Business

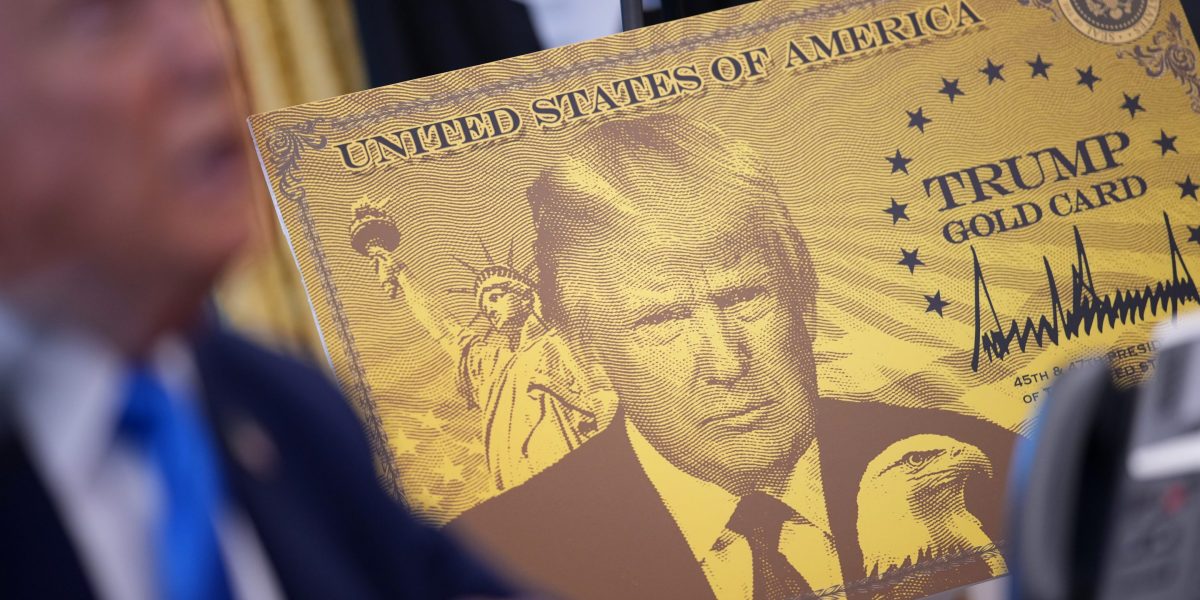

Europe residency gets harder to buy as Trump sells gold card

Published

3 months agoon

By

Jace Porter

While President Donald Trump is creating new options for the world’s wealthy to move to the US, Europe has been heading in the opposite direction.

The continent is pulling back on its so-called golden visa programs after they failed to deliver the hoped-for benefits and in some cases backfired. That’s especially true for Portugal, where one of Europe’s most popular programs led to foreigners bidding up homes at the expense of locals.

In most but not all cases, the threshold for residency in Europe was much lower than the $1 million price tag on the Trump Gold Card — part of a broader upheaval of US immigration policy, which includes charging companies a $100,000 to hire college-educated workers from abroad.

Here’s an overview of Europe’s golden visa programs:

Portugal

The country ended the real estate path to a residency permit in 2023 in a bid to ease property prices. But an alternative route still exists.

Aimed at bolstering Portugal’s capital base, applicants must put at least €500,000 ($590,000) into an approved investment or venture capital fund. To qualify, the entities need to have more than 60% of resources in domestic assets, including bonds, stocks or local projects like farming and solar panels.

If opting to donate to a non-profit group, the amount goes down to €250,000, or as low as €200,000 if the organization benefits an area with a low-population density. The program has been popular with US, Brazilian and Chinese nationals.

Wealthy foreigners only have to spend one week a year in Portugal for the first year, and 14 days every subsequent two-year period to qualify for a fast-track to residency.

It’s had some strange effects like increasing the value of avocado farms and contributing to stock market gains. A classic-car museum in a small village has also raised money to improve its collection.

UK

A special visa for foreigners who invest significant sums in Britain has been discussed as part of Prime Minister Keir Starmer’s plans to blunt the economic blow from recent tax hikes and wider curbs on work permits.

