Business

5 stocks to buy—and 5 to avoid—if 2026 brings a downturn

Published

3 weeks agoon

By

Jace Porter

It’s getting frothy out there. Pick any stock market metric, whether it’s the Nasdaq’s closing price or a more technical measure like the Shiller P/E ratio, and the number will look unusually large. Throw in crazy AI valuations, for privately held startups and publicly traded stocks alike, and what we’re seeing looks a lot like a bubble.

Perhaps this time is different. But note that phrase served as the ironic title of an acclaimed 2011 book by economists Carmen Reinhart and Kenneth Rogoff—a work whose subtitle is “Eight Centuries of Financial Folly.” In any case, if you’re one of many looking at your swollen portfolio with a mix of glee and dread, it may be time to consider a rebalancing act.

This section of this year’s Investor’s Guide offers some ideas on how to go about that. We offer tips on how to play defense in the current stock market (spoiler: Candymakers are a sweet bet for sour times). We also devote some space to stocks that might be best held at arm’s length; whatever these companies’ ultimate fates might be, these aren’t the times or the prices at which to be a buyer. And for optimists, we have a preview of some buzzy rumored IPOs coming next year. Choppy markets can make for attractively priced debuts: Perhaps you will find the next UPS, which went public right before the dotcom bust, or Visa, which listed on the eve of the 2008 financial crisis. We’ll also weigh in on gold and Bitcoin.

In the wake of Warren Buffett penning his final letter to investors, it feels fitting to say his most famous adage applies like never before: Be greedy when others are fearful, and fearful when others are greedy.

Playing defense: Stocks for a slowdown

Jim Masturzo, chief investment officer of multi-asset strategies at investment manager Research Affiliates, says a good first step is to diversify beyond stocks to TIPS (Treasury Inflation-Protected Securities) or commodities like gold. When it comes to equities, Roger AliagaDiaz, Vanguard chief economist in the Americas, advises embracing value stocks—stocks whose prices are low relative to their earnings. Not all value stocks are created equal, of course. Here are some categories and names to consider that are likely to fare well in an economic downturn (prices are as of market close Nov. 13):

Consumer plays:Amy Arnott, a portfolio strategist at financial services firm Morningstar, says companies that produce staples like food and cleaning products are less correlated with broader economic trends. Stocks in this “consumer defensive” category include Colgate-Palmolive (CL, $79), which makes toothpaste and other household items. In addition to selling goods that consumers will buy in any economy, “Colgate is unique in the fact that they are very globally diversified,” says Erin Lash, Morningstar’s director of consumer equity research.

Lash is also a fan of Mondelez International (MDLZ, $57), a candy, food, and beverage company, in part because it derives more than 70% of its revenue outside North America. “Confectionery in particular remains an affordable indulgence for consumers,” she says.

You’ve still got your health: Stocks in the health care sector, another recession-resistant industry, are another way to buffer your portfolio from market shocks. David Trainer, CEO of investment research firm New Constructs, likes HCA Healthcare (HCA,$473), which operates around 190 hospitals and 150 other health care facilities in the U.S. and U.K. “Demand for health care is going up like crazy,” says Trainer, adding that this trend, combined with HCA’s more-than-decade-long history of notching consistent profits, makes it a strong, undervalued play.

Energy hogs: Once-boring energy stocks became buzzy owing to the AI sector’s insatiable need for power, which has produced record-high electricity demand. But even if the AI boom goes south, energy businesses aren’t as risky as they seem, says Masturzo of Research Affiliates, because overall demand for power remains strong.

MPLX (MPLX, $52) is an Ohio company that owns oil pipelines and fuel transportation facilities. “As long as people need energy, they’re going to transport it,” says Trainer. Its price/earnings ratio in mid-November was 11, much lower than the average of 31 among the S&P 500.

“Anti-AI”: Arnott, the strategist at Morningstar, says that if investors are worried about the overvaluation of AI stocks, they could look to Buffett. The business legend’s Berkshire Hathaway (BRK.B, $513) is a conglomerate that Arnott describes as “an anti-AI play.” The firm derives much of its income from sectors like energy, railroads, and insurance—services that will be very much in demand even if the AI bull market turns bearish.

