Business

Venture Global didn’t disrupt the energy sector by making friends. VG is in its ‘slander’ era with aims to dominate the industry

Published

2 months agoon

By

Jace Porter

By the beginning of this year, the world’s leading gas exporter, the United States, grew the capacity to ship nearly 100 million metric tons of liquefied natural gas per year—incredibly rapid growth for a U.S. industry that only started exporting a decade ago.

By 2030, a little-known startup, Venture Global, is projected to exceed that volume all by itself. It only began shipping three years ago. The oil and gas outsiders at Venture Global are doing so by upending project design norms, upsetting the Big Oil hierarchy, and dominating the nascent gas export industry.

The business of exporting natural gas—it needs to be liquefied to be shipped overseas in tankers—has taken off thanks to the nation’s ongoing shale gas boom, the world’s growing power needs, and the desire to rely less on Russian gas. Liquefied natural gas (LNG) is the biggest sector of U.S. oil and gas growth, responding to more gas demand than even the burgeoning AI data center construction surge. Just from 2024 to 2028, North America’s LNG export capacity should more than double, according to the U.S. Department of Energy.

The pace of Venture Global’s growth is staggering. Its speed has shocked virtually every industry analyst. It has no plans to slow down through the early 2030s. Even cofounder and CEO Mike Sabel is surprised by what he has built: The company has exceeded his expectations on timelines and production capacity. Not bad for a company founded by leaders with only ancillary energy experience.

“The markets for years convinced themselves that we would fail, and they didn’t need to react to us, and that was helpful to us,” Sabel told Fortune, highlighting Venture Global’s Arlington, Virginia headquarters far away from the energy epicenter in Houston. “We were out of sight and out of mind.”

Now, Venture Global is on pace to surpass U.S. LNG export pioneer and leader Cheniere Energy in capacity before the end of the decade, Sabel and analysts said.

Gleefully embracing its “disruptor” status, Venture Global has grown despite upsetting the industry. Big Oil giant Shell accused Venture Global of deceit—not disruption—in a contract dispute. And, in an overambitious initial public offering early this year, the company sought a market valuation approaching $110 billion—double that of Cheniere—while riding the pro-fossil fuel, Trump inauguration wave—only for its market cap to plunge to a low of $17 billion in early April.

Still, Venture Global won its arbitration fight against Shell in August. Shell, BP, and others had accused Venture Global of unfairly profiting on cargo sales before fulfilling their long-term contracts—and the stock has more than doubled since its low, bringing it to a market cap over $36 billion.

“We’re following the trajectory of the disruptors in lots of industries. First, you’re ignored. Then you get ridiculed by the incumbents and those that criticize people with new ideas,” Sabel said. “Then, as you start to impact the incumbents, they slander you, which is the phase we’re in now. Eventually they figure out they’re losing, and they try to figure out how to compete. The commercial strategy of a lot of competitors in the market is to say mean things about us, hoping that slows us down, which it hasn’t.”

Venture Global’s main differentiator is building smaller, modular LNG facilities—called liquefaction “trains”—at its massive, U.S. Gulf Coast plants at Calcasieu Pass and Plaquemines in southwestern and southeastern Louisiana, respectively. Whereas a rival might build four huge trains, VG’s new Plaquemines campus will soon count 36 modular trains when it’s completed.

These cost-efficient facilities can come online more quickly, one at a time, while construction goes on, turning on revenue streams faster, Sabel said. “This has largely been about the realization that we developed a new way to do this, and that it changes the competitive landscape.”

Energy analyst Jack Weixel, of East Daley Analytics, said Venture Global is demonstrating a “remarkable turnaround” from its Calcasieu Pass startup and arbitration issues, as well as from President Biden’s temporary LNG permitting moratorium last year.

“They’re very much looking at this like an assembly line. Just the sheer number of facilities coming online is incredible,” Weixel said. “They were pretty bold right out of the gate. They had some stumbles, but they persevered. They’re just out there hustling.”

From Sri Lanka to Haiti to Louisiana

The hustle dates back over 15 years ago to Sabel and his cofounding partner, Bob Pender, considering building natural gas facilities throughout the world from Sri Lanka to Haiti before homing in on exporting from the U.S.