An investor visa is possible for people willing to fund sectors seen as strategically important, such as artificial intelligence, clean energy and life sciences, Bloomberg previously reported.

While the British government is wary about reviving problems associated with past golden visa programs, an investor visa could signal that the UK is charting a different course from the EU, which is trying to curb migration incentives aimed at the rich.

Separately, the UK is considering plans to waive some visa fees for top global talent, the Financial Times reported on Monday.

Greece

Investors from outside the European Union can obtain a golden visa in Greece by buying residential property worth €800,000 in Athens, the second-largest city of Thessaloniki or on islands with a population of more than 3,100 people.

Elsewhere in the country, the home has to be worth at least €400,000. Alternatively, an investment of €250,000 can be made in a commercial property that is converted for residential use.

In all cases, the properties can’t be used for short-term rentals and must be larger than 120 square meters (1,300 square feet).

Other options for obtaining residency include making investments of varying amounts in Greek government bonds, technology startups or renovating historical buildings.

Citizens from China and Turkey are the top two groups who have received Greek golden visas, while demand from the UK increased after Brexit. Israeli applications have risen amid the ongoing Gaza conflict, while more recently demand from the US has grown, according to official figures.

The residence permit is issued for five years and can be renewed indefinitely, provided the investment is maintained. Investors who obtain the visa aren’t obliged to reside in Greece.

Hungary

The country shut down its original golden visa program in 2017 amid corruption concerns, but brought back a new version last year. The relaunch aimed to attract wealthy foreigners while addressing some of the criticisms levelled at the earlier program. It also sought to channel investment into the local economy without overheating the housing market.

Applicants can now qualify in two ways. One option is putting at least €250,000 into an approved real estate investment fund. These investments must be held for five years, and the fund is required to invest at least 40% of its net assets in Hungarian residential property.

The second path involves a €1 million donation to a higher-education institution operated by a public-interest trust.

The permit is granted for up to 10 years and can be renewed once for another decade, making it one of the longest-term residency options in Europe.

Importantly, Hungary scrapped the earlier €500,000 direct residential property purchase route at the start of this year, meaning investors can no longer qualify by buying real estate outright.

Italy

The country introduced a special visa aimed at attracting foreign investors in late 2017. In exchange for a strategic investment, the program allows non-EU citizens a renewable two-year residency permit.

Investments that count toward the visa include at least €2 million in Italian state bonds, €500,000 in an Italian company or €250,000 in an innovative Italian startup. Alternatively, applicants can also make a philanthropic donation of at least €1 million in sectors of public interest.

The Investor Visa for Italy — suspended for citizens from Russia and Belarus — is only for individuals, but recipients can apply for residency permits for spouses, children and elderly parents.

Numbers on the program are scarce. As of the end of 2021, there had been 64 applications from 20 different nationalities and 50 people were accepted for a total of €40 million in investments. Prime Minister Giorgia Meloni’s administration has not provided further updates on the program.

Spain

Prime Minister Pedro Sanchez’s government last year ended its golden visa program for foreign property buyers in a bid to increase the amount of affordable housing available to locals.

The program, which granted residence permits to non-EU citizens who invest at least €500,000 in a house in Spain, attracted thousands of people. Investors were mainly from China, Russia, the US and UK.

Like some similar programs, it was launched in the wake of the 2008 financial crisis, when Spain was desperate for funds, but it became a political liability for Sanchez with the economy growing and Spaniards struggling to afford homes.

Ireland

With a now-thriving economy, Ireland ended its golden visa program in February 2023 following a review of its “appropriateness.” Introduced by the Irish government in 2012 for non-EU nationals with a personal wealth of at least €2 million, applications were dominated by wealthy Chinese individuals.

The government continued to process applications received by the Feb. 15 deadline, approving 535 visas in 2024 — 97% of which were from Chinese nationals. In the first six months of 2025, Ireland approved 208 applications including 185 Chinese and 11 US individuals.

It’s expected to take a number of years to process the remaining applications received up to the deadline, the Department of Justice said.

