Hello, Beatrice Nolan here, filling in for Jeremy Kahn. The AI industry has been mulling a key question recently: Is China pulling ahead in the AI race?

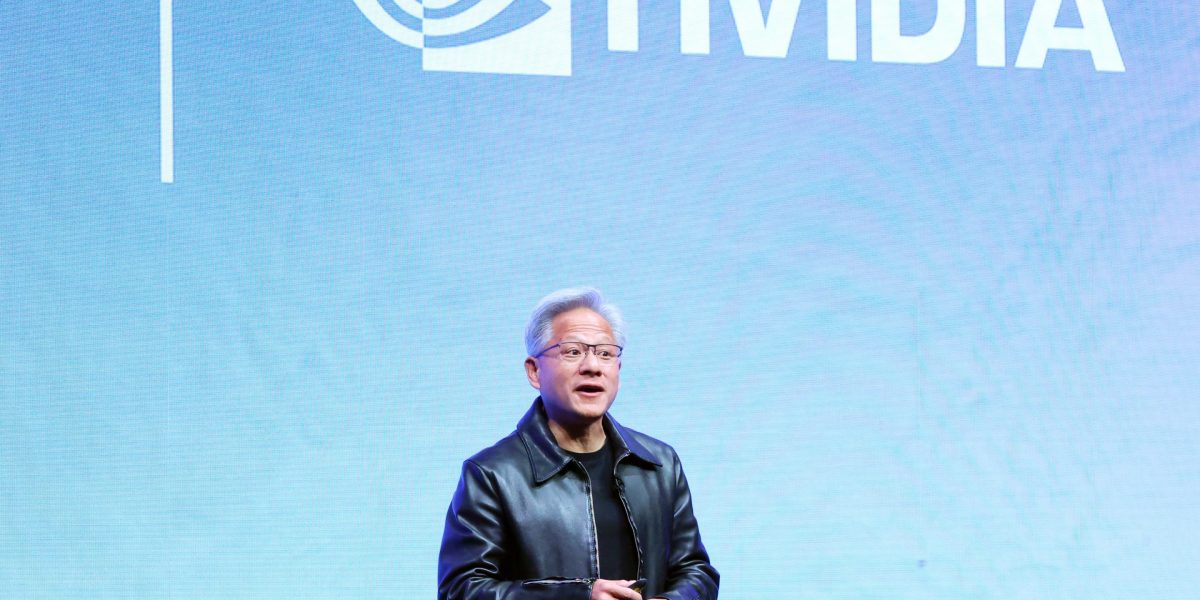

It’s a debate sparked by Nvidia CEO Jensen Huang, who made headlines last week after stating that “China is going to win the AI race.” Huang cited Western cynicism, export restrictions, and China’s advantageous energy situation, noting that companies find it far easier to secure energy supplies there. Huang later walked back the comments in a statement shared to Nvidia’s X account, clarifying that China was, in fact, “nanoseconds behind America in the AI race.”

Huang, of course, may have his own vested interest in saying all this, but he isn’t the only one to claim China may be catching up with the U.S.’s AI efforts. In fact, there are a few reasons to believe Huang’s original claim may be a valid one.

The energy issue

For one, if the AI race fundamentally comes down to an infrastructure competition, one driven by the ability of nations to construct and power massive, energy-intensive data centers rather than by who can achieve incremental algorithmic improvements, China currently holds a significant advantage.

The country has demonstrated a capacity to execute large-scale projects with speed and coordination, thanks in part to the government’s very active role in the economy. And, as Huang highlighted in his comments last week, subsidized electricity and streamlined regulatory processes make it substantially easier for companies to operate power-hungry AI facilities in China. By contrast, U.S. firms face a fragmented regulatory landscape and comparatively higher energy costs, which could hinder the rapid scaling of AI infrastructure.

Experts have long warned that electricity supply is likely to be the next critical bottleneck for the AI industry, and that Beijing appears to be ahead in addressing a few of these critical energy challenges. In contrast, power grids in many U.S. cities are so strained that some companies are choosing to build their own power plants instead of depending on the existing electrical infrastructure.

U.S. tech firms are still exploring alternative power solutions, but these projects may take years to come to fruition, if they ever do. Energy constraints are even hitting some of tech’s biggest players; for example, Microsoft recently disclosed that it has GPUs “sitting in inventory” because it can’t find enough power to use them.

The open-source lead

There’s also the open-source issue. According to a recent report from a16z, China has also now officially overtaken the U.S. when it comes to open-source AI downloads. A16z called the shift a “skull graph moment,” which is the point at which a challenger not only closes what once seemed like an unbeatable gap with an incumbent but also starts to pull ahead.

Anjney Midha, general partner at a16z, also recently issued a warning around China’s dominance in open-source models, particularly with startups like DeepSeek and its R1 model; he encouraged U.S. companies to invest in frontier teams and work to close the open-source gap.

China-based companies like DeepSeek have also shown they are masters at optimizing processes. For example, with DeepSeek’s R1, the company proved that while it may not invent the first version of something, it is capable of producing it faster and cheaper, without sacrificing performance.

Recent research from both Tencent and DeepSeek has also demonstrated how China is increasingly emerging as a source of AI innovation. For example, Tencent’s CALM model showed that replacing token-by-token generation with continuous vector prediction dramatically improved efficiency, while DeepSeek’s new open-source model compresses text into visual representations, allowing AI systems to process far more information at lower cost. There is some argument that these methods may have already been quietly used by Western labs like OpenAI or Anthropic, but have just not been publicized in the same way.