Don’t buy ’em now

In a frothy market all stocks are risky— and that’s doubly true for companies that may have soared too high in the recent boom, or that face harsh economic headwinds. Here are candidates to avoid, at least until business conditions revive or their prices come down to earth.

Circle (CRCL, $82) went public this summer in one of the most successful IPOs in history. That was then; now, the crypto firm is struggling to hold its value as interest rates, which directly impact Circle’s stablecoin revenue, are poised to decline. Circle’s share price is facing further pressure from the end of a lockup period for employee stock sales, and its ongoing struggle to control expenses.

Tesla (TSLA, $402) is on pace to record its worst year of profits since 2021. It’s also headed for a second straight year of shrinking sales in its car business. Still, the stock is trading at all-time highs. Why? Investors are likely betting that CEO Elon Musk will deliver on moonshot promises of self-driving cars and humanoid robots. Maybe Musk is worth his recently won $1 trillion pay package, but the likelihood of Tesla turbocharging its car sales in 2026 to match its current valuation seems out of this world.

Bears are sounding the alarm over inflated valuations for AI companies, and there’s perhaps no purer publicly traded AI play than CoreWeave (CRWV, $78). The company operates data centers across the U.S. and sells computing capacity to Microsoft, Google, and OpenAI. CoreWeave “is the poster child of the AI infrastructure bubble,” Kerrisdale Capital, an investment management firm shorting the company’s stock, wrote in September. The core of CoreWeave’s risk lies with its liabilities: To finance the construction of its data centers, it has incurred billions in debt and taken on hefty lease obligations. Can it juice its revenue to outpace that tsunami of liabilities?

Two words: prediction markets. That describes the business of upstarts Kalshi and Polymarket, which made their names offering odds on U.S. politics, but are fast expanding to other categories—including sports betting. This has left DraftKings (DKNG, $30) one of the most popular online sportsbooks, on its back foot. “Analysts are downplaying the tectonic shift that we believe is occurring in the sports betting market and DKNG,” wrote short-seller Spruce Point Capital Management in an October report.

After President Trump unveiled a sweeping set of tariffs on what he termed “Liberation Day,” swaths of companies saw their share prices tumble. Many have since recovered, but Deere (DE, $473), the venerable maker of John Deere agricultural and construction machinery, has continued to struggle. For the first three quarters of 2025, the company reported year-over-year decreases in net sales, and it’s been wrestling with the impact as trade wars play havoc with American farm exports—not a good sign for tractor sales.

IPOs to watch for in 2026

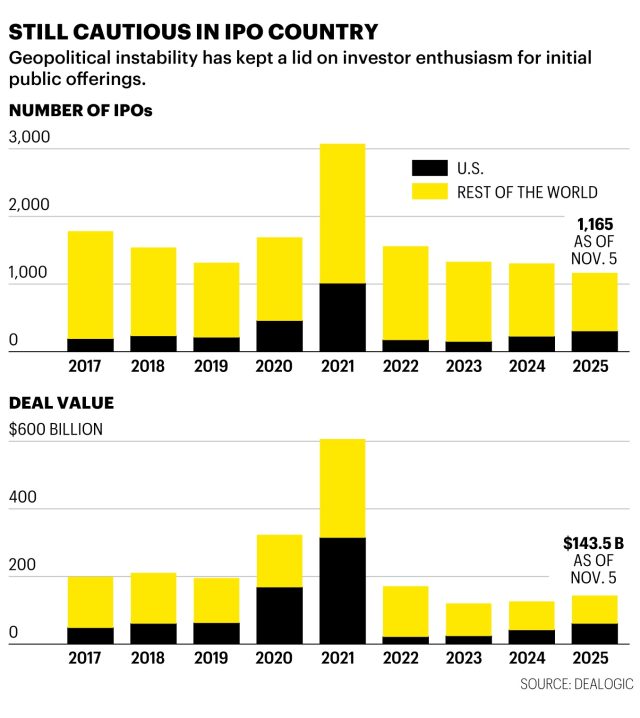

If 2024 amounted to an IPO drought, the 2025 IPO market has been more like a persistent drizzle. That, more or less, bodes well for an even steadier stream of public debuts in 2026.

