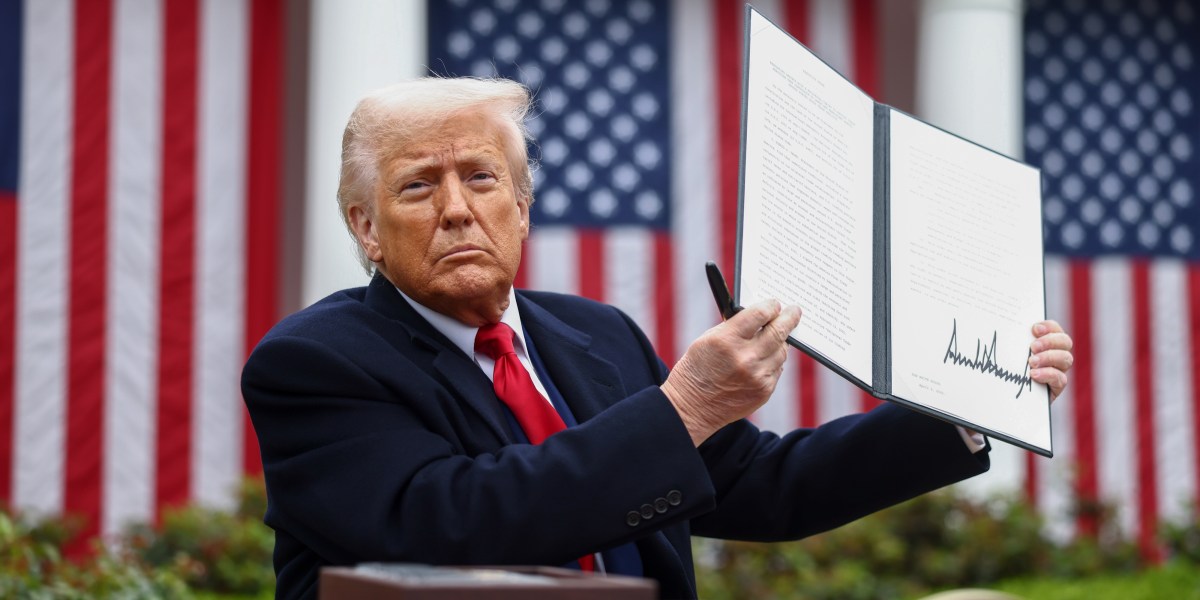

Despite the midday decision on Wednesday by President Donald Trump to pause most of his controversial tariff hikes, the risk to retailers remains very present that duties can be once again imposed in a few months, maintaining uncertainty over how they operate even as they begin to plan buying for the holiday season.

But Walmart Inc CEO Doug McMillon told investors that the world’s largest retailer has navigated many periods of uncertainty before, such a the tariff hikes of 2018 and the post-pandemic inflation surge, assuring them the company had a strategy moving forward.

“We have a plan to execute. There will be a Christmas, and people will celebrate Christmas, and they will buy items, and we will sell them those items,” McMillon said during a media briefing at the conclusion of the company’s 2025 investor day in Dallas.

Those plans include keeping a robust inventory and stocked shelves despite trade uncertainty. That’s possible in part because of Walmart’s clout with vendors, which allows it to absorb a significant part of any cost increases.

“Some of the confidence that we’ve been expressing is really founded on: we know who these buyers are,” he said. “They have great tools to manage this long-standing supplier relationship, and we believe that they will execute well.”

To be sure, the retailer is still navigating a tricky path. Although the major grocer only imports one-third of what it sells, China is the biggest source of that inventory. And China was not included in Trump’s tariff pause—in fact, it was singled out for higher tariffs. That means Walmart is still at risk from higher duties for a big chunk of its products.

But McMillon, who for years was a buyer at Walmart and Sam’s Club, said that higher tariffs can be managed by having higher margin, higher priced products subsidize lower margin items. In other words, the higher costs stemming from a tariff can be offset by a higher price imposed on an item with low price elasticity, or items whose demand is not particularly price sensitive.

The company also has a big advantage over many rivals is that many of its goods are replenishable, so it doesn’t carry the same potential risk of being forced to clear out as much discounted unsold seasonal merchandise at other retailers. Instead, it can just stop ordering new inventory, or decrease the size, if demand softens.

“Right now, our merchants are thinking about quantities,” McMillon said. But he was clear that the company had “not canceled anything yet.”

This story was originally featured on Fortune.com

Source link

Entertainment8 years ago

Entertainment8 years ago

Politics8 years ago

Politics8 years ago

Entertainment8 years ago

Entertainment8 years ago

Entertainment8 years ago

Entertainment8 years ago

Tech8 years ago

Tech8 years ago

Tech8 years ago

Tech8 years ago

Tech8 years ago

Tech8 years ago

Politics8 years ago

Politics8 years ago