Sabel, an investment banker and entrepreneur, says he was lunching at a Washington, D.C., restaurant when a Sri Lankan waiter he’d befriended pushed the idea of developing a coal plant after the end of his native country’s civil war.

Sabel was intrigued and, through a lawyer friend, he met Bob Pender, then a partner at Hogan Lovells, who brought expertise in project financing to the table.

“[My wife] was happy to let me go over to Sri Lanka in the middle of a civil war,” Sabel said with a laugh. Sabel made the trek and quickly realized the greater need in Sri Lanka and worldwide was for regasification facilities that receive the LNG and covert it back into gas for power generation.

Following the 2010 Haiti earthquake, Pender served as legal consultant to the Interim Haiti Recovery Commission. Sabel and Pender saw an opportunity for Haiti to reduce its dependence on pricy, heavy fuel oil for power by building smaller-scale gas facilities.

“While we were looking at smaller-scale loads potentially going to Haiti, it got us thinking about smaller-scale sources of liquefaction, which led us to look at smaller-scale development projects in the U.S.,” Sabel said.

Thus Venture Global was born via the idea of going big by going smaller. Pender remains executive co-chairman with Sabel today.

When Venture Global submitted its federal permitting applications for its Calcasieu Pass project in 2015, the industry was largely dismissive of the unknown outsider whose project, they assumed, had little chance of ever becoming a reality.

“We compete in a commodity market. Everyone produces the same product, so it’s really about cost and speed of production,” Sabel said. “Think of building a commercial office tower, but you figure out how you can start leasing the floors from the bottom up as you go. By the time you get to the top floor, you’ve earned a substantial amount of revenue that defrays the cost of construction.”

Development and contracting took time—offering cheaper, long-term deals to foreign buyers—but the first LNG came online from Calcasieu Pass in early 2022, just as Russia invaded Ukraine, sending global gas prices skyrocketing.

Venture Global benefited not only from the timing, but also because it takes years to develop these massive projects. When competitors finally saw that Venture Global was legit, Sabel said, the company had three projects underway in Calcasieu Pass, Plaquemines—which is mostly online today—and CP2. The $15 billion, first phase of CP2 just began construction near to Calcasieu Pass and is slated to start producing LNG in 2027.

“By the time they (rivals) realize—wait a minute—we’re not failing, we’d grabbed all this other market share,” Sabel said. “Well, now we’re not the little startup we were a few years ago.”

Conflicts and victories

While Venture Global’s Calcasieu Pass first began shipping small cargoes in early 2022 when prices spiked, it didn’t complete final commissioning and begin fulfilling contract obligations until April of this year.

There’s the rub. For three years, Venture Global sold its LNG for heavier profits while the final trains were completed before selling to contracted customers at cheaper prices. Customers alleged this was a manipulation—the company could have sold at the cheaper, contracted level from the get-go, they have claimed.

That said, Venture Global suffered pandemic-related supply chain and construction issues, hurricane delays, and power supply problems during the same timeframe, Sabel said. Venture Global couldn’t fulfill all its contracts until the LNG plant was finished, he argued.

But Shell, BP, Spanish energy major Repsol, and others filed for arbitration over the dispute. While the others are still pending, Venture Global believes it set a winning precedent with a victory in the Shell arbitration.

Even if Venture Global upset some in the industry, its lower-cost approach is allowing it to offer cheaper contracts that keep bringing in new customers from China to Europe.

Then, early this year Venture Global went public with its massive, eyebrow-raising valuation.

Rystad Energy LNG analyst Mathieu Utting believes it was a calculated move.

“We thought it was a little bit strategic just to put it out there at a very, very high number and then let it come back down, because it seemed like the number that they ended up at, they were still very happy with,” Utting said. “But it was definitely a little bit bizarre.”

Regardless, Sabel isn’t satisfied with the stock price, even though it is on the rise.

“We’re very unhappy with how the stock has performed, and we expect—as people watch us execute and exceed what we said we were going to do—that it will right-size,” Sabel said.

“Maybe every CEO in history has said that,” he added, turning from serious to laughter.

The debate on Venture Global’s future now turns to bulls versus bears. When the Biden administration implemented an LNG permitting moratorium, it was largely about environmental concerns along the Gulf Coast. But the argument also focused on the wave of construction leading to a global gas glut and cratering prices.

