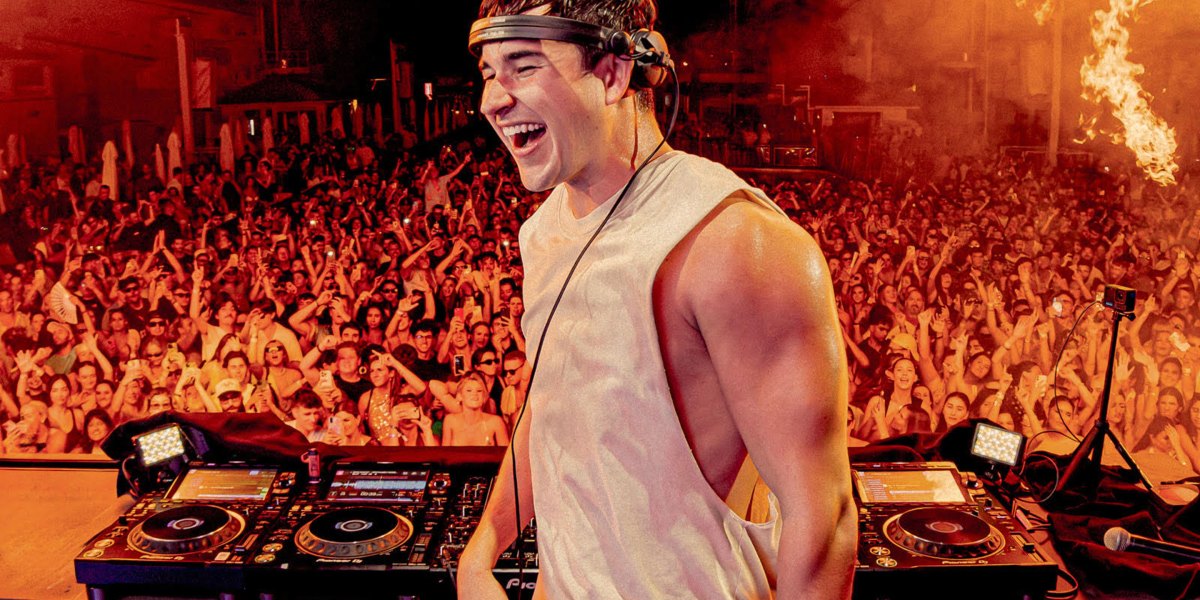

It wasn’t too long ago that John Summit, 31, (born John Schuster) was commuting home from a grueling day of accounting work in Chicago and chugging cold brews to find the energy to make music. Working at a Big Four firm like Ernst & Young meant some days ended up being nine-to-nine instead of nine-to-five.

At the time, it was numbers by day, music by night. His day job paid a $65,000 annual salary, but his real passion was making music. Whether in his college dorm or parents’ basement, music became a creative escape that would later become the launch pad for his emerging empire.

After quitting Ernst & Young for its grueling 12 hour days, another accounting job promised better hours—so he pivoted. It only lasted a couple months before he was let go, after showing up to work with bloodshot eyes from a weekend DJ shift playing underground sets from 2 a.m. to 6 a.m. Turns out his co-workers were more focused on crunching numbers than spinning tracks.

“But by then I was kind of asking for it because I kind of saw a path to being a full time DJ producer. It didn’t matter bc at that point, I already had record label releases,” Summit tells Fortune.

He had more free time to work on music, and his DJ career and his career began to flourish, thanks in part to an online fan base. Pandemic wide shutdowns further fueled a crowd that was eager for live events.

“I was like, okay, thank God, now I can go full all in on this,” he recalled.

So that’s what he did. Before the pandemic wide shutdowns, he was only making a few hundred dollars a gig. In 2020, Summit’s hit “Deep End,” took off on TikTok and launched his career.

It would be an understatement to say days look a little bit different now.

Swapping the monotonous cubicle for full-time party life, Summit is now a multi-millionaire DJ, producer and owner of his own music label “Experts Only.”

“I make more in one show than I probably would make in my entire accounting career now,” Summit said.

John Summit on his first millions: ‘It felt like I was signing an NFL contract’

After signing a music publishing deal in the six-figure range, Summit saw more breathing room to fully pivot. After all, he wasn’t able to afford paying rent in his early days—so the advance gave him the chance to practice music more independently. His breakout year culminated in a full-circle moment at Lollapalooza 2022, where the hometown crowd confirmed what Summit already knew: he was in the perfect career.

The moment he describes “he really made it” was when he signed for millions with LIV as a part of the resort Fontainebleau Las Vegas, that took him into the seven figure range. The agreement was 20 shows a year in a three year deal.

