- The dollar is down over 9% year to date compared with a standard basket of currencies, with the euro stronger relative to U.S. currency than at any point since November 2021. The safe-haven status of gold is also in focus as the precious metal’s price hits record highs above the $3,420 mark.

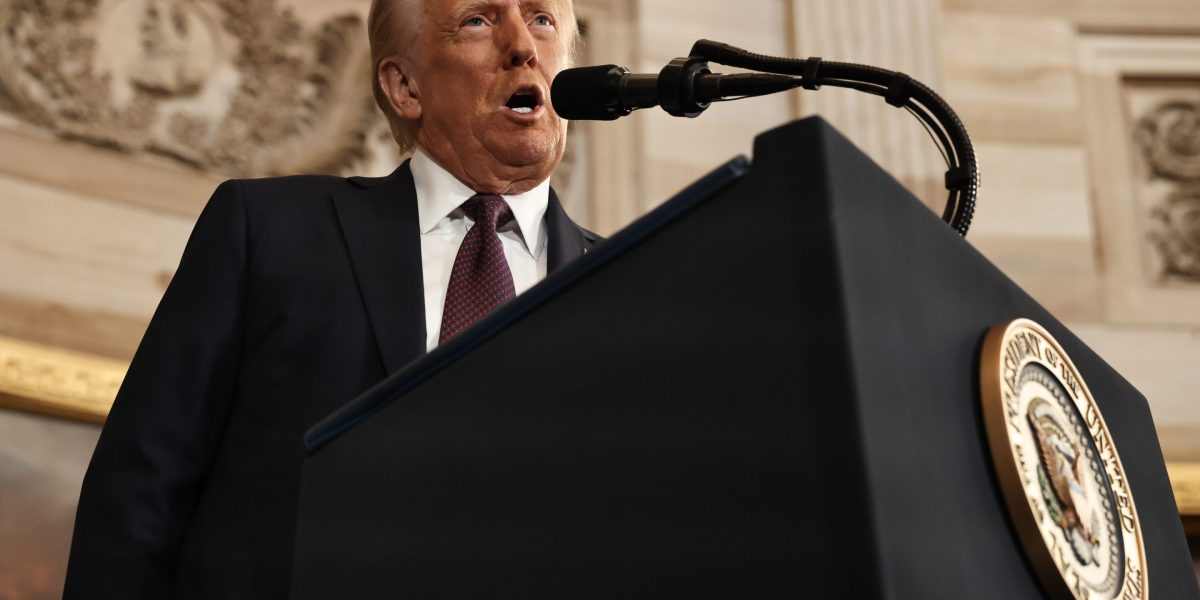

President Donald Trump’s tariffs are ostensibly aimed at forcing the world to “buy American,” but investors are doing the opposite with U.S. assets. The selloff in equities and Treasury bonds has even hit the almighty dollar, putting its safe-haven status in question, and Trump’s badgering of Federal Reserve Chair Jerome Powell doesn’t appear to be helping.

While the virtues of central bank independence have become mainstream economic dogma, experts warn it lacks a strong legal basis. On Monday, markets got their first chance to react to Trump’s top economist saying the administration is studying its options to fire the Fed chair. The dollar slid to a two-year low, and the S&P 500 dropped over 3% as the president took to social media and once again called on Powell and the Fed to cut interest rates, which Trump claims will complement his tariff strategy.

“With these costs trending so nicely downward, just what I predicted they would do, there can almost be no inflation,” Trump wrote on Truth Social, “but there can be a SLOWING of the economy unless Mr. Too Late, a major loser, lowers interest rates, NOW.”

Last week, the president said Powell’s termination could not “come fast enough” after the Fed chair warned Trump’s announced tariffs could result in both slowing growth and higher inflation, a dreaded combination known as “stagflation.” Powell acknowledged such a scenario is difficult for central banks, which raise interest rates to fight inflation but lower them to spur economic activity.

A day later, Trump repeatedly criticized the world’s most important central banker while talking to reporters with Italian Prime Minister Giorgia Meloni.

“If I want him out, he’ll be out of there real fast, believe me,” Trump said.

Powell has maintained that he can only be fired “for cause,” presumably referring to Section 10 of the Federal Reserve Act. While not explicitly defined in the statute, the Supreme Court’s 1935 decision in Humphrey’s Executor v. United States held that protection meant the head of such an agency could only be removed for “inefficiency, neglect of duty, or malfeasance”—and not for current policy disagreements.

Trump has already tested that precedent by firing Democratic members of the National Labor Relations Board and Merit Systems Protection Board, with both cases going to the Supreme Court. Regardless, Jay Hatfield, CEO of Infrastructure Capital Advisors, thinks the court’s 1935 standard could be used to describe Powell and the Fed’s slow response to rising inflation in 2021.

Now, he agrees with Trump that the central bank should cut rates. Still, even Hatfield, who manages ETFs and a series of hedge funds, told Fortune the president needs to back off on his threats.

“We just don’t need more volatility, more uncertainty right now,” he said.

Treasury Secretary Scott Bessent seems to agree. Last week, Politico reported Bessent has repeatedly warned White House officials that any attempt to fire Powell risks destabilizing markets.

Will the dollar lose its safe-haven status?

The independence of the Federal Reserve is a key part of what makes the U.S. economy appealing to investors. When politics interferes with the central bank’s ability to set monetary policy, however, inflation tends to be the result, which has been a major problem in autocracies like Turkey.

Trump, notably, is far from the first president to pressure the Fed to cut interest rates. President Richard Nixon told then–Fed Chair Arthur Burns to keep rates low in the early 1970s, later contributing to America’s worst bout with stagflation.

The crisis was only cured after Burns’ successor, Paul Volcker, raised rates to a record 20%. The move induced a painful and unpopular recession. However, the rise of an independent central bank committed to fighting inflation helped usher in a period of macroeconomic stability known as the “Great Moderation,” according to Paul Donovan, chief economist at UBS Global Wealth Management.

“Building that trust takes years,” he wrote in a note Monday. “Losing that trust can happen overnight.”

To many, recent market turmoil has signaled a dramatic drop of confidence in the U.S. The dollar is down over 9% year to date compared with a standard basket of currencies, with the euro stronger relative to U.S. currency than at any point since November 2021. The safe-haven status of gold is in focus as the precious metal’s price hits record highs above the $3,420 mark.

Of course, Trump and several of his allies have called for a weaker dollar to make American exports cheaper abroad. At a Senate hearing in 2023, Powell was questioned about its status as the world’s reserve currency by now–Vice President JD Vance.

“It’s the place where people want to be in times of stress,” Powell said, “using dollar-denominated assets.”

That’s not the case right now, though.

This story was originally featured on Fortune.com

Source link

Entertainment8 years ago

Entertainment8 years ago

Politics8 years ago

Politics8 years ago

Entertainment8 years ago

Entertainment8 years ago

Entertainment8 years ago

Entertainment8 years ago

Tech8 years ago

Tech8 years ago

Tech8 years ago

Tech8 years ago

Tech8 years ago

Tech8 years ago

Politics8 years ago

Politics8 years ago