Utting believes a glut is on its way starting in 2030 and lasting until 2035 or so—right when VG is largely finished ramping up its incredible wave of growth. China’s shrinking LNG imports are of the utmost concern.

Venture Global and Weixel, of East Daley, are much more bullish, arguing that global demand will keep rising faster than many expect with electrification, AI, and coal-to-gas power switching.

Venture Global is already near the capacity to export 40 MTPA (million tonnes per annum) of LNG between its Calcasieu Pass and Plaquemines facilities. The CP2 project would add another 28 MTPA.

A subsequent, smaller CP2 expansion would bring yet another 10 MTPA, and a planned Plaquemines expansion prior to 2030 would tack on about 25 MTPA. That would all total over 102 million metric tons of annual capacity by 2030 if all goes as planned, Sabel said.

Finally, a CP3 project is in development for another 30 MTPA after 2030, he said.

For comparison, current industry leader Cheniere aims to grow to about 75 MTPA near 2030—big growth, but not keeping pace with Venture Global’s plans.

“This is like Barry Bonds and Mark McGwire going at it,” Weixel said, comparing them to the retired, home run hitters.

Sabel prefers comparing VG to another sport.

“We have the esprit de corps of a small-town football team. No one wants to let down their teammates,” he said. “We to this day still feel like the underdog that a lot of people are rooting against, and it makes us come together to prevail.”

You may like

Business

The $124 trillion Great Wealth Transfer is intensifying as inheritance jumps to a new record

Published

2 hours agoon

December 6, 2025By

Jace Porter

Nearly $300 billion was inherited this year as the Great Wealth Transfer picks up speed, showering family members with immense windfalls.

According to the latest UBS Billionaire Ambitions Report, 91 heirs inherited a record-high $297.8 billion in 2025, up 36% from a year ago despite fewer inheritors.

“These heirs are proof of a multi-year wealth transfer that’s intensifying,” Benjamin Cavalli, head of Strategic Clients & Global Connectivity at UBS Global Wealth Management, said in the report.

Western Europe led the way with 48 individuals inheriting $149.5 billion. That includes 15 members of two “German pharmaceutical families,” with the youngest just 19 years old and the oldest at 94.

Meanwhile, 18 heirs in North America got $86.5 billion, and 11 in South East Asia received $24.7 billion, UBS said.

This year’s wealth transfer lifted the number of multi-generational billionaires to 860, who have total assets of $4.7 trillion, up from 805 with $4.2 trillion in 2024.

Wealth management firm Cerulli Associates estimated last year that $124 trillion worldwide will be handed over through 2048, dubbing it the Great Wealth Transfer. More than half of that amount will come from high-net-worth and ultra-high-net-worth people.

Among billionaires, UBS expects they will likely transfer about $6.9 trillion by 2040, with at least $5.9 trillion of that being passed to children, either directly or indirectly.

While the Great Wealth Transfer appears to be accelerating, it may not turn into a sudden flood. Tim Gerend, CEO of financial planning giant Northwestern Mutual, told Fortune’s Amanda Gerut recently that it will unfold more gradually and with greater complexity.

“I think the wealth transfer isn’t going to be just a big bang,” he said. “It’s not like, we just passed peak age 65 and now all the money is going to move.”

Of course, millennials and Gen Zers with rich relatives aren’t the only ones who sat to reap billions. More entrepreneurs also joined the ranks of the super rich.

In 2025, 196 self-made billionaires were newly minted with total wealth of $386.5 billion. That trails only the record year of 2021 and is up from last year, which saw 161 self-made individuals with assets of $305.6 billion.

But despite the hype over the AI boom and startups with astronomical valuations, some of the new U.S. billionaires come from a range of industries.

UBS highlighted Ben Lamm, cofounder of genetics and bioscience company Colossal; Michael Dorrell, cofounder and CEO of infrastructure investment firm Stonepeak; as well as Bob Pender and Mike Sabel, cofounders of LNG exporter Venture Global.

“A fresh generation of billionaires is steadily emerging,” UBS said. “In a highly uncertain time for geopolitics and economics, entrepreneurs are innovating at scale across a range of sectors and markets.”

