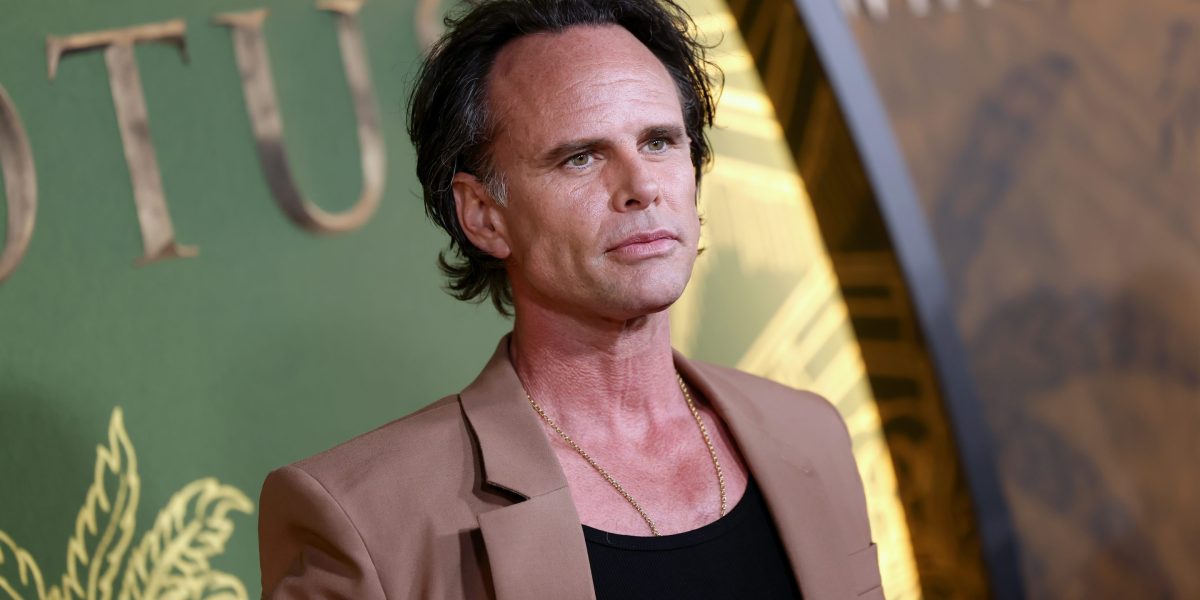

- American actor Walton Goggins, star of “The White Lotus,” launched his Hollywood career after responding to an American Express letter asking him to open a line of credit. The deal came with two round-trip tickets, which got him to California for cheap.

Many people might be looking for a sign to take a leap of faith. And for Walton Goggins—star of the hit drama series currently streaming on HBO, “The White Lotus”—that epiphany came in the form of a bank letter.

“I got this invitation from American Express to take on debt,” he said in a 2019 interview on The Late Show with Stephen Colbert. “With this invitation came two round-trip ticket [offers]. One was $99 east of the Mississippi. The other was $199 west of the Mississippi.”

Goggins estimates the credit card had a measly limit of $500, but he cared less about building credit than getting to Hollywood.

At the time, he was a college student at Georgia Southern University in Statesboro, Georgia and a ticket from Atlanta to Los Angeles was around $1,100. This American Express deal made the dream of getting to California within reach—and so the entertainer saw it as a sign “from God” to move to LA and become an actor. “That was it, I was out. I quit college,” he added.

Goggins is now raking it in on ‘The White Lotus’

The first time he went out to California, he didn’t snag an agent. But by the second time he traveled there, he decided to plant his roots. With $300 in his pocket and a really bad apartment rental in North Hollywood, Goggins got a representative fairly quickly and started booking roles. His first gig was in a Billy Crystal comedy movie called “Mr. Saturday Night” released in 1992.

Since then, Goggins has appeared in over 50 movies and 40 TV shows—and has been nominated for 38 awards in the entertainment industry, snagging nine wins.

He has been a recurring muse in Quentin Tarantino’s projects, from “Django Unchained” to “The Hateful Eight”; played Detective Shane Vendrell for six years on “The Shield”.

Right now, he’s starring in the third season of “The White Lotus.” It’s estimated that lead actors on HBO series can earn between $150,000 to $500,000 per episode—while supporting characters get anywhere from $50,000 to $150,000, per IMDB.

But none of it may have happened if he hadn’t responded to an American Express letter most people would toss into the trash.

“I’m only here because of American Express,” he said in the interview.

Starting careers in the most unlikely of ways

Goggins isn’t the only person to launch their career—or finally turn to their true passion—in an unorthodox way. Signs can spring up from the most unlikely of places.

Steve Jobs may be remembered for creating one of the most popular products of all time: the iPhone. But he didn’t get his start in the most conventional (or legal) way.

Jobs and his Apple co-founder Steve Wozniak first got into business together by illegally selling ‘blue boxes’—electronic devices that allowed users to exploit telephone systems to make free long-distance calls. That young rebellion set Jobs and Wozniak on the path to founding their $3.2 trillion brainchild.

“If it hadn’t been for the blue boxes, there would have been no Apple,” Jobs said in a 1994 video interview archived by the Silicon Valley Historical Association. “I’m 100% sure of that. Woz and I learned how to work together, and we gained the confidence that we could solve technical problems and actually put something into production.”

Martha Stewart, America’s beloved cook and homemaker, didn’t delve into her true passions until after launching her career as a high-power Wall Street stockbroker. But just seven years into Stewart’s career, in 1973, there was a stock market crash that lasted until the following year. Being seen as the ‘bad guy’ who lost her clients’ money wore her down, so she left the company to start her own catering business. The rest is history.

Other entrepreneurs took off in unlikely places. Kat Cole, veteran businesswoman and CEO of AG1, launched her white-collar career while she was working as a Hooters waitress.

At just 19, she was tapped to travel around the world to help spur interest among foreign markets; by 23, she was the head of global training for managers and employees. The corporation may seem an unorthodox place to start—but it set her on a path to later become the CEO of Cinnabon, and sit on boards of brands like Milk Bar.

This story was originally featured on Fortune.com

Source link

Entertainment8 years ago

Entertainment8 years ago

Politics8 years ago

Politics8 years ago

Entertainment8 years ago

Entertainment8 years ago

Entertainment8 years ago

Entertainment8 years ago

Tech8 years ago

Tech8 years ago

Tech8 years ago

Tech8 years ago

Tech8 years ago

Tech8 years ago

Politics8 years ago

Politics8 years ago