“The IPO market is not closed,” says Merritt Hummer, partner at Bain Capital Ventures. “It’s just curated, and I think that’ll continue to be the case.

That cautious but decidedly positive sentiment is a bigger deal than it may appear on the surface. After IPOs soared in 2021 amid near-zero interest rates and stay-athome investor mania, the past few years have been muted. According to Dealogic, there were 1,010 IPOs in the U.S. in 2021, including marquee brands like Rivian, Bumble, and Robinhood. Over the next three years, however, the market collectively mustered only 546 more public offerings, with just a handful of big names in the mix.

Then came 2025, which through Q3 has seen more than 300 U.S. IPOs, including blockbuster debuts from CoreWeave, Circle, and Figma. It was a decent but not great year in the view of market watchers, but they’re bullish on 2026. “Everything is set up for a much more positive year, because multiples are still pretty strong for tech in the public markets,” says Kyle Stanford, PitchBook director of research for U.S. venture capital.

Geopolitical instability has fueled post-2021 stagnation in the IPO market, as have higher interest rates. But that stagnation means the bench for potential venture-backed IPOs runs deep with companies that have been biding their time.

There are obvious giants waiting in the 2026 wings, the most notable of which is Databricks, a cloud platform for AI and data analytics valued north of $100 billion. Long discussed as an inevitable public company, Databricks has a key advantage that will be essential for any company looking to go public at a premium: an AI angle.

“Anything with an AI story is getting a premium,” says Mary D’Onofrio, Crosslink Capital partner. “Databricks, for example, had $4 billion of run rate revenue, and AI products were providing $1 billion of it…Anything that can touch on AI, which tugs on the purse strings and the willingness to buy of customers, suggests ongoing growth.”

This is equally true for other names attracting IPO buzz, including Canva, which in 2024 acquired Leonardo.ai, leveraging the startup to launch new AI-flavored products. (The successful IPO of fellow design unicorn Figma is being cited as evidence of Canva’s readiness.) There’s also Deel, an HR platform valued at around $17 billion, which makes its AI case by investing in automation. (Notably, none of these companies are making the kinds of massive infrastructure investments that have some industry watchers worried about an AI bubble.)

All this AI talk evokes the question: What about OpenAI? It’s not impossible, but most watchers think OpenAI won’t take the leap into public markets until 2027.

Meanwhile, the most underrated IPO story of 2026 could very well be fintech. This year saw the likes of Chime, Klarna, and Circle go public, and unicorns like Plaid and Rapyd are rumored to be waiting in the wings.

“Chime and Circle showed that fintechs with clear profitability paths can perform well, and that gave the market confidence again,” says Aditi Maliwal, Upfront Ventures general partner and early Chime investor. “‘Profitability’ wasn’t a word anyone was using in the 2012 to 2019 runup. And now it’s the most important term we talk about and are thinking about for next year.”

Others tech firms to watch out for: cybersecurity company 1Password, fleet management software provider Motive, and fitness tracking app Strava.

But a word of caution: A host of factors could rain on this parade. PitchBook’s Stanford doesn’t expect a recession, but says that if one materialized it would stymie the IPO pipeline. And then there are the unpredictable dynamics of the AI boom. David Chen, Morgan Stanley’s head of global technology investment banking, thinks much of the current hype will create serious long-term value. But not every AI-fueled rise will live up to that hype.

“It kind of reminds me of when I started in this industry in 1999,” Chen says. “If expectations aren’t met…you’ll have a lessening of interest temporarily, which always happens in tech. There are always winners and losers.”

Can gold and Bitcoin sustain their runs?

Gold has always been the ultimate safe haven in times of economic trouble. But these days, a growing number of market watchers say investors should opt instead for digital gold—a popular nickname for Bitcoin. Owing to the rules governing its creation, there will only ever be 21 million Bitcoins in circulation, which is a big reason fans say it should be treated as a permanent store of value, just like the famous yellow metal. “It’s the only place you can go that’s independent from government inflation,” says David Pakman, a managing partner at the venture capital firm CoinFund. “It’s the kind of asset you’ll hand down to your kids—you must own it.”