Business

Apple rocked by executive departures, with chip chief at risk of leaving next

Published

2 hours agoon

December 6, 2025By

Jace Porter

Apple Inc., long the model of stability in Silicon Valley, is suddenly undergoing its biggest personnel shake-up in decades, with senior executives and key engineers both hitting the exits.

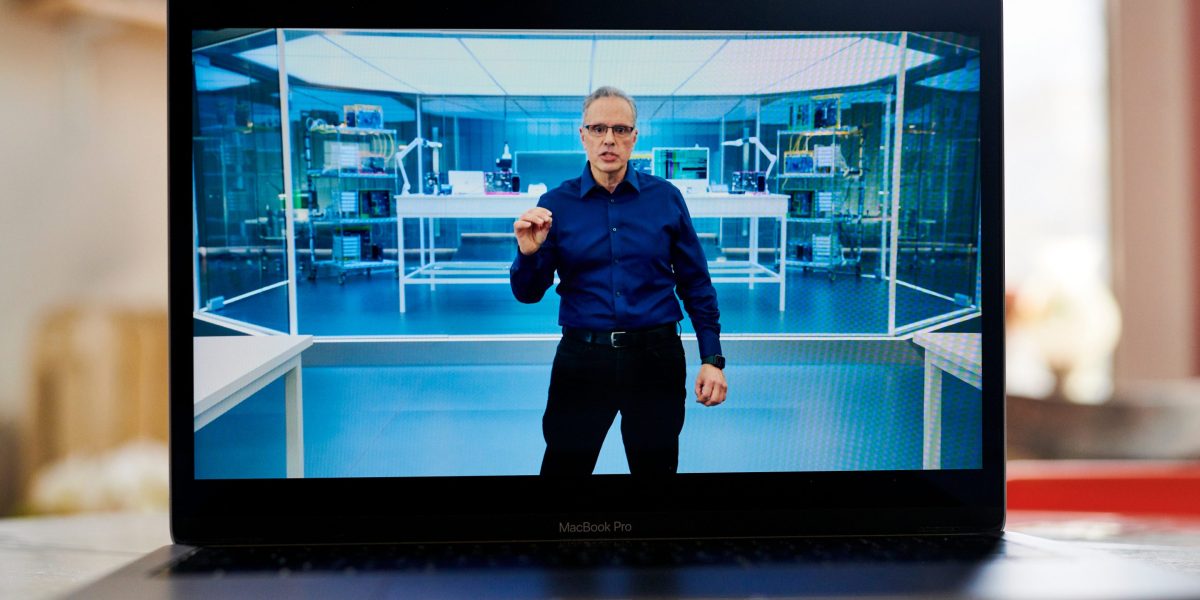

In just the past week, Apple’s heads of artificial intelligence and interface design stepped down. Then the company announced that its general counsel and head of governmental affairs were leaving as well. All four executives have reported directly to Chief Executive Officer Tim Cook, marking an exceptional level of turnover in Apple’s C-suite.

And more changes are likely coming. Johny Srouji — senior vice president of hardware technologies and one of Apple’s most respected executives — recently told Cook that he is seriously considering leaving in the near future, according to people with knowledge of the matter. Srouji, the architect of Apple’s prized in-house chips effort, has informed colleagues that he intends to join another company if he ultimately departs.

At the same time, AI talent has been fleeing for tech rivals — with Meta Platforms Inc., OpenAI and a variety of startups poaching many of Apple’s engineers. That threatens to hamper the company’s efforts to catch up in artificial intelligence, an area where it’s struggled to make a mark.

It all adds up to one of the most tumultuous stretches of Cook’s tenure. Though the CEO himself is unlikely to leave imminently, the company has to rebuild its ranks and figure out how to thrive in the AI era.

Within the company, some of the departures are cause for deep concern — with Cook looking to stave off more with stronger compensation packages for key talent. In other cases, the exits just reflect the fact that veteran executives are nearing retirement age. Still, many of the shifts constitute a disconcerting brain drain.

While Cook maintains that Apple is working on the most innovative product lineup in its history — a slate that’s expected to include foldable iPhones and iPads, smart glasses, and robots — Apple hasn’t launched a successful new product category in a decade. That leaves it vulnerable to poaching from a range of nimbler rivals better equipped to develop the next generation of devices around AI.

