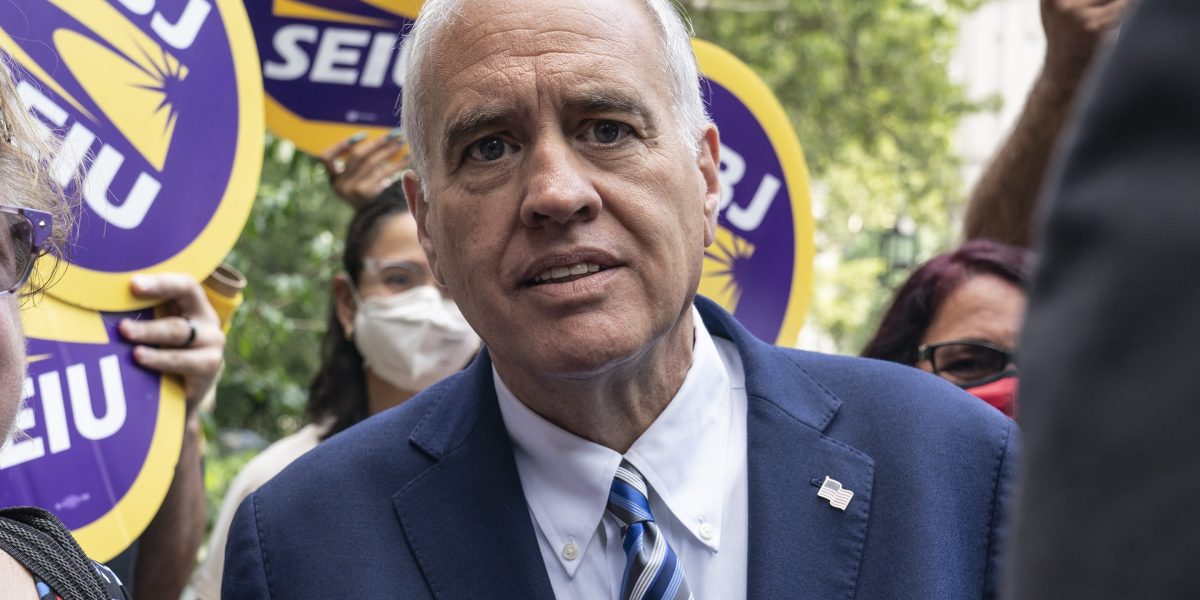

- Employment in New York’s securities industry reached the highest level in three decades at more than 200,000 workers, reported state Comptroller Thomas DiNapoli on Wednesday. And along with sky-high employment, the total estimated 2024 bonus pool among New York Stock Exchange member firms is the largest on record since 1987. But looming uncertainty due to federal policy is muddying the industry outlook for 2025.

Wall Street is back and profits are soaring. And according to a new report, so are bonuses.

New York State Comptroller Thomas P. DiNapoli reported on Wednesday that Wall Street’s annual wealth infusion for employees—its bonus pool—notched a new record at $47.5 billion in 2024, an increase of 34% over the year prior. The bonus pot hasn’t veered even close to this level since 2021, when the total swelled to $42.7 billion, before tumbling back down to $33.9 billion in 2022.

The comptroller’s office publishes a yearly estimate of bonus payouts for those employed in the securities industry based on personal income tax withholding trends and cash bonuses paid. The average bonus deposit, accounting for those at the entry level all the way up to those with panoramic views in corner offices, was $244,700, DiNapoli found. A year earlier, the average payout was $186,100. The 131 New York Stock Exchange member firms’ profits rose 90% in 2024, the comptroller reported.

“The record high bonus pool reflects Wall Street’s very strong performance in 2024,” DiNapoli said in a statement. “This financial market strength is good news for New York’s economy and our fiscal position, which relies on the tax revenue it generates. However, increasing uncertainty in the economy amid significant federal policy changes may dampen the outlook for parts of the securities industry in 2025.”

Tariffs have claimed a starring role among the many policy changes implemented by the Trump administration, rocking major market averages with uncertainty and volatility. The S&P 500 is down 3% the past month and 1.5% year to date. One of the cascade effects of those federal policy changes—and the presence of Tesla CEO Elon Musk in Washington, D.C.—has resulted in pressure on DiNapoli. As comptroller, DiNapoli oversees the state’s $270 billion retirement fund, which holds a stake in Tesla valued at more than $800 million. A group of 23 Democratic state senators urged the comptroller this month to divest from the Musk-helmed automaker.

According to the two dozen state senators who reached out to DiNapoli, the Tesla stake is the fund’s seventh-largest holding, and it is in jeopardy while Musk is the CEO.

“Musk’s actions leading President Donald Trump’s Department of Government Efficiency (DOGE) have led to a deterioration of the company’s reputation among its most loyal customers,” states the letter, signed by Senator Patricia Fahy (D.-Albany) and 22 other senators.

Tesla did not immediately respond to a request for comment.

Meanwhile, the traders, supervisors, analysts, and portfolio managers in New York have a front-row seat to the volatility. The lucrative industry, with an average annual salary of $471,000, helps make up the beating heart of New York City, with 69% of employees residing in one of the five boroughs. More than a quarter of New York City residents who work in securities and finance make more than $250,000 a year. Similarly, more than half of commuters from Westchester County and 41% of commuters from Long Island who work in securities make more than $250,000 a year, according to New York state labor figures.

DiNapoli reported that one in 11 jobs in New York City is somehow linked to the securities industry, and the state derives 19% of its tax collections from it. The 2024 bonus pot will gin up an extra $600 million in income tax this year, and an additional chunk of change valued at $275 million will go into New York City’s coffers in 2024 compared to 2023. Securities industry employment is the highest it’s been in some 30 years with 201,500 workers in contrast to 198,400 the year before. It’s higher than any other state, the comptroller reported.

Still, while New York City boasts the largest number of securities-industry jobs in the U.S., the figure has tumbled consistently since the ’90s, according to labor data. In 1990, a third of all securities jobs were in NYC, compared to 17.4% in 2024. And while New York state added 15,600 securities industry jobs between 2019 and 2023, Texas outpaced it by adding 19,400 jobs of its own. Florida added 13,300 jobs during the same period.

Also worth noting, major financial firms including Goldman Sachs and Citigroup have announced job cuts and restructurings, which could impact headcount in the state’s securities industry.

This story was originally featured on Fortune.com

Source link

Entertainment8 years ago

Entertainment8 years ago

Politics8 years ago

Politics8 years ago

Entertainment8 years ago

Entertainment8 years ago

Entertainment8 years ago

Entertainment8 years ago

Tech8 years ago

Tech8 years ago

Tech8 years ago

Tech8 years ago

Tech8 years ago

Tech8 years ago

Politics8 years ago

Politics8 years ago