It’s clear many people agree with Pakman, based on Bitcoin hitting a record-high price of around $125,000 in October, and seeing its market cap swell to over $2 trillion. The World Gold Council and prominent goldbugs, who used to ignore Bitcoin, now regularly denounce it, recognizing competition.

Does this mean gold’s days as the safest of assets are numbered? Hardly. As of November, Bitcoin’s market cap was only around 7% of the total value of all above-ground gold. What’s more, gold has been on an unprecedented tear this year, hitting $3,000 an ounce for the first time in March, and $4,000 less than six months later.

The eye-popping runs have left goldbugs and Bitcoin believers ecstatic. But Mike McGlone, a senior commodities strategist with Bloomberg Intelligence, says he is experiencing a different emotion. He describes himself as “frightened” by the soaring prices of numerous commodities, including gold, and believes a major correction is coming that could see the price of the yellow metal drop 25% or more.

McGlone says he is especially skeptical of Bitcoin’s trajectory after attending an investing summit in Naples where he witnessed people stand and clap whenever someone mentioned the cryptocurrency. “This is classic peak market stuff,” he warned, predicting that Bitcoin could fall to around $50,000 in the coming year.

Indeed, there are signs that the crypto rally, fueled by the launch of Bitcoin ETFs and the Trump administration’s favorable regulatory policies, is running out of gas. In early November, the currency dipped below the $100,000 mark and has since floated closer to that level than to its all-time high. Pakman, though, is taking the long view. “It’s just the greatest asset ever created,” he said. “Bitcoin has performed better than any asset over 11 of the last 14 years. —Jeff John Roberts

This article appears in the December 2025/January 2026 issue of Fortune with the headline “What to buy, and not buy, in 2026.”

You may like

Business

OpenAI COO Brad Lightcap says code red will ‘force’ focus, as ChatGPT maker ramps up enterprise push

Published

20 minutes agoon

December 9, 2025By

Jace Porter

OpenAI’s Chief Operating Officer Brad Lightcap says the company’s recent ‘code red’ alert will force the $500 billion startup to “focus” as it faces heightened competition in the technical capabilities of its AI models and in making inroads among business customers.

“I think a big part of it is really just starting to push on the rate at which we see improvement in focus areas within the models,” Lightcap said on stage at Fortune’s Brainstorm AI conference in San Francisco on Tuesday. “What you’re going to see, even starting fairly soon, will be a really exciting series of things that we release.”

Last week, in an internal memo shared with employees, OpenAI CEO Sam Altman said he was declaring a “Code Red” alarm within the organization, according to reports from The Information and the Wall Street Journal. Altman told employees it was “a critical time for ChatGPT,” the company’s flagship product, and that OpenAI would delay other initiatives, including its advertising plans to focus on improving the core product.

Speaking at the event on Tuesday, Lightcap framed the code red alert as a standard practice that many businesses occasionally undertake to sharpen focus, and not an OpenAI specific action. But Lightcap acknowledged the importance of the move at OpenAI at this moment, given the growth in headcount and projects over the past couple of years.

“It’s a way of forcing company focus,” Lightcap said. “For a company that’s doing a bazillion things, it’s actually quite refreshing.”

He continued: “We will come out of it. I think what comes out of it that way will be really exciting.”

In addition to the increasing pressure from Google and its Gemini family of LLM models, OpenAI is facing heightened competition from rival AI lab Anthropic among enterprise customers. Anthropic has emerged as a favorite for businesses, particularly software engineers, due to its popular coding tools and reputation for AI safety.

Lightcap told the audience that the company was focused on pushing enterprise adoption of AI tools. He said OpenAI was developing two main levels of enterprise products: user-focused solutions like ChatGPT, which boost team productivity, and lower-level APIs for developers to build custom applications. However, he noted the company currently lacks offerings in the middle tier, such as tools are user-directed but also have deep integration into enterprise systems, like AI coding assistants that employees can direct while tapping into the organization’s code bases. He said the company was also prioritizing further investments to enable enterprises to tackle longer-term, complex tasks using AI.