A spokesperson for Cupertino, California-based Apple declined to comment.

The exit of Apple’s AI chief, John Giannandrea, followed a number of stumbles in generative AI. The company’s Apple Intelligence platform has suffered from delays and subpar features. And a highly touted overhaul to the Siri voice assistant is roughly a year and a half behind schedule. Moreover, the software will rely heavily on a partnership with Alphabet Inc.’s Google to fill the gaps in its capabilities.

Against that backdrop, Apple began phasing Giannandrea out of his role in March but is allowing him to remain until next spring.

Within Apple, employees have long expected Giannandrea to step aside — and some have expressed surprise that he’s sticking around as long as he is.

But parting ways with Giannandrea sooner would have been taken as public acknowledgment of a problem, people familiar with the situation said.

Design veteran Alan Dye, meanwhile, is heading to Meta’s Reality Labs unit — a remarkable defection to one of Apple’s fiercest rivals.

Within a day of that news, Apple turned around and announced that it had poached one of Meta’s executives. Jennifer Newstead, chief legal officer at the social networking company, will become Apple’s general counsel. She helped oversee Meta’s successful antitrust battle with the US Federal Trade Commission — experience that’s likely to prove useful in Apple’s own legal fight with the Justice Department over alleged anticompetitive practices.

Read More: Apple Taps Meta Lawyer as General Counsel in Latest Shake-Up

Newstead is taking over for Kate Adams, who served eight years in the role and will retire in late 2026. Lisa Jackson, vice president for environment, policy and social initiatives, is retiring as well — and her duties will be divided up among other executives.

Though the news of Adams’ departure was jarring — especially considering the number of Apple legal disputes currently on her plate — she’s had a fairly long tenure for a general counsel at the company.

Jackson, meanwhile, was widely expected to be leaving soon. The former Obama administration official has kept a lower profile during President Donald Trump’s second term, opting to dispatch deputies to handle discussions with the White House. Bloomberg News had previously reportedthat she was considering retirement.

These exits follow an even bigger departure. Jeff Williams, Cook’s longtime No. 2, retired last month after a decade as chief operating officer. Another veteran leader, Chief Financial Officer Luca Maestri, stepped into a smaller role at the start of 2025 and is likely to retire in the not-too-distant future.

The flurry of retirements reflects a demographic reality for Apple. Many of its most senior executives have been at the company for decades and are roughly the same age — either in their 60s or nearing it.

Cook turned 65 last month, fueling speculation that he would join the exodus. People close to the executive have said that he’s unlikely to leave soon, though succession planning has been underway for years. John Ternus, Apple’s 50-year-old hardware engineering chief, is considered by employees to be the frontrunner CEO candidate.

When Cook does step down, he’s likely to shift into the chairman job and maintain a high level of influence over the iPhone maker. That makes it unlikely that Apple will select an outsider as the next CEO, even as executives like Nest Labs founder Tony Fadell are being pushed as candidates by people outside the company. Though Fadell helped invent Apple’s iconic iPod, he left the tech giant 15 years ago on less-than-friendly terms.

For now, Cook remains active at Apple and travels extensively on behalf of the company. However, the executive does have an unexplained tremor that causes his hands to shake from time to time — something that’s been discussed among Apple employees in recent months.

The shaking has been noticed by both executives and rank-and-file staff during meetings and large company gatherings, according to people familiar with the matter. But people close to Cook say he is healthy and refute rumors to the contrary that have circulated in Silicon Valley.

Read More: The Apple Insiders in the Running to Succeed Cook

A more imminent risk is the departure of Srouji, the chip chief. Cook has been working aggressively to retain him — an effort that included offering a substantial pay package and the potential of more responsibility down the road. One scenario floated internally by some executives involves elevating him into the role of chief technology officer. Such a job — overseeing a wide swath of both hardware engineering and silicon technologies — would potentially make him Apple’s second-most-powerful executive.

But that change would likely require Ternus to be promoted to CEO, a step the company may not be ready to take. And some within Apple have said that Srouji would prefer not to work under a different CEO, even with an expanded title.

