Plenty of nervousness remained, though, as more canceled flights are coming over the next week to comply with the Federal Aviation Administration’s order to reduce service at the nation’s busiest airports.

The order is in response to air traffic controllers — who haven’t been paid in nearly a month as the shutdown drags on — calling out of work in higher numbers as they deal with financial pressure.

While it’s left some passengers making backup plans and reserving rental cars, the flights canceled Friday represented just a small portion of overall flights nationwide.

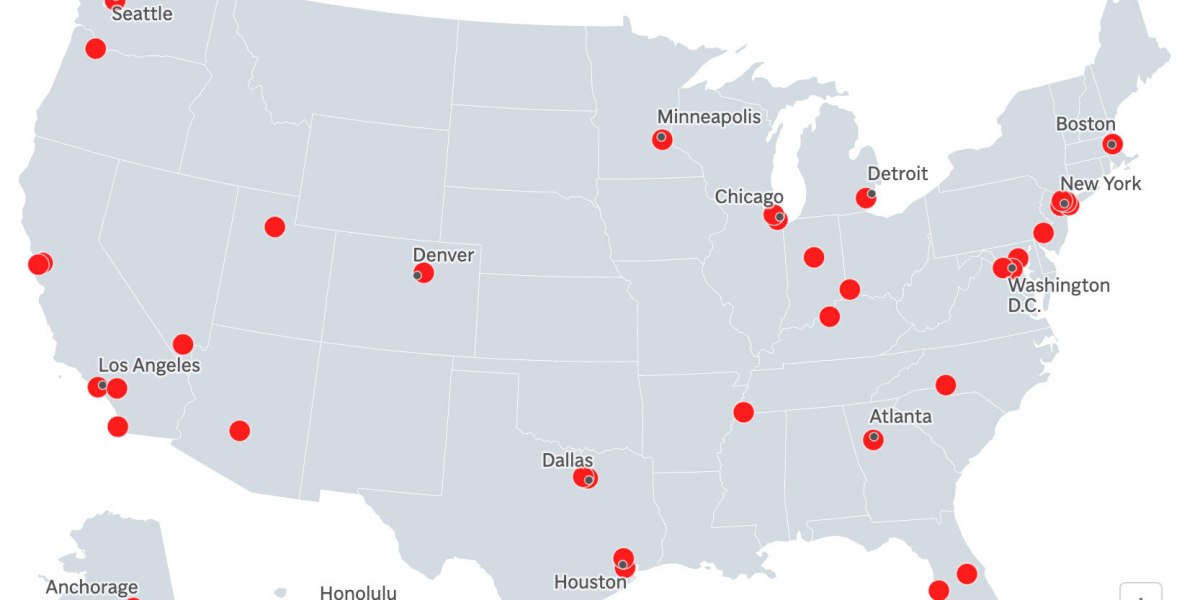

Passengers still faced last-minute cancellations and long security lines at the 40 airports targeted by the slowdown including major hubs in Atlanta, Dallas, Denver and Charlotte, North Carolina.

Airlines expect limited disruptions this weekend and stressed that international flights are not expected to be affected.

But if the shutdown persists much longer, and more controllers call out of work after they miss their second paycheck on Tuesday, the number of cancellations could jump from the initial 10% reduction of flights to 15% or 20%, Transportation Secretary Sean Duffy said on Fox News on Friday.

Long lines and, for some, long drives

Those who showed up before sunrise Friday at Houston’s George Bush Intercontinental Airport faced security lines that barely moved, prompting some people to lie down while they waited.

“It was snaking around all different parts of the regular area,” Cara Bergeron said after flying from Houston to Atlanta. “I’ve never seen anything like that.”

Others were less fortunate.

Karen Soika from Greenwich, Connecticut, found her flight out of Newark, New Jersey, was rebooked for an hour earlier. Then she learned her plane was actually leaving from New York’s John F. Kennedy International Airport, at least an hour away.

Soika, a surgeon, unsuccessfully tried to book a rental car to get to Utah for a weekend trip before settling on an option that seemed straight out of Hollywood.

“I’m going to U-Haul and I’m going to drive a truck cross-country,” said Soika, who is advising on medical scenes there for a spinoff of the TV series “Yellowstone.”