Business

AI isn’t the reason you got laid off (or not hired), top staffing agency says

Published

51 minutes agoon

December 9, 2025By

Jace Porter

AI is not the main reason most people are losing their jobs right now; weak demand, economic headwinds, and skill mismatches are doing more of the damage, according to the latest quarterly outlook from ManpowerGroup, one of the largest staffing agencies in the world. While automation and AI are surely reshaping job descriptions and long‑term hiring plans, the first-quarter 2026 employment outlook survey suggests workers without the right mix of technical and human skills are far more exposed than those whose capabilities match what employers say they need.

ManpowerGroup claims its Employment Outlook Survey, launched in 1962, is the most extensive forward-looking survey of its kind, unparalleled in size, scope, and longevity, and one of the most trusted indicators of labor market trends worldwide. Looking ahead to the turn of the year, the survey says employers around the globe still plan to hire, but at a slower pace and with fewer additions to headcount than earlier in the pandemic recovery.

Globally, 40% of organizations expect to increase staffing in the first quarter and another 40% plan to keep headcount unchanged, yet the typical company now anticipates adding only eight workers, down steadily from mid‑2025 levels. Large enterprises with 5,000 or more employees have cut their planned hiring roughly in half since the second quarter of 2025, underscoring just how much large employers are tightening belts even as they keep recruiting in priority areas.

Regional patterns are uneven. North America’s employment outlook has dropped sharply year on year to one of its weakest readings in nearly five years, while South and Central America and the Asia Pacific–Middle East region report comparatively stronger optimism. Europe’s outlook is muted, with only a small decline from last year, suggesting that many employers there are in wait‑and‑see mode rather than embarking on aggressive expansion or deep cuts.

Talent shortage, not job shortage

Despite cooling hiring volumes, 72% of organizations say they still struggle to find skilled talent, only slightly less than a year ago, reinforcing the idea that there is a talent shortage, not a work shortage. Europe reports the most acute pressure, with nearly three‑quarters of employers citing difficulty filling roles, while South and Central America report the least, though two‑thirds of companies in that region are still affected.

The survey suggests shortages are particularly severe in the information sector and in public services such as health and social care. In those fields, three‑quarters of organizations report difficulty finding the right people, even as some workers in adjacent roles complain of layoffs and stalled careers, highlighting the growing gap between available workers and the specific skills employers require.