“So it’s like 60 shows. It felt like I was signing, like an NFL contract, you know, like three years X amount of millions,” Summit said. From there, the financial security allowed him to place bets on bigger shows.

Summit describes growing his live audiences from hundreds to tens of thousands.

“It changes every weekend,” he said. “I just played Austin City Limits, and that felt like the biggest show ever—around 80,000 people. Every week, I’m trying to top myself.”

“The first party we did was three years ago at Floyd here in Miami, to 200 people, and then we just did Experts Only for 50,000 people a couple weeks ago. So I guess that’s a good showcase of how it’s scaled over three years,” he said.

The start of “Experts Only” and becoming an entrepreneur

In between touring continents in 2022, the entrepreneur found time to start his own label “Experts Only.”

When planning for sets up to 10 hours long, Summit began building a community of underground, unsigned artists, playing up to 15 of them at his shows. Having a niche for being a trend setter, he thought “why not use my platform for other artists?”

“I feel like I’m very much a good taste maker nowadays,” he said. “Someone will send me a record, it goes off during my set, and I sign it. That gives them the marketing push from me playing it out and championing it—which, of course, makes other DJs start playing it too.”

He finds Experts Only rewarding because it allows him to focus on cultivating talent from others too.

“When I just work on John Summit, it does feel like very me, me, me,” he said.

“Experts Only” is still growing. The company now has 10+ core employees (marketing, radio, management, etc.) and hundreds of event staff per festival. Summit says he thinks of the brand as a community, where his fans represent him like they would a favorite sports team.

As promoters hit him up to bring Experts Only from Los Angeles to Japan, the final goal of his new empire is to throw parties without even playing at them. He drew the comparison to how Jeff Bezos operates at Amazon since stepping down as CEO. “It still operates without him. That’s the dream.”

“The hardest thing about it is I’m just one person,” he added.

Despite ditching accounting–he’s still far out of the business world

Despite escaping the nine-to-five world and going full-on artist mode, the label owner hasn’t escaped business life. In fact, he still attends all his meetings and Zoom calls with his salaried staff that work in offices. Like other workers in the corporate world, he prefers work-life balance, putting off assignments at 5 p.m. and treating Sundays as his hibernation days.

“I don’t let anyone talk to me after, like, five o’clock, really, unless it’s just quick little things,” he said. “It’s kind of funny that I escaped the accounting world, but you can never escape the business world,” he said.

“I take Sundays off, that’s my hangover day, but I think that’s kind of everyone’s day off across the globe, right?”

Summit used to do 250 shows a year (four to five shows a week), but now he’s changed his business model to two big shows a week. He’s also active on social media, working with the team on multiple posts a day.

“When you’re signing a record to the label, you’re getting not just the community that we have, but this giant marketing arm as well,” he said. “I’m not the person that’s going to negotiate money or contract, I think you have to assign certain people to different tasks. I think I’m a good cop in most scenarios.”

John Schuster vs. John Summit

Despite starting his own brand, Summit says he is a reserved introvert. He doesn’t like public speaking but still has the confidence to play in front of crowds of 50,000 people.

“DJs are traditionally introverted nerds. That’s what we are—we’re on our computer. So to really channel that energy, it’s almost like I’ve had to create a split persona to force myself on stage.”

His album, Comfort in Chaos is a lens into his personal journey of bridging his public and private worlds. He says his personalities are categorized into two: John Summit and John Schuster.

“John Schuster, is the at home introvert that makes music all day, every day, and then John Summit is my stage name, and it is like a persona and a mentality. You have to force yourself to be in front of people,” he said.

To cope with the nerves, he tries to crank out a bunch of push-ups before getting on stage like playing at a big sports game. “It helps me not overthink everything,” he said.

Summit didn’t know he’d be a DJ from a super young age, his nonlinear path is what made him into who he is today. His advice for coping with career imposter syndrome: fake it till you make it.

Despite turning DJing into a lucrative lifestyle path—Summit said he’d still be “over the moon” to do it if he only made $65,000.

“I could pretty much retire right now, if I wanted to, but now I just really just do it for the love of the game.”

Politics8 years ago

Politics8 years ago

Entertainment8 years ago

Entertainment8 years ago

Politics8 years ago

Politics8 years ago

Entertainment8 years ago

Entertainment8 years ago

Entertainment8 years ago

Entertainment8 years ago

Politics8 years ago

Politics8 years ago

Business8 years ago

Business8 years ago

Tech8 years ago

Tech8 years ago