Does China already have the AI race in the bag? Probably not just yet. But its AI companies are certainly well placed to make a strong play.

With that, here’s more AI news.

Beatrice Nolan

bea.nolan@fortune.com

FORTUNE ON AI

Data-center operator CoreWeave is a stock-market darling. Bears see its finances as emblematic of an AI infrastructure bubble —Jeremy Kahn and Leo Schwartz

AI reasoning models that can ‘think’ are more vulnerable to jailbreak attacks, new research suggests —Beatrice Nolan

DBS rolls out Gen AI chatbot, as Southeast Asia’s largest bank incorporates AI in its workflow —Angelica Ang

EU considers weakening landmark AI Act amid pressure from Trump and U.S. tech giants, news report says —Beatrice Nolan

AI won’t become a bubble as long as everyone stays ‘thoughtful and disciplined,’ Microsoft’s Brad Smith says —Jim Edwards

EYE ON AI NEWS

Anthropic is on track to turn a profit years ahead of OpenAI. According to the Wall Street Journal, Anthropic is on track to break even by 2028, while OpenAI expects to post losses until 2030 due to heavy spending on computing and infrastructure. OpenAI also expects to burn through 14 times more cash than Anthropic before reaching profitability. OpenAI has signed a string of high-profile deals to fuel its growth, including $38 billion with AWS, chip deals with NVIDIA and AMD, and an expanded pact with CoreWeave now totaling $22.4 billion. Anthropic has taken a different approach, choosing to focus on enterprise clients and managing costs in line with revenue growth. Read more from the Journal here.

Meta’s Yann LeCun reportedly plans to exit and launch an AI startup. Meta’s chief AI scientist, Yann LeCun, is preparing to leave the company to launch his own startup, according to a report from the Financial Times. The move would be a major shift for one of the field’s most influential figures, who has worked at the Big Tech company for 11 years. LeCun’s move comes months after Meta restructured its AI efforts under a new “Superintelligence Labs” division led by former Scale AI CEO Alexandr Wang. LeCun, who helped pioneer deep learning and has long advocated for open-source AI, is reportedly in early talks to raise funding for his new venture. Read more from the FT here.

China’s DeepSeek calls for AI ‘whistle-blowers’ on job losses. Chinese AI startup DeepSeek made a rare public appearance at the World Internet Conference, where one senior researcher warned of the societal risks of advanced AI, according to South China Morning Post. Representing founder Liang Wenfeng, Chen Deli called for companies to act as “whistle-blowers” by alerting the public to jobs likely to be automated first. While the company was optimistic about AI’s long-term potential, DeepSeek acknowledged its technology could also pose some risks. Read more from the South China Morning Post here.

OpenAI gets hit with seven new lawsuits. OpenAI is facing several more lawsuits in California claiming that ChatGPT drove users—including teenagers and adults with no prior mental health issues—to suicide or delusions. The cases allege wrongful death, assisted suicide, involuntary manslaughter, and negligence. Attorneys argue that “OpenAI designed GPT-4o to emotionally entangle users” and “released it without the safeguards needed to protect them.” OpenAI called the reports “incredibly heartbreaking” and said it is reviewing the filings. Read more about the cases here.

EYE ON AI RESEARCH

Advanced AI reasoning models are more vulnerable to jailbreak attacks. That could be a problem for AI companies. New research from Anthropic, Oxford, and Stanford suggests that AI models with advanced reasoning capabilities, including OpenAI’s GPT, Anthropic’s Claude, Google’s Gemini, and xAI’s Grok, may be more susceptible to hacks than previously thought. Using a new approach called “Chain-of-Thought Hijacking,” researchers found that attackers were able to hide harmful commands within long reasoning steps, bypassing built-in safety measures, with success rates exceeding 80% in some tests. The study found that the more a model reasons, the more susceptible it becomes to the attack. The research undermines the assumption that the more advanced a model becomes at reasoning, the stronger its ability to refuse harmful commands. Researchers propose “reasoning-aware defenses” that monitor safety checks during each reasoning step, restoring safeguards while letting AI models tackle complex problems effectively.

AI CALENDAR

Nov. 26-27: World AI Congress, London.

Dec. 2-7: NeurIPS, San Diego.

Dec. 8-9: Fortune Brainstorm AI San Francisco. Apply to attend here.

BRAIN FOOD

To backstop, or not to backstop? OpenAI had to walk back a few comments last week after the company’s CFO, Sarah Friar, suggested that the federal government could “backstop”—with financial support or guarantees to cover potential losses—the debt that AI companies take on when purchasing AI chips. This would mean that OpenAI could also benefit from lower interest rates and get some of its promised data centers built faster. The remarks sparked a firestorm and the ire of AI czar David Sacks. But not everyone thought it was such a shocking suggestion. Some even mused that the idea might have some merit if the U.S. really is in a high-stakes race with China, which is already subsidizing the energy needed for its own AI development. Either way, Friar later retreated on the comment via a LinkedIn post. CEO Sam Altman chimed in a separate post reassuring critics: “We do not have or want government guarantees for OpenAI datacenters.”

Politics8 years ago

Politics8 years ago

Entertainment8 years ago

Entertainment8 years ago

Politics8 years ago

Politics8 years ago

Entertainment8 years ago

Entertainment8 years ago

Entertainment8 years ago

Entertainment8 years ago

Politics8 years ago

Politics8 years ago

Business8 years ago

Business8 years ago

Tech8 years ago

Tech8 years ago