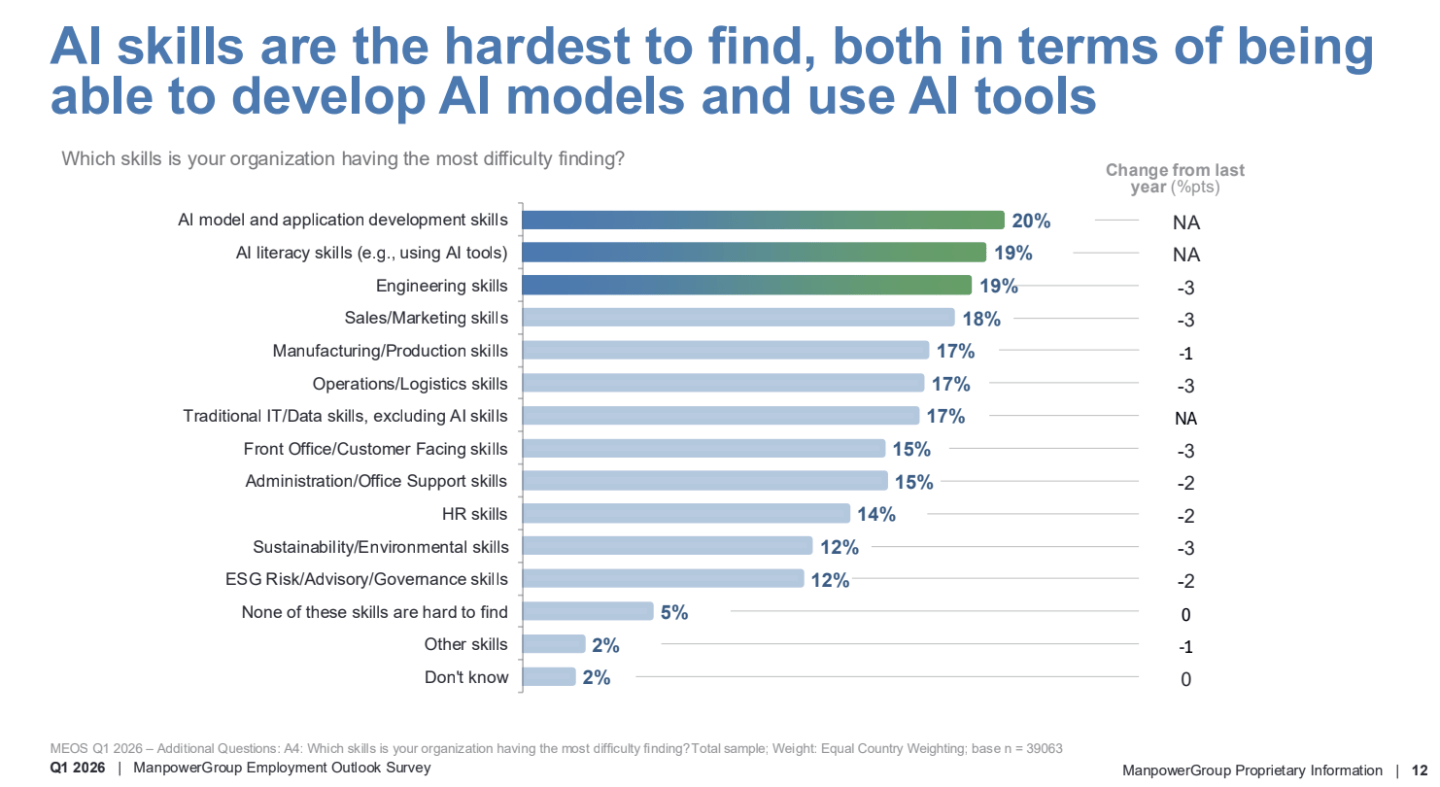

AI skills are scarce, but AI isn’t the axe

If AI were the primary driver of layoffs, employers would not simultaneously report that the hardest capabilities to find are AI‑related. Yet 20% of organizations say AI model and application development skills are the most difficult to hire for, and another 19% say the same about AI literacy, meaning the ability to use AI tools effectively; in Asia-Pacific and the Middle East, these shortages are even more pronounced.

At the same time, when firms do reduce staff, they mostly blame the economy, not automation. Employers who expect to downsize cite economic challenges, weaker demand, market shifts, and reorganizations as the top reasons for cuts, with automation and efficiency improvements playing a secondary role and affecting only certain roles or functions. Changes in required skills appear at the bottom of the list of stated reasons for staff reductions, suggesting that technology is transforming jobs more often than it is eliminating them outright.

Skills mismatch at the heart of layoffs

The report points to a widening skills mismatch as a central fault line in the labor market. Employers say the skills needed for their services have changed, creating new roles in some areas while making other roles redundant, and they struggle to rehire for positions that require capabilities many displaced workers do not yet possess. For organizations that are adding staff, nearly a quarter say advancements in technology are driving that hiring, but they need workers with the right expertise to fill those tech‑driven roles.

Courtesy of ManpowerGroup

Outside of hard technical skills, hiring managers are clear about what they want: Communication, collaboration, and teamwork top the list of soft skills, followed by professionalism, adaptability, and critical thinking. Digital literacy is also rising in importance, especially in information‑heavy sectors, making it harder for workers who lack basic comfort with technology to compete even for nontechnical jobs.

Rather than replacing workers with machines outright, many employers are trying to bridge the gap by retraining the people they already have. Upskilling and reskilling remain the most common strategies for dealing with talent shortages, ahead of raising wages, turning to contractors, or using AI and automation explicitly to shrink headcount.