The Netherlands

A program to attract foreign investors by offering residency in exchange for a €1.25 million investment was discontinued in April last year because of a lack of interest.

Less than 10 permits were issued over the past years, according to the Dutch Immigration Service’s website. Even after rules were relaxed, the Netherlands didn’t receive more applicants.

Malta

Europe’s top court banned a program by Malta that provided a so-called golden passport, in other words offering ciitizenship in exchange for investment. It was last the EU member state that had such a program.

The European Court of Justice decision from late April specified that an EU member state could not issue a passport unless an applicant had a “genuine link” to the nation, addressing a key criticism of loose rules.

The European Commission, the EU’s executive branch, has long warned that golden visa programs expose the bloc to money laundering and security risks. The war in Ukraine also generated concern that sanctioned individuals may have used them to acquire access to the bloc.

North Macedonia

The country has a citizenship-by-investment program, allowing foreigners to get citizenship if they invest in North Macedonia, which is a candidate for EU membership. The amount ranges from €200,000 in a government-approved fund to €400,000 in a new business facility that creates at least 10 jobs — retail and hospitality sectors are excluded.

You may like

Business

America’s mobile housing affordability crisis reveals a system where income determines exposure to climate disasters

Published

8 seconds agoon

December 10, 2025By

Jace Porter

Option A is a beautiful home in California near good schools and job opportunities. But it goes for nearly a million dollars – the median California home sells for US$906,500 – and you’d be paying a mortgage that’s risen 82% since January 2020.

Option B is a similar home in Texas, where the median home costs less than half as much: just $353,700. The catch? Option B sits in an area with significant hurricane and flood risk.

As a professor of urban planning, I know this isn’t just a hypothetical scenario. It’s the impossible choice millions of Americans face every day as the U.S. housing crisis collides with climate change. And we’re not handling it well.

The numbers tell the story

The migration patterns are stark. Take California, which lost 239,575 residents in 2024 – the largest out-migration of any state. High housing costs are a primary driver: The median home price in California is more than double the national median.

Where are these displaced residents going? Many are heading to southern and western states like Florida and Texas. Texas, which is the top destination for former California residents, saw a net gain of 85,267 people in 2024, much of it from domestic migration. These newcomers are drawn primarily by more affordable housing markets.

This isn’t simply people chasing lower taxes. It’s a housing affordability crisis in motion. The annual household income needed to qualify for a mortgage on a mid-tier California home was about $237,000 in June 2025, a recent analysis found – over twice the state’s median household income.

Over 21 million renter households nationwide spent more than 30% of their income on housing costs in 2023, according to the U.S. Census Bureau. For them and others struggling to get by, the financial math is simple, even if the risk calculation isn’t.

I find this troubling. In essence, the U.S. is creating a system where your income determines your exposure to climate disasters. When housing becomes unaffordable in safer areas, the only available and affordable property is often in riskier locations – low-lying areas at flood risk in Houston and coastal Texas, or higher-wildfire-risk areas as California cities expand into fire-prone foothills and canyons.

Climate risk becomes part of the equation

The destinations drawing newcomers aren’t exactly safe havens. Research shows that America’s high-fire-risk counties saw 63,365 more people move in than out in 2023, much of that flowing to Texas. Meanwhile, my own research and other studies of post-disaster recovery have shown how the most vulnerable communities – low-income residents, people of color, renters – face the greatest barriers to rebuilding after disasters strike.

Consider the insurance crisis brewing in these destination states. Dozens of insurers in Florida, Louisiana, Texas and beyond have collapsed in recent years, unable to sustain the mounting claims from increasingly frequent and severe disasters like wildfires and hurricanes. Economists Benjamin Keys and Philip Mulder, who study climate change impacts on real estate, describe the insurance markets in some high-risk areas as “broken”. Between 2018 and 2023, insurers canceled nearly 2 million homeowner policies nationwide – four times the historically typical rate.

Yet people keep moving into risky areas. For example, recent research shows that people have been moving toward areas most at risk of wildfires, even holding wealth and other factors constant. The wild beauty of fire-prone areas may be part of the attraction, but so is housing availability and cost.

