscal year 2027-28, when implementation would begin, and $382 billion recurring.

He called it “the greatest attack on home rule in over 50 years.”

All eight measures still have additional committee stops before reaching the House floor.

Politics8 years ago

Politics8 years ago

Entertainment8 years ago

Entertainment8 years ago

Politics8 years ago

Politics8 years ago

Entertainment8 years ago

Entertainment8 years ago

Entertainment8 years ago

Entertainment8 years ago

Politics8 years ago

Politics8 years ago

Business8 years ago

Business8 years ago

Tech8 years ago

Tech8 years ago