Larger companies are particularly invested in this approach, with the share of organizations prioritizing upskilling rising along with firm size. Employers in every major region report plans to train workers for new tools and workflows, reflecting the recognition that technology’s rapid advance will demand continuous learning rather than one‑time restructurings.

The big grain of salt for this survey is that it is limited to the next quarter. In the case of a worse long-term downturn, all bets could be off about just how many jobs could be automated with AI tools. This question is beyond the scope of the Manpower survey, but Goldman Sachs economists tackled the issue in October, writing, “History also suggests that the full consequences of AI for the labor market might not become apparent until a recession hits.” David Mericle and Pierfrancesco Mei noted that job growth has been modest in recent quarters while GDP growth has been robust, and that is “likely to be normal to some degree in the years ahead,” noting an aging society and lower immigration. The result is an oxymoron: “jobless growth.”

Until the era of jobless growth fully arrives, though, the Manpower survey suggests that growth will consist of hiring humans who have the right AI skills, whatever those turn out to be.

For this story, Fortune journalists used generative AI as a research tool. An editor verified the accuracy of the information before publishing.

Business

American farmers warn Trump’s $12 billion bailout isn’t enough to solve trade, pricing woes

Published

1 hour agoon

December 9, 2025By

Jace Porter

President Donald Trump has delivered on his promise to provide aid to U.S. farmers hit by his sweeping tariff policy, but that hasn’t freed the agriculture industry from their worries of tight margins and volatile markets.

On Monday, Trump, alongside Treasury Secretary Scott Bessent, Agriculture Secretary Brooke Rollins, and National Economic Council director Kevin Hassett, announced a $12 billion farm aid program, which outlined much-needed relief for farmers who sounded the alarms about increasing input costs and fewer export opportunities amid ongoing trade tensions. Farmers will begin receiving funds by the end of February, Rollins said.

“Now we’re once again in a position where a president is able to put farmers first,” Trump said at a Monday roundtable of farmers and lawmakers. “But unfortunately, I’m the only president that does that.”

While farmers and agricultural economists see the package as a way to move forward after a disappointing harvest season, they fear the precedent of cash bailouts does not provide systemic solutions to a beleaguered industry, and don’t believe the $12 billion gesture is enough to solve agriculture’s deeper challenges.

“We’re talking $12 billion, and while it is a lot of money, in the grand scheme of things, it’s still going to be a Band-Aid on a bigger wound,” Ryan Loy, assistant professor and extension economist for the University of Arkansas Division of Agriculture, told Fortune. “How can we triage this situation right now, work on that longer-term solution? That’s really, I think, the overall attitude toward it.”

The one-time payment program will send $11 billion to major row-crop producers growing corn, soybeans, and rice, and the remaining $1 billion will be reserved for specialty crop-growers, such as sugar. Trump said additional aid programs will depend on whether trade improves with China and other countries. While the money is welcome, farmers say they’d rather have the government secure stable markets and trade relations.

“At the end of the day, the farmers, they just want to conduct business, not necessarily have to get these packages to help them out during these times,” Loy said.

Farmers’ struggles

Since Trump introduced expansive import taxes—especially on China, provoking a wave of retaliatory tariffs—farmers have seen input costs increase while export demand and crop prices plummet.

“It’s been a bit of a roller coaster in terms of not just uncertainty over our global markets and our prices, but also whether or not we were going to see any relief on the input side,” Kyle Jore, an economist, northwest Minnesota-based farmer, and secretary of the Minnesota Soybean Growers Association, told Fortune.

Tariffs on farming-related machinery as well as products like seeds and fertilizer sit at 9%, costing U.S. farmers about $33 billion more, according to North Dakota State University’s Agricultural Trade Monitor. That includes a more-than 15% tax on tractors and herbicides.

Soybean farmers, responsible for the U.S.’ biggest agricultural export that makes up about 14% of the country’s total crops sent overseas, have been hit particularly hard by tariffs. Trade disputes with Beijing have disincentivized China from buying American soybeans, and the country has instead turned to South American countries like Argentina and especially Brazil, which makes up about 71% of China’s soybean imports, according to the American Soybean Association.