The policy failures behind the false choice

In my view, this isn’t really about individual choice – it’s about policy failure. The state of California aims to build 2.5 million new homes by 2030, which would require adding more than 350,000 units annually. Yet in 2024, the state only added about 100,000 – falling dramatically short of what’s needed. When local governments restrict housing development through exclusionary zoning, they’re effectively pricing out working families and pushing them toward risk.

My research on disaster recovery has consistently shown how housing policies intersect with climate vulnerability. Communities with limited housing options before disasters become even more constrained afterward. People can’t “choose” resilience if resilient places won’t let them build affordable housing.

The federal government started recognizing this connection – to an extent. For example, in 2023, the Federal Emergency Management Agency encouraged communities to consider “social vulnerability” in disaster planning, in addition to things like geographic risk. Social vulnerability refers to socioeconomic factors like poverty, lack of transportation or language barriers that make it harder for communities to deal with disasters.

However, the agency more recently stepped back from that move – just as the 2025 hurricane season began.

In my view, when a society forces people to choose between paying for housing and staying safe, that society has failed. Housing should be a right, not a risk calculation.

But until decision-makers address the underlying policies that create housing scarcity in safe areas and fail to protect people in vulnerable ones, climate change will continue to reshape who gets to live where – and who gets left behind when the next disaster strikes.

Ivis García, Associate Professor of Landscape Architecture and Urban Planning, Texas A&M University

This article is republished from The Conversation under a Creative Commons license. Read the original article.

Business

Inside tractor maker CNH’s push to bring more artificial intelligence to the farm

Published

31 minutes agoon

December 10, 2025By

Jace Porter

Jay Schroeder, the chief technology officer of CNH, was recently in Brazil, discussing artificial intelligence use cases to support the company’s research and development team. The agricultural equipment maker has put a lot of effort into governance and assessing certified tools from vendors, but the actual application of the technology within its own research division remains very nascent.

What has held Schroeder back, he says, are lingering concerns about the return on investment of AI. He cites an MIT study published over the summer that found that 95% of AI pilots fail.

“It’s great that we’ve got people engaged in AI,” says Schroeder, who quickly pivots to ask rhetorically, “How do we measure success? What are the things that we can measure to say, ‘This has been a worthwhile investment for CNH?’”

Schroeder, a three-decade veteran of CNH who began his career as an engineer focused on mid-range tractor transmission design, isn’t completely cautious when it comes to leveraging AI. The tech has been deployed across broad corners of the business including software development, to assist with drafting contracts, producing R&D database queries, and content management.

CNH has scored some wins that Schroeder has been able to track. The company is leaning on AI to assist software engineers who are focused on precision agricultural technology and the FieldOps farm management systems, where AI, machine learning, and sensors are applied to digitally enhance farming. Early data has shown that these engineers are reducing the time needed for documentation by 60%, giving them more time to write new code.

Another project underway involves AI-enabled spraying systems that use cameras and machine learning to detect the difference between weeds and planted crops when applying chemicals in the field. Farmers who use AI in this manner can reduce the amount of herbicides they use by 80%.

Other applications have more nebulous gains. CNH’s engineers participated in a pilot program where they were able to use AI to pull field reports from dispersed datasets across the company. Within three minutes, this generative AI tool can produce a report that includes details about a design project, CNH’s standards for developing the gear, field test reports, and other key information.

“Can you measure that?” asks Schroeder. He says that many hours are being saved from the work that would have gone into developing one of those reports manually in the past. But putting an exact figure on the time savings is more difficult.

Investments in AI and other emerging technologies, like autonomous robots, have become central to the pitch made by CNH and other tractor suppliers as farmers face intense cost pressures and feelthe dire effects of climate change. In the United Kingdom, where the Dutch-incorporated CNH has its headquarters and main operations, heat and drought led to around $1 billion in lost production this year. Three of the five worst harvests in the history of the U.K. have occurred since 2020, according to the figures from the U.K.-based nonprofit Energy and Climate Intelligence Unit.

Only 3% of the world’s land is suitable for crops, but the global population is growing by 35 million each year, according to CNH. Farmers have to squeeze out more efficiencies in the field to meet that rising demand.

