As the New York Times reported yesterday, Bezos has helped fund a new AI startup called Project Prometheus, which—with $6.2 billion in backing—would make it one of the most well-financed early-stage startups in the world. Notably, as co-CEO alongside Vik Bajaj, a physicist and chemist who previously worked at [hotlink]Google,[/hotlink] X, the company’s “Moonshot Factory,” Bezos has taken a formal operational role in a company for the first time since stepping down as Amazon CEO in July 2021.

According to the article, the company is focusing on AI-powered engineering and manufacturing in areas including computers, aerospace and automobiles, and has poached researchers from OpenAI, Google DeepMind and Meta. According to someone familiar with Project Prometheus’ work, the startup seeks to apply AI to physical tasks, which requires systems that can learn not just from massive amounts of digital data, like LLMs do, but from real-world trial and error.

Still, even in the high-flying, multi-billion-dollar AI startup space, the competition is fierce: Besides the billions poured into the likes of OpenAI, Anthropic, and Elon Musk’s xAI, former OpenAI CTO Mira Murati’s Thinking Machines raised $2 billion earlier this year, while former OpenAI chief scientist Ilya Sutskever has raised $3 billion for his research startup, Safe Superintelligence. Then there is Paris-based Mistral, which closed a Series C of about $2 billion in September, and even You.com’s Richard Socher is rumored to be trying to raise $1 billion for a new research lab.

Bezos, of course, has more than enough Benjamins to lead in this bubbly AI landscape. He has also clarified that while he admits that an AI bubble exists, it’s not the same as the dot-com boom and bust of the late 1990s and early 2000s, when around $5 trillion in market value evaporated.

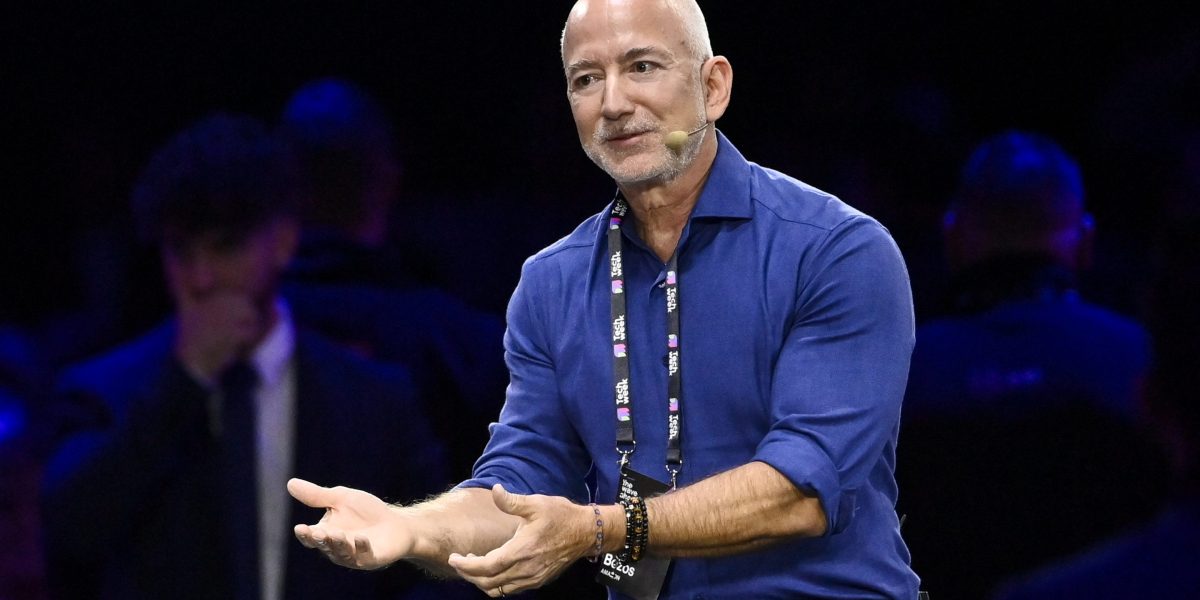

“This is a kind of industrial bubble, as opposed to financial bubbles,” he said at Italian Tech Week last month.

Ultimately, industrial bubbles can be positive, Bezos added, pointing out that the biotech and pharmaceutical bubble in the 1990s led to the development of life-saving drugs—though in the process, many public companies that IPO’d during the boom went bankrupt or were acquired at a fraction of their starting value by the end. But, Bezos said industrial bubbles are “not nearly as bad” as other bubbles.

“It can even be good, because when the dust settles and you see who are the winners, societies benefit from those investors,” Bezos said. “That is what is going to happen here too. This is real, the benefits to society from AI are going to be gigantic.”

Bezos, who also invested last year in Physical Intelligence, a robotics AI start-up, is clearly betting that this industrial AI bubble will pay off big. But in the world of AI, even $6.2 billion isn’t enough to pop the champagne—at least not yet.

See you tomorrow,

Sharon Goldman

X:@sharongoldman

Email: sharon.goldman@fortune.com

Submit a deal for the Term Sheet newsletter here.