To be sure, thawing relations between the U.S. and China has enlivened soybean trade. China committed in October to resume orders of U.S. soybeans after halting all purchases in May, promising to import 12 million tons of soybeans by the end of the year, as well as at least 25 million tons in each of the next three years. However, soybean prices have still lagged because of stifled demand, and farmers saw their third straight year of losses, in large part due to tariff turmoil.

According to agricultural economists, Trump’s farm aid program doesn’t hurt, but its benefits are limited: The bailout announcement arrived late in the harvest season, with farmers already booking orders at lower prices, nearly guaranteeing losses for the year. The package also doesn’t address input costs, which Jore sees as critical in improving tight margins.

“A lot of farmers are making purchasing decisions on the ‘26 year crop right now,” he said. “And the hope was that by now, we’d start to see some of the fertilizers and stuff come down, and it’s just not happening to the extent that we were hoping for.”

Changing systems

Joe Maxwell, a Missouri farmer and cofounder and chief strategy officer of agriculture watchdog group Farm Action, said many of the issues plaguing the U.S. agriculture industry—including input costs—go beyond the trade disputes created by the Trump administration. His celebration of the bailout package was tempered by his belief the administration should be addressing policies that for years have been hurting the industry.

“The message we’re wanting to get to Washington, D.C., is that the system is broke,” Maxwell told Fortune. “We need the financial support that the president has announced. But we need Congress to take a serious look at the structure of these programs, because it’s just failed.”

While input costs have risen substantially from tariffs, Maxwell said the reason behind rising fertilizer and seed prices have more to do with corporate consolidations and monopolies dominating the input industry. According to Farm Action’s Agriculture Consolidation Data Hub, three fertilizer companies (CF Industries, Nutrien, and Koch) control 93% of North American nitrogen fertilizer sales in North America. Four seed companies (Bayer, Corteva, ChemChina, and BASF) similarly dominated 60% of the global seed market.

On Saturday, Trump signed an executive order creating a task force to investigate alleged antitrust practices impacting the cost of farming.

“There is a disconnect from the fundamentals in the market, basic supply, demand,” Maxwell said. “One of the fundamentals is competition, and that does not exist in America’s agriculture.”

Maxwell also noted Congress provides subsidies for export crops, which he argued has created an oversupply problem. That exposes U.S. farmers, such as soybean producers, in instances like trade disputes when export demand plummets, he added. These subsidies also discourage American farmers from planting fruits and vegetables that would make the U.S. less reliant on exports and encourage crop diversification, which lends itself better to regenerative farming practices like crop rotation, which can decrease input costs and ultimately widen profits, Maxwell argued.

The USDA directed Fortune to its press release about the bailout program when asked for comment.

Until the government addresses the purported anticompetitive input industry and how subsidies may be exposing the agriculture industry in times of trade volatility, bailout packages will only go so far, Maxwell said.

“If we don’t go after the antitrust violations that are there, and we don’t change the structure of our farm programs, we will not solve the financial crisis farmers are facing today,” he concluded.

Nazi-Loving Misogynist Nick Fuentes Tells Piers Morgan He’s Still a Virgin at 27

UK fashion manufacturers margins recover, but overall picture is mixed – report

TGH’s John Couris puts Florida on the map in Modern Healthcare’s 100 most influential

Trending

-

Politics8 years ago

Politics8 years agoCongress rolls out ‘Better Deal,’ new economic agenda

-

Entertainment8 years ago

Entertainment8 years agoNew Season 8 Walking Dead trailer flashes forward in time

-

Politics8 years ago

Politics8 years agoPoll: Virginia governor’s race in dead heat

-

Entertainment8 years ago

Entertainment8 years agoThe final 6 ‘Game of Thrones’ episodes might feel like a full season

-

Entertainment8 years ago

Entertainment8 years agoMeet Superman’s grandfather in new trailer for Krypton

-

Politics8 years ago

Politics8 years agoIllinois’ financial crisis could bring the state to a halt

-

Business8 years ago

Business8 years ago6 Stunning new co-working spaces around the globe

-

Tech8 years ago

Tech8 years agoHulu hires Google marketing veteran Kelly Campbell as CMO