“The biggest impact on a farmer’s profitability is the yield, besides commodity prices, obviously,” says Gerrit Marx, CEO of CNH, which ranks No. 217 on the Fortune 500 Europe. “In the end, we want to help the farmer make better decisions.”

Farm-equipment suppliers have been squeezed by the impact of tariffs, which has led to weakening demand for their expensive tractors, combines, and harvesters. Last month, CNH reported weaker year-over-year sales for the company’s third quarter, as shipments slowed to dealers that have been working their way through excess inventories. But even as it faces those headwinds, CNH has vowed to invest nearly $5 billion over five years into its U.S. manufacturing and R&D facilities.

“The solutions we’re developing for AG [agriculture] are really helping to feed the world,” says Schroeder. “I grew up on a family farm…so for me, it’s personal.”

CNH’s primary technology partner is Microsoft, and the company has been in active conversations with the tech giant to deploy some AI tools to support precision-technology product development. Already, all CNH employees have access to the free, web-based version of Microsoft Copilot, and about 1,000 of the “AI power users” have access to the premium license.

The company’s precision agricultural tech AI projects, Schroeder says, are still “mostly in the pilot phase. We have a long hill to climb.”

One AI tool that CNH launched externally at the beginning of 2025 is the “AI Tech Assistant,” which was deployed to hundreds of agricultural and construction dealer groups to field questions about any issues for CNH-branded machinery and propose a repair plan.

Marx says that every member of CNH’s global leadership team is running at least one generative or agentic AI pilot program within their respective fields.

He says CNH is looking for tangible benefits to business outcomes. One area of increased focus is the application of generative AI to produce conversational, real-time insights that can connect the dots between the seeds, fertilizers, and equipment a farmer has at their disposal, as well as current and near-future weather patterns, to help improve crop management and planning.

“Tomorrow, the agronomist will become a set of agentic AIs that help the farmer to make bigger decisions better,” says Marx.

John Kell

Send thoughts or suggestions to CIO Intelligence here.

NEWS PACKETS

The emerging federal-versus-state battle to regulate AI. In the wake of around 100 different laws adopted by 38 states during this year’s legislative session, President Trump this week moved to issue an executive order that would aim to prevent state’s from passing laws restricting AI. Over-regulating AI, Trump and his allies believe, will make it harder for the U.S. to compete with China. But state governors have expressed fears about the impact of AI—on hiring and employment, consumer protection, fraud, and other risks—motivating them to act in absence of federal regulations.

Nvidia wins Trump’s blessing to sell AI chips in China. On Tuesday, Trump announced that he had granted Nvidia permission to sell the company’s H200 AI chip to China, giving the AI chip maker an opportunity to chase billions in orders from the market that would purportedly only go to “approved customers.” But, the Financial Timesreported that China would limit access to H200 chips and that buyers would likely need to go through an approval process that would require them to explain why domestic providers are unable to meet their needs.

Nike cuts CTO role; Deere CIO retires. Athletic-gear giant Nike has eliminated two C-suite roles, including the CTO position, as CEO Elliott Hill aims to eliminate “layers” to accelerate a turnaround plan. CTO Muge Dogan is departing after just two years in the role. She previously spent more than 16 years at Amazon. Meanwhile, Deere & Co. announced that CIO Raj Kalathur would retire in January after 28 years at the agricultural machinery manufacturer. Kalathur has served as CIO since 2019 and oversaw Deere’s IT function and John Deere Financial, the financial-services provider for dealers and customers that buy the company’s equipment. Deere didn’t provide further details on who would succeed Kalathur.

IBM scoops up Confluent for $11 billion. Shares of data-streaming platform Confluent jumped after the company agreed to a $31-per-share cash takeover offer from IBM. It’s one of the tech giant’s largest takeovers ever in a deal that will bolster its AI offerings. IBM says that it expects that global data demand will more than double by 2028 and asserts that the IBM-Confluent combination will enable better and faster deployment of generative and agentic AI. As Bloomberg reports, IBM CEO Arvind Krishna has led efforts to reposition the company’s business around selling AI-related services to clients and buying up software companies. Those efforts appear to be paying off, with around 80% of IBM’s 300 clients who buy AI products being new over the past two quarters, IBM told the Wall Street Journal when it reported earnings in October.

