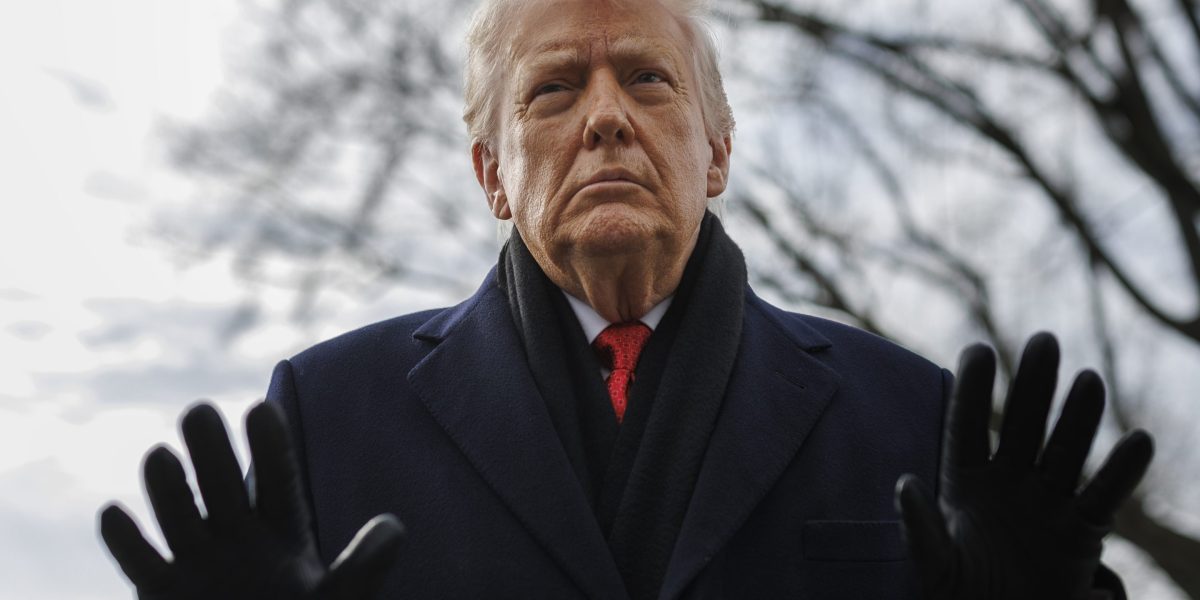

“I love Europe, and I want to see Europe go good,” Trump said on Wednesday at the Davos, Switzerland, meeting. “But it’s not heading in the right direction.”

But the president conceded that Europe is doing one thing better: keeping its drug prices low.

“A pill that costs $10 in London costs $130. Think—it costs $10 in London, costs $130 in New York or in Los Angeles,” he said to murmurs from the crowd.

Europe may not be recognizable to Trump’s friends, but Trump said he has other friends returning from London, remarking on the affordability of medication there. Indeed, a 2024 Rand study found that across all drugs, U.S. customers paid on average 2.78 times higher prices than in 33 other countries, including France, Germany, and the United Kingdom, in 2022.

The president has adopted a “most favored nation” policy meant to both lower drug costs for Americans while pushing other countries to pay more. Trump made a concerted effort in his second term to address astronomical drug costs, including minting a deal with 17 pharmaceutical companies to slash U.S. prices to match medication costs overseas. The move followed a sweeping executive order issued in May to introduce the most-favored-nation policy. On Wednesday, Trump alluded to an executive order he signed last week, pledging to lower drug prices by up to 90%.

Fallout with France

Trump said pharma companies did not initially believe countries would be willing to change prices. Trump noted in his remarks that he first approached French President Emmanuel Macron about increasing drug prices, but Macron refused.

“I said, ‘Emmanuel, you’re going to have to lift the price of that pill,” Trump said.

Trump said that threatening a 25% tariff on French goods, including wines and champagne, sealed the deal. Macron’s office disputed Trump’s assertion that he pressured the French president into lowering drug prices.

“It’s being claimed that President @EmmanuelMacron increased the price of medicines. He does not set their prices. They are regulated by the social security system and have, in fact, remained stable,” Macron’s office said in an X post. “Anyone who has set foot in a French pharmacy knows this.”

Included in the post was a gif of Trump with animated “Fake news!” text overlaid on the image.

Health policy experts say drug prices in the U.S. are so high because of a system structured differently from other countries that allow companies to negotiate with individual insurance companies or pharmacy benefit managers, giving them more leverage to raise prices than in other countries’ systems, where there is one regulatory agency negotiating drug prices for a population.

Efficacy of Trump’s efforts to lower drug costs

Industry leaders think Trump’s efforts to lower drug costs could pay off. Vas Narasimhan, CEO of pharmaceutical giant Novartis, told Fortune’s Jeremy Kahn at a USA House session in Davos on Wednesday that Trump identified a valid issue in the high cost of U.S. drugs.

About two-thirds of new drugs on the market over the last decade have come from the U.S., a result of its highly developed research and development (R&D) infrastructure. Some argue that other countries benefit from U.S. innovation without paying their fair share to support the industry’s growth.

“When you look at what underpins R&D in our industry, it’s been primarily in the United States,” Narasimhan said. “The United States is the source of more than half the profits of the industry, and without the United States, you wouldn’t have all of these innovations, all these incredible medicines.”

Narasimham emphasized the need for a “more balanced approach” to funding R&D, implying that other countries should pay more for U.S.-produced pharmaceuticals. He pointed to Trump’s deal with the 17 drug companies as a “reasonable” solution.

Early signs, however, suggest drug prices have not come down. A January report from drug price research firm 46brooklyn found drug companies, including 16 firms with which Trump made deals since September, raised drug prices for at least some of their drugs in the first two weeks of 2026. The median increase of the 872 brand-name drugs with hiked prices was about 4%, the same rate as the year before.

Reuters similarly reported earlier this month, citing data from 3 Axis Advisors, that those 17 drug companies had raised the prices of 350 medications. Public health experts attributed the rise to the behind-the-scenes nature of the deals between drug companies and insurers.

“These deals are being announced as transformative when, in fact, they really just nibble around the margins in terms of what is really driving high prices for prescription drugs in the U.S.,” Dr. Benjamin Rome, a health policy researcher at Brigham and Women’s Hospital in Boston, told the outlet.

The Department of Health and Human Services did not immediately respond to Fortune’s request for comment.

Politics9 years ago

Politics9 years ago

Entertainment9 years ago

Entertainment9 years ago

Politics9 years ago

Politics9 years ago

Politics9 years ago

Politics9 years ago

Entertainment9 years ago

Entertainment9 years ago

Entertainment9 years ago

Entertainment9 years ago

Business9 years ago

Business9 years ago

Tech9 years ago

Tech9 years ago