If Srouji does depart, which isn’t yet a certainty, the company would likely tap one of his two top lieutenants — Zongjian Chen or Sribalan Santhanam — to replace him.

The recent shifts are already reshaping Apple’s power structure. More authority is now flowing to a quartet of executives: Ternus, services chief Eddy Cue, software head Craig Federighi and new COO Sabih Khan. Apple’s AI efforts have been redistributed across its leadership, with Federighi becoming the company’s de facto AI chief.

Ternus is also poised to take a starring role next year in the celebration of Apple’s 50th anniversary, further raising his profile. And he’s been given more responsibility over robotics and smart glasses — two areas seen as future growth drivers.

Further reorganization is likely. Deirdre O’Brien, head of retail and human resources, has been with Apple for more than 35 years, while marketing chief Greg Joswiak has spent four decades at the company. Apple has elevated the key lieutenants under both executives, preparing for their eventual retirements.

At the same time, Apple is contending with a talent drain in its engineering ranks. This has become a serious concern for the executive team, and Apple’s human resources organization has been instructed to ramp up recruitment and retention efforts, people familiar with the situation said.

Robby Walker, who had overseen Siri and an initiative to build a ChatGPT-like search experience, left the company in October. His replacement, Ke Yang, departed after only weeks in the job, joining Meta’s new Superintelligence Labs.

To help fill the void left by Giannandrea, Apple hired Google and Microsoft Corp. alum Amar Subramanya as vice president of artificial intelligence. He’ll report to Federighi, the software chief.

But there’s been a broader collapse within Apple’s artificial intelligence organization, spurred by the departure of AI models chief Ruoming Pang. Pang, along with colleagues such as Tom Gunter and Frank Chu, went to Meta, which has used eye-popping compensation packages to lure talent.

Roughly a dozen other top AI researchers have left the organization, which is suffering from low morale. The company’s increasing use of external AI technology, such as Google’s Gemini, has been a particular concern for employees working on large language models.

Apple’s AI robotics software team has also seen widespread departures, including its leader Jian Zhang, who likewise joined Meta. That group is tasked with creating underlying technology for products such as a tabletop robot and a mobile bot.

The hardware team for the tabletop device, code-named J595, has been bleeding talent too — with some headed to OpenAI. Dye also was a key figure overseeing that product’s software design.

Read More: Apple’s AI Push to Hinge on Robots, Security, Lifelike Siri

The user interface organization has been hit as well, with several team members leaving between 2023 and this year. That attrition culminated in Dye’s exit, which stemmed partly from a desire to integrate AI more deeply into products and a feeling that Apple hasn’t been keeping pace in the area. Another top interface leader under Dye, Billy Sorrentino, also left for Meta.

The hardware side of the design group — the team responsible for the physical look and feel of Apple’s products — has been nearly wiped out over the last half-decade. Many staffers followed former design chief Jony Ive to his studio, LoveFrom, or went to other companies.

Longtime interface designer Stephen Lemay is now stepping in as Dye’s replacement. Cook is also taking on more responsibility for overseeing design, a role that had been held by Williams.

Ive, a visionary designer who helped create the iPhone, iPad and Apple Watch, is now working with OpenAI to develop a new generation of AI-enhanced devices. That company acquired Ive’s startup, io, for more than $6 billion to jump-start its hardware business — setting its sights on Apple’s territory.

Like Meta, OpenAI has become a key beneficiary of Apple’s talent flight. The San Francisco-based company has hired dozens of Apple engineers across a wide range of fields, including people working on the iPhone, Mac, camera technology, silicon design, audio, watches and the Vision Pro headset.

In a previously unreported development, the AI company is hiring Apple’s Cheng Chen, a senior director in charge of display technologies. His purview included the optics that go into the Vision Pro headset. OpenAI recruited Tang Tan, one of Apple’s top hardware engineering executives, two years ago.

Read More: Apple’s Star Designer Who Introduced iPhone Air Leaves Company

And over the summer, the company lost the dean of Apple University, the internal program designed to preserve the company’s culture and practices after the passing of co-founder Steve Jobs. Richard Locke, who spent nearly three years at Apple, left to become dean of the Massachusetts Institute of Technology’s business school.