Joey Abrams curated the deals section of today’s newsletter.Subscribe here.

VENTURE DEALS

– CeleroCommunications, an Irvine, Calif.-based digital signal processor technology company, raised $140 million across Series B, Series A, and seed rounds. CapitalG led the Series B round and SutterHillVentures led the Series A and seed rounds.

– SolveTherapeutics, a Belmont, Calif.-based developer of therapies for solid tumor malignancies, raised $120 million in funding. Yosemite led the round and was joined by Abingworth, AllyBridgeGroup, B Capital, BalyasnyAssetManagement, Merck &Co., SymBiosis, and existing investors.

– Gridware, a San Francisco-based developer of active grid response technology, raised $55 million in Series B funding. Tiger Global and GenerationInvestmentManagement led the round and were joined by existing investors SequoiaCapital, Convective Capital, FiftyYears, True Ventures, Lowercarbon, and Y Combinator.

– Voize, a Berlin, Germany-based AI companion designed for nursing care, raised $50 million in Series A funding. BaldertonCapital led the round and was joined by existing investors HVCapital, Redalpine, and YCombinator.

– PowerLattice, a Vancouver, Wash.-based developer of a power delivery chiplet designed to reduce compute power needs for AI accelerators, raised $25 million in Series A funding. PlaygroundGlobal and CelestaCapital led the round.

– Hummink, a Paris, France-based high precision capillary printing company, raised €15 million ($17.4 million) in funding. KBCFocusFund, CapHorn, and Bpifrance led the round.

– Mate, a Tel Aviv, Israel-based cybersecurity platform, raised $15.5 million in seed funding. Team8 and InsightPartners led the round.

– Endolith, a Denver, Colo.-based developer of technology designed to help miners recover copper from already discarded ore, raised $13.5 million in Series A funding. SquadraVentures led the round and was joined by DraperAssociates, DenverVentures, EverBlue, AlumniVentures, ManaVentures, and others.

– Albatross, a Baar, Switzerland-based AI platform designed to help with real-time product discovery, raised $12.5 million in funding. MMCVentures led the round and was joined by Redalpine, Daphni, and angel investors.

– Reelables, a London, U.K.-based developer of smart labels for tracking cargo and inventory, raised $10.4 million in Series A funding from AmigosVentures, Moneta, and others.

– Keychain, a New York City-based AI-powered private label operating system, raised $10 million in funding from W23Global and others.

– Shipday, a Menlo Park, Calif.-based delivery and logistics technology company, raised $7 million in Series A funding. ECPGrowth and IbexInvestorsMobility VC led the round and were joined by B Capital and SupplyChainVentures.

– Luminal, a San Francisco-based GPU optimization company, raised $5.3 million in seed funding. FelicisVentures led the round and was joined by angel investors.

– SubImage, a San Francisco-based cloud security platform designed to map a company’s entire infrastructure, raised $4.2 million in seed funding from FundersClub, Y Combinator, PhosphorCapital, and TransposePlatform.

– Cellbyte, a Munich, Germany-based AI-powered platform designed to help pharmaceutical companies accelerate drug launches, raised $2.8 million in seed funding. FrontlineVentures led the round and was joined by YCombinator, PaceVentures, SarasCapital, and SpringboardHealthAngels

PRIVATE EQUITY

– CD&R agreed to take SealedAirCorporation, a Charlotte, N.C.-based food and protective packaging company, private for $10.3 billion.

– BainCapital acquired a majority stake in ConcertGolf Partners, a Lake Mary, Fla.-based owner-operator of private golf and country clubs, from Clearlake CapitalGroup. Financial terms were not disclosed.

– RootstockSoftware, backed by GryphonInvestors, acquired PraxisSolutions, a Richmond, Va.-based Salesforce consulting and implementation firm. Financial terms were not disclosed.

– TPG Rise Climate agreed to acquire a majority stake in PikeCorporation, a Charlotte, N.C.-based provider of infrastructure engineering and construction solutions for the electrical grid. Financial terms were not disclosed.

EXITS

– GibraltarIndustries agreed to acquire OmniMaxInternational, a Peachtree Corners, Ga.-based provider of residential roofing accessories and rainware solutions, from StrategicValuePartners for $1.3 billion.

– Carlyle acquired TarrytownExpocare, an Austin, Texas-based expocare pharmacy, from SheridanCapitalPartners. Financial terms were not disclosed.

OTHER

– Cloudflare agreed to acquire Replicate, a San Francisco-based platform designed to make it easier for developers to deploy and run AI models. Financial terms were not disclosed.

FUNDS + FUNDS OF FUNDS

– The LegalTech Fund, a Fort Lauderdale, Fla.-based venture capital fund, raised $110 million for its second fund focused on legal technology companies.

Politics8 years ago

Politics8 years ago

Entertainment8 years ago

Entertainment8 years ago

Politics8 years ago

Politics8 years ago

Entertainment8 years ago

Entertainment8 years ago

Entertainment8 years ago

Entertainment8 years ago

Politics8 years ago

Politics8 years ago

Business8 years ago

Business8 years ago

Tech8 years ago

Tech8 years ago