New York Times, Chicago Tribune sue Perplexity. The New York Times and the Chicago Tribune have sued Perplexity, saying the AI startup is copying and distributing their exclusive content. This adds to a growing list of more than 40 court cases in the U.S. in which copyright holders have sued AI companies, the Times reports. The Times was also in court last week for its ongoing litigation with OpenAI, with the latter suffering a legal blow after a federal judge ruled that the ChatGPT maker must produce millions of anonymized chat logs from its users in a copyright case that stems from a late 2023 lawsuit by the news organization.

ADOPTION CURVE

EY says that AI-driven gains are being pumped into reinvestment, not job cuts. While headlines continue to swirl around AI’s impact on jobs—including the recent report from outplacement firm Challenger, Gray & Christmas that AI has been responsible for nearly 55,000 job layoffs in 2025—consulting giant EY is making the case that savings in AI are far more likely to be poured back into the business. Nearly all business leaders (96%) report AI-driven gains in productivity, but they are far more focused on reinvesting than eliminating jobs.

When asked what they’ve done with the dollars saved from AI, these leaders report spending to support existing AI capabilities (47%), develop new AI capabilities (42%), strengthen cybersecurity (41%), invest in R&D (39%), and upskilling and reskilling employees (38%), according to consulting giant EY’s fourth AI Pulse Survey. Only 17% report those gains led to reduced headcount.

“We see that a lot of companies are coming back with positive returns and are getting even more bullish in what their investment theses are,” Dan Diasio, EY global consulting AI leader, tells Fortune. “More of those executives are putting more capital towards AI, many of them doubling what their investments were over the course of the next 12 months.”

The EY survey data aligns with Diasio’s thinking. About 27% of respondents currently commits a quarter or more of their IT budget to AI, but that share of respondents is projected to nearly double to 52% in 2026. The group that spends half or more of their IT budget on AI is expected to quintuple, to 19% next year from just 3% today.

Courtesy of EY

JOBS RADAR

Hiring:

– USPTO is seeking a CIO, based in Alexandria, Virginia. Posted salary range: $208.4K-$225.7K/year.

– Signal Mutual is seeking a VP, head of IT, based in Norwalk, Connecticut. Posted salary range: $180K-$220K/year.

– Aritzia is seeking a head of cloud and infrastructure, based in Seattle. Posted salary range: $200K-$400K/year.

– Image Solutions is seeking a director of IT, based in Long Beach, California. Posted salary range: $180K-$200K/year.

Hired:

– Nationwideannounced that Michael Carrel will serve as CTO, elevated to the role after more than 30 years of experience at the insurance company. Most recently, Carrel served as SVP and CTO for Nationwide Financial, the financial services arm of the company. Carrel succeeds Jim Fowler, who is departing to join telecom company Lumen Technologies.

– Lumen Technologiesnamed Fowler as chief technology and product officer, effective January 5. Fowler will succeed Dave Ward, who is departing to assume the role of president and chief architect at software giant Salesforce. Fowler has served on Lumen’s board of directors since 2023 and will step down, effective immediately, in connection with his new role. He most recently served as CTO at Nationwide since 2018.

– Condé Nastappointed Vasanth Williams as chief product and technology officer, assuming the role this week and joining the media company’s executive leadership team. Most recently, Williams served as chief product officer and EVP of engineering at Major League Baseball. He also held technology roles at Amazon, Microsoft, and Yodle.

– 1-800-Flowers.com appointed Alexander Zelikovsky as CIO, leading IT applications and platforms, data architecture, data management, cybersecurity, and business intelligence. Prior to joining the online floral and gifts retailer, Zelikovsky most recently served as CIO at shipping and mailing company Pitney Bowes. He also held technology leadership roles at Huggies and Kleenex manufacturer Kimberly-Clark.

– Owens Corning elevated CIO Annie Baymiller, adding the EVP title, a promotion the building materials manufacturer said reinforces a recent company commitment to accelerate the usage of digital tools and analytics. Baymiller has served as the company’s CIO since 2023 and initially joined Owens Corning in 2006. She will continue to report directly to CEO Brian Chambers.

