Business

Bosses are right: remote workers spend 2.5 fewer hours on the clock than their coworkers in the office

Business

Fed chair race: Warsh overtakes Hassett as favorite to be nominated by Trump

Business

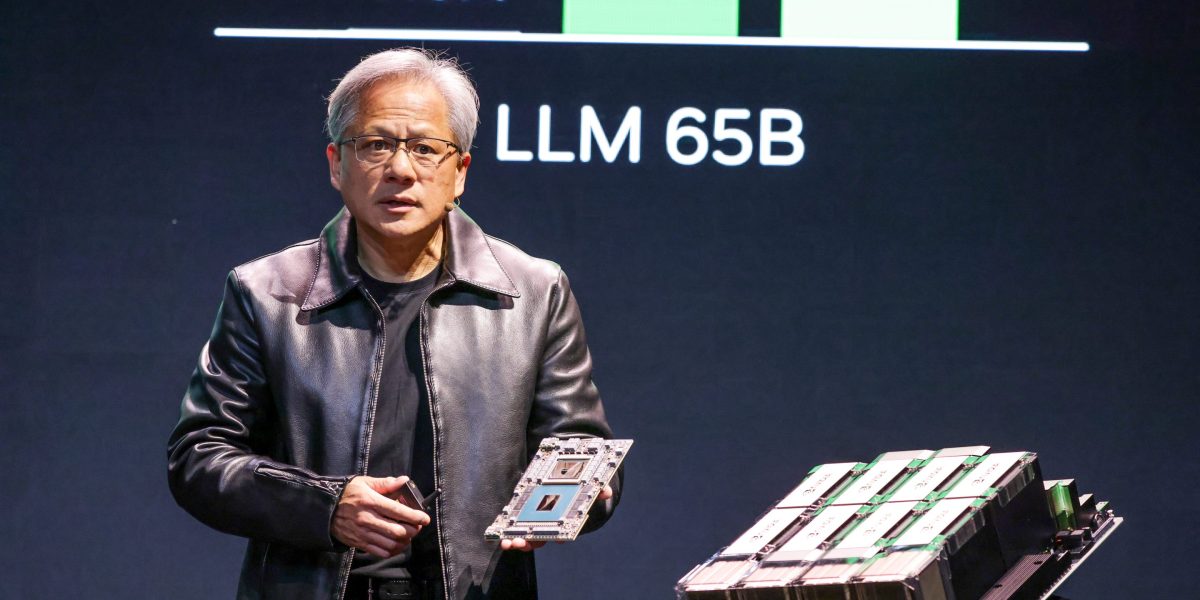

What happens to old AI chips? They’re still put to good use and don’t depreciate that fast

Business

‘I had to take 60 meetings’: Jeff Bezos says ‘the hardest thing I’ve ever done’ was raising the first million dollars of seed capital for Amazon

-

Politics8 years ago

Politics8 years agoCongress rolls out ‘Better Deal,’ new economic agenda

-

Entertainment8 years ago

Entertainment8 years agoNew Season 8 Walking Dead trailer flashes forward in time

-

Politics8 years ago

Politics8 years agoPoll: Virginia governor’s race in dead heat

-

Entertainment8 years ago

Entertainment8 years agoThe final 6 ‘Game of Thrones’ episodes might feel like a full season

-

Entertainment8 years ago

Entertainment8 years agoMeet Superman’s grandfather in new trailer for Krypton

-

Politics8 years ago

Politics8 years agoIllinois’ financial crisis could bring the state to a halt

-

Business8 years ago

Business8 years ago6 Stunning new co-working spaces around the globe

-

Tech8 years ago

Tech8 years agoHulu hires Google marketing veteran Kelly Campbell as CMO