Business

Epstein grand jury documents from Florida can be released by DOJ, judge rules

Published

3 hours agoon

December 6, 2025By

Jace Porter

A federal judge on Friday gave the Justice Department permission to release transcripts of a grand jury investigation into Jeffrey Epstein’s abuse of underage girls in Florida — a case that ultimately ended without any federal charges being filed against the millionaire sex offender.

U.S. District Judge Rodney Smith said a recently passed federal law ordering the release of records related to Epstein overrode the usual rules about grand jury secrecy.

The law signed in November by President Donald Trump compels the Justice Department, FBI and federal prosecutors to release later this month the vast troves of material they have amassed during investigations into Epstein that date back at least two decades.

Friday’s court ruling dealt with the earliest known federal inquiry.

In 2005, police in Palm Beach, Florida, where Epstein had a mansion, began interviewing teenage girls who told of being hired to give the financier sexualized massages. The FBI later joined the investigation.

Federal prosecutors in Florida prepared an indictment in 2007, but Epstein’s lawyers attacked the credibility of his accusers publicly while secretly negotiating a plea bargain that would let him avoid serious jail time.

In 2008, Epstein pleaded guilty to relatively minor state charges of soliciting prostitution from someone under age 18. He served most of his 18-month sentence in a work release program that let him spend his days in his office.

The U.S. attorney in Miami at the time, Alex Acosta, agreed not to prosecute Epstein on federal charges — a decision that outraged Epstein’s accusers. After the Miami Herald reexamined the unusual plea bargain in a series of stories in 2018, public outrage over Epstein’s light sentence led to Acosta’s resignation as Trump’s labor secretary.

A Justice Department report in 2020 found that Acosta exercised “poor judgment” in handling the investigation, but it also said he did not engage in professional misconduct.

A different federal prosecutor, in New York, brought a sex trafficking indictment against Epstein in 2019, mirroring some of the same allegations involving underage girls that had been the subject of the aborted investigation. Epstein killed himself while awaiting trial. His longtime confidant and ex-girlfriend, Ghislaine Maxwell, was then tried on similar charges, convicted and sentenced in 2022 to 20 years in prison.

Transcripts of the grand jury proceedings from the aborted federal case in Florida could shed more light on federal prosecutors’ decision not to go forward with it. Records related to state grand jury proceedings have already been made public.

When the documents will be released is unknown. The Justice Department asked the court to unseal them so they could be released with other records required to be disclosed under the Epstein Files Transparency Act. The Justice Department hasn’t set a timetable for when it plans to start releasing information, but the law set a deadline of Dec. 19.

The law also allows the Justice Department to withhold files that it says could jeopardize an active federal investigation. Files can also be withheld if they’re found to be classified or if they pertain to national defense or foreign policy.

One of the federal prosecutors on the Florida case did not answer a phone call Friday and the other declined to answer questions.

A judge had previously declined to release the grand jury records, citing the usual rules about grand jury secrecy, but Smith said the new federal law allowed public disclosure.

The Justice Department has separate requests pending for the release of grand jury records related to the sex trafficking cases against Epstein and Maxwell in New York. The judges in those matters have said they plan to rule expeditiously.

___

Sisak reported from New York.

Alix Earle and Braxton Berrios Reportedly Split

Plenty of Celebs Staying Cozy In Earmuffs!

Kylie Jenner Unzips Red Jacket, Flashes Cleavage in Hot New Clip

Trending

-

Politics8 years ago

Politics8 years agoCongress rolls out ‘Better Deal,’ new economic agenda

-

Entertainment8 years ago

Entertainment8 years agoNew Season 8 Walking Dead trailer flashes forward in time

-

Politics8 years ago

Politics8 years agoPoll: Virginia governor’s race in dead heat

-

Entertainment8 years ago

Entertainment8 years agoThe final 6 ‘Game of Thrones’ episodes might feel like a full season

-

Entertainment8 years ago

Entertainment8 years agoMeet Superman’s grandfather in new trailer for Krypton

-

Politics8 years ago

Politics8 years agoIllinois’ financial crisis could bring the state to a halt

-

Business8 years ago

Business8 years ago6 Stunning new co-working spaces around the globe

-

Tech8 years ago

Tech8 years agoHulu hires Google marketing veteran Kelly Campbell as CMO