– Westfield appointed Lloyd Scholz as enterprise CIO, joining the property and casualty insurance company after most recently serving as senior managing director and CTO at insurance provider Markel. Prior to Markel, Scholz spent 16 years at credit-card giant Capital One in leadership roles focused on data engineering, analytics platforms, cloud strategy, and enterprise technology.

– DXC Technology promoted Russell Jukes to serve as chief digital information officer, an expanded role to oversee the IT services and consulting company’s end-to-end digital and AI agenda. Jukes has worked for DXC since 2017, when the company was formed through the merger of Hewlett Packard Enterprise’s enterprise services business division and Computer Sciences Corporation.

Business

Goldman Sachs CFO on the company’s AI reboot, talent, and growth

Published

1 hour agoon

December 10, 2025By

Jace Porter

Good morning. Goldman Sachs is betting big on using AI to fundamentally rethink how the company operates.

At the Goldman Sachs U.S. Financial Services Conference on Tuesday, CFO Denis Coleman discussed the company’s recently announced OneGS 3.0 initiative—a multiyear overhaul of its OneGS program aimed at integrating AI throughout the bank’s operating model to reduce complexity and boost productivity. The effort is a top priority and will involve every division and function across the company, from business lines to control functions to engineering, Coleman said. “At its core, it’s an effort to drive more scale and more growth,” he said.

Goldman Sachs (No. 32 on the Fortune 500) is emphasizing the quality, availability, accuracy, and timeliness of data that underpins all of its AI initiatives, Coleman noted. That focus includes ensuring the company invests properly in shared platforms that span the organization.

“We’re asking all of our people to rethink the human processes they go through,” Coleman said. “And then we’re making investments in AI and agentic AI to accelerate change across these processes and platforms.”

They have identified six discrete workstreams, created dedicated teams, and tasked them with reviewing key activities, analyzing pain points, and identifying opportunities for efficiency, he said. Each group will then present formal investment cases for leadership review.

“We’ll fund some of those investments and hold teams accountable for the productivity outcomes that follow,” Coleman said. “This is a fundamental rethinking of how we expect our people to operate at Goldman Sachs.”

He added, “We don’t want to simply add more manual processes to drive growth. We need to convert some of that effort into digitized and automated systems—and rethink how those engines work.” Coleman expressed optimism that the OneGS 3.0 strategy will help fuel the firm’s continued growth.

‘The bar for talent remains high’

During the discussion, Coleman also addressed the talent environment, a key concern for many CFOs. “We continue to see incredible demands for people who want to come and work at Goldman Sachs, more than a million people asking to move in laterally to the firm,” Coleman said. “We can accommodate far less than 1%, so we’re still in a position to be extremely selective on the people that we hire.”

Goldman Sachs reduced headcount earlier in 2025 as part of its annual performance review process, which typically targets the lowest 3% to 5% of performers. The company moved that process up to the second quarter from its usual September timing. Despite those cuts, Goldman still expects a net increase in headcount by the end of 2025, supported by hiring in key growth areas.

“The bar for talent remains very high,” Coleman said. “We continue to operate as a pay-for-performance organization. Our goal is to pay competitively—especially for our very best people in each domain—and we are laser-focused on that.”

He added, “As long as markets stay buoyant and the outlook remains optimistic, maintaining that focus will be critical.”

Regarding the U.S. economic outlook, Coleman described it as “resilient and conducive to business.” He added, “We obviously have a Fed decision coming up. Our economists expect a 25-basis-point cut, likely followed by a pause at the beginning of 2026, and then possibly two more cuts.” Coleman also noted that 2025 is shaping up to be the second-biggest year in history for announced mergers and acquisitions industrywide.

SherylEstrada

sheryl.estrada@fortune.com

Leaderboard

Fortune 500 Power Moves

Kathryn A. Mikells, senior vice president and chief financial officer of Exxon Mobil (No. 8), will retire effective Feb. 1, 2026. Mikells, who has undergone several procedures to address a debilitating but non-life-threatening health issue, is stepping down to focus on her recovery, according to an SEC filing.