Hertz reported a sharp increase in one-way car rentals.

Airlines scramble to rebook passengers

More than 1,000 flights were called off nationwide Friday — five times the number canceled Thursday, according to FlightAware, a website that tracks flight disruptions.

Reagan National Airport was hit the hardest with at least 18% of its arrivals — 81 flights — canceled Friday. The major hubs of O’Hare, Atlanta, Denver and Dallas-Fort Worth rounded out the top five airports for cancellations, but those airports only lost around 3% of their flights.

Not all the cancellations were due to the FAA order, and both United and American airlines said they were able to quickly rebook most travelers.

The airlines focused their cuts on smaller regional routes to airports where they have multiple flights a day, helping minimize the number of passengers impacted.

Delta Air Lines said it scratched roughly 170 flights Friday while American planned to cut 220 each day through Monday. Southwest Airlines cut about 120 flights Friday.

The FAA said the reductions impacting all commercial airlines are starting at 4% of flights at the busiest airports and will ramp up to 10% over the coming week.

“I just don’t want to be stranded at the airport sleeping on a bench,” Michele Cuthbert, of Columbus, Ohio, said about an upcoming flight to Dallas. “Everyone’s paying the price for the politics that’s going on. We’re just collateral damage.”

If the shutdown continues, there may be another knock-on effect ahead of the holidays.

Nearly half of all U.S. air freight is shipped in the bellies of passenger aircraft, so the disruption could raise costs for shipping goods, said Patrick Penfield, professor of supply chain practice at Syracuse University.

“Air travel is part of the infrastructure backbone of the American economy,” said Greg Raiff, CEO of the Elevate Aviation Group consultancy. “This shutdown is going to impact everything from cargo aircraft to people getting to business meetings to tourists being able to travel.”

Why is this happening?

The FAA said the cuts are necessary to relieve pressure on air traffic controllers. Many are pulling six-day work weeks with mandatory overtime, and increasing numbers have begun calling out as the financial strain and exhaustion mount.

“I don’t want to see the disruption. I don’t want to see the delays,” Transportation Secretary Sean Duffy told reporters at Ronald Reagan National Airport, just outside of Washington.

The FAA’s order comes as the Trump administration ramps up pressure on Democrats in Congress to end the shutdown.

Ending the government shutdown would ease the situation for controllers, but the FAA said the flight cuts will remain in place until their safety data improves.

Denver International Airport is working to fill in the gap, creating a food pantry for its federal employees and asking the FAA for permission to use the airport’s revenue to pay for controllers’ wages. The airport said Friday it has not heard back from the FAA yet.

What can airlines and travelers do?

Airlines are in uncharted territory, said Kerry Tan, a professor at Loyola University Maryland in Baltimore who has studied the industry.

“The uncertainty associated with the government shutdown makes it challenging for airlines to rationally plan their response and optimize their flight operations,” Tan said.

Carriers are required to refund customers whose flights are canceled but not to cover costs such as food and hotels unless a delay or cancellation results from a factor within the control of the airlines, according to the Department of Transportation.

Christina Schlegel, who is booked on a flight to Florida on Wednesday ahead of a Bahamas cruise, said her husband suggested they drive if their flight is canceled, but she’d rather try a different flight or airport.

Schlegel, a travel adviser from Arlington, Virginia, has told clients to not panic, to monitor their flights and to arrive at the airport early.

“People really should be thinking, ‘What else can I do?’” she said. “’Can I already research some other potential flights? What other flights are out there?’ Have that information in your back pocket.”

___

Associated Press journalists Charlotte Kramon in Atlanta; John Seewer in Toledo, Ohio; Hallie Golden in Seattle; Matt Sedensky and Charles Sheehan in New York; Paul Wiseman in Washington, and Ted Shaffrey in New Jersey contributed.

Politics8 years ago

Politics8 years ago

Entertainment8 years ago

Entertainment8 years ago

Politics8 years ago

Politics8 years ago

Entertainment8 years ago

Entertainment8 years ago

Entertainment8 years ago

Entertainment8 years ago

Politics8 years ago

Politics8 years ago

Business8 years ago

Business8 years ago

Tech8 years ago

Tech8 years ago