On Dec. 8, ExxonMobil named Neil A. Hansen, 51, as her successor. Hansen has served as president of Exxon Mobil Global Business Solutions since May 2025 and previously held senior roles in Energy Products, Europe, Africa and Middle East Fuels, and in the company’s controllers, audit, treasury, and investor relations departments, including vice president of investor relations and corporate secretary.

Like other executive officers of the corporation, Hansen will not have an employment contract. His annual salary will be $1.02 million, and he remains eligible for performance-based bonuses and long-term equity incentives.

Every Friday morning, the weekly Fortune 500 Power Moves column tracks Fortune 500 company C-suite shifts—see the most recent edition.

More notable moves

Jeff Chesnut was appointed CFO of Conestoga Energy, a provider of low-carbon intensity, effective immediately. With over 25 years of experience in strategic planning, capital markets, and finance, Chesnut will play a pivotal role in executing Conestoga’s growth strategy. Prior to joining Conestoga, Chesnut served as SVP of treasury, investor relations and corporate development at Upbound Group, Inc. (Nasdaq: UPBD). Before that, he served as EVP and CFO at publicly listed Loyalty Ventures Inc., which was a spinoff from publicly listed Alliance Data Systems, Inc. (now Bread Financial), where he spent over a decade.

James Robert “Rob” Foster was promoted to SVP of finance and CFO of ATI Inc. (NYSE: ATI), effective Jan. 1. Foster succeeds Don Newman, who will serve as strategic advisor to the CEO beginning Jan. 1. As previously announced, Newman will retire on March 1, 2026, and serve in an advisory capacity. Foster, a longtime ATI leader, most recently served as president of ATI’s specialty alloys and components business. He previously served as ATI’s VP of finance, supply chain and capital projects, overseeing the company’s global finance organization, capital deployment processes, and enterprise supply chain performance. Earlier, he led finance for both ATI’s operating segments and the forged products business.

Big Deal

The 11th annual Women in the Workplace report, released by McKinsey & Company and LeanIn.Org, examines the state of women in corporate America and Canada. This year, only half of companies are prioritizing women’s career advancement—a continuation of a multiyear decline in commitment to gender diversity. For the first time, women are less interested than men in being promoted.

One of the key findings is that sponsorship matters. “Women overall are less likely than men to have a sponsor—and entry-level women stand out for receiving far less sponsorship than any other group of women or men,” according to the report. “Even when entry-level women do have a sponsor, they’re promoted at a lower rate than men. Sponsors have a substantial impact on career outcomes: in the past two years, employees with sponsors have been promoted at nearly twice the rate of those without.”

Going deeper

Overheard

“I think in the next five years, you’re going to see large sections of factory work replaced by robots—and part of the reason for that is that these physical AI robots can be reprogrammed into different tasks.”

—Arm CEO Rene Haas said at Fortune Brainstorm AI in San Francisco on Monday.

America’s mobile housing affordability crisis reveals a system where income determines exposure to climate disasters

Taylor Swift Cries in Eras Tour Docuseries

Milan Men’s Fashion Week schedules 76 events for January 2026, including 18 in-person catwalk shows

Trending

-

Politics8 years ago

Politics8 years agoCongress rolls out ‘Better Deal,’ new economic agenda

-

Entertainment8 years ago

Entertainment8 years agoNew Season 8 Walking Dead trailer flashes forward in time

-

Politics8 years ago

Politics8 years agoPoll: Virginia governor’s race in dead heat

-

Entertainment8 years ago

Entertainment8 years agoThe final 6 ‘Game of Thrones’ episodes might feel like a full season

-

Entertainment8 years ago

Entertainment8 years agoMeet Superman’s grandfather in new trailer for Krypton

-

Politics8 years ago

Politics8 years agoIllinois’ financial crisis could bring the state to a halt

-

Business8 years ago

Business8 years ago6 Stunning new co-working spaces around the globe

-

Tech8 years ago

Tech8 years agoHulu hires Google marketing veteran Kelly Campbell as CMO