Business

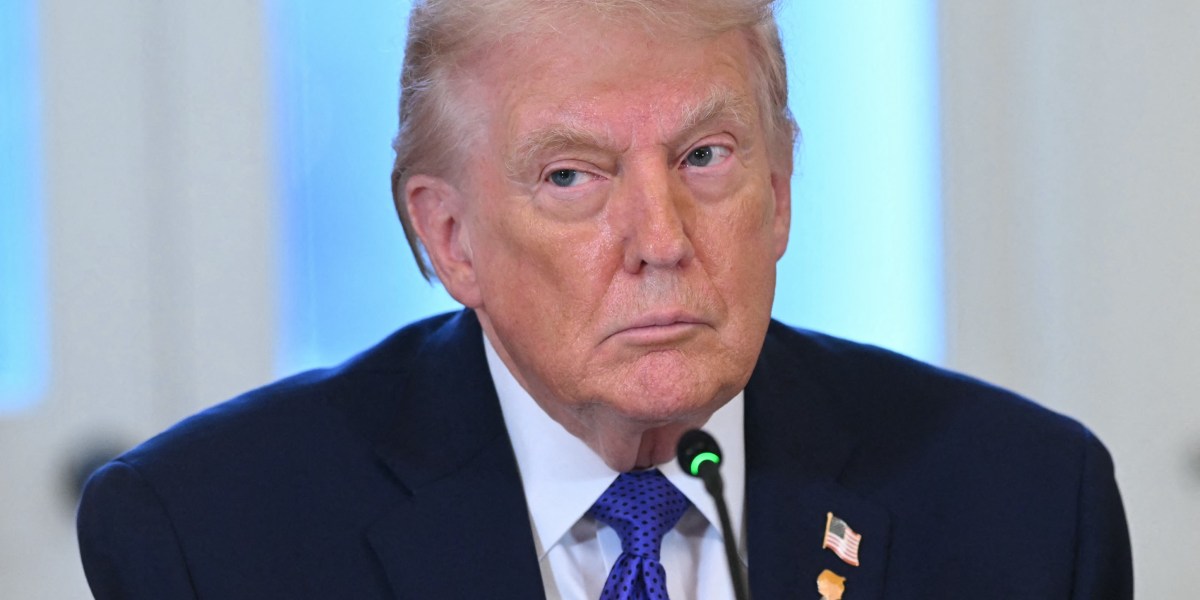

Why Trump’s plan to shut out institutional investors could raise housing costs

Published

4 hours agoon

By

Jace Porter

Given President Trump’s pledge to conquer America’s housing crisis, and the plan he just grandiosely delivered to do it, you’d think he’d soon hatch a new credo to spotlight the campaign—something like MAHAA, for “Make America’s Homes Affordable Again.” Indeed, the biggest part of the overall “affordability” problem that’s so crucial to voters, and increasingly dominates the debate among politicians—led by Trump himself—is the explosion in the cost of housing. The rise in what families need to pay for the staple of staples that they strive to own over all others has, since just before the pandemic’s onset, far outstripped the sticker shock on the likes of groceries, cars, insurance, or any other key item. Put simply, America’s biggest household expense has grown so enormous that most first-time buyers don’t have the means to take it on.

The tens of millions of renters in the wings know the math all too well. The two factors that determine the ability to buy, home prices and mortgage rates, have both moved in the wrong direction big-time, and shockingly fast. According to the American Enterprise Institute, average prices have risen over 150% since the start of 2019, and home loan rates posted at Mortgage News Daily have ballooned by two-thirds, from roughly 3.7% to today’s 6.2%. That dire twofer, the National Association of Home Builders reckons, has made home ownership an aspiration that’s beyond the grasp for three in four U.S. households.

Trump proposes an unorthodox fix: Blocking institutional investors from amassing homes to rent

On Jan. 6, Trump unveiled a program to restore housing affordability by banning what he considers a major force driving prices higher: purchases of homes by big investors that they recast as rentals. As the president wrote on Truth Social, “For a very long time owning a home was considered the pinnacle of the American Dream [that’s become] increasingly out of reach for too many people, especially younger Americans. I am immediately taking steps to bar large institutional investors from buying more single-family homes. I will be calling on Congress to codify it.”

The same day, in an unusual confluence in policy, Gavin Newsom basically endorsed the president’s initiative. A spokesman for the California governor declared, “When housing is treated mainly as a corporate strategy, Californians feel the impact. Prices go up, rents rise, and fewer people have a chance to buy a home.” The idea that Wall Street is a potent force in inflating home prices, and must be stopped, has also stirred prominent voices in Congress. Senators Elizabeth Warren (D-Mass.) and Jeff Merkley (D-Ore.) have each introduced (so far unsuccessful) legislation that would impose tax penalties on big home acquirers. New York Gov. Kathy Hochul has joined the chorus calling for a crackdown, blasting the large own-to-rent purveyors for “buying up the housing supply and leaving everyday homebuyers with fewer and fewer affordable options.” The movement’s also gaining traction at the local level: Two municipalities in Indiana recently nixed long-term rentals by investors, the first in the U.S. to do so.

Restricting institutional housing buyers is counterproductive, says a leading expert

The president and his growing crowd of allies from both parties are essentially arguing that by purchasing large numbers of single-family homes, either in new developments or long-standing neighborhoods, then renting them out, large investors are substantially shrinking the inventory available for sale. That supposedly drives up prices for regular folks, since they’re bidding on a pool of available houses that’s a lot smaller than if those big players weren’t competing with them. The theory goes, stop the institutional buying led by such publicly traded giants as Invitation Homes and American Homes 4 Rent, and an array of investment firms including Pretium Partners and Brookfield Asset Management, and prices would fall or at least flatten, notching a big advance in affordability.

“There’s no empirical evidence that large institutions have driven up housing prices,” says Ed Pinto, codirector of the American Enterprise Institute Housing Center. Pinto argues that the rise of institutional buyers is a symptom, not a cause of the housing crisis—and that in fact, they’re helping to address the real problem that misguided policies engineered on Main Street and in Washington, D.C., caused in the first place: a severe shortage of new construction, and hence homes for sale, caused by restrictive local zoning and excessive demand for that paltry supply triggered by the Fed’s easy-money policies that drove mortgage rates to super-bargain levels following the pandemic. It’s that combination—not these supposed marauders—that unleashed the rampant price run-up that’s locking out most Americans. “These companies are not pillaging homebuyers,” says Pinto. “It’s just the opposite. As more and more people can’t afford to buy single-family homes, they’re providing the option of living in one at lower cost by renting. That takes those people out of the purchase market, and hence can take pressure off prices.”

Single-family rentals also provide extra flexibility for America’s workforce. Say someone moves to a new city for a job as a nurse or construction foreman, but believes they may relocate in a year or two for a fresh position in another locale, either in the same company or for another employer. The ability to rent a home means they get all the lifestyle benefits of owning, but don’t need to make a big financial commitment on a property that they may live in only for a relatively short time.

Pinto points out that in two rough periods for housing, investors came to the rescue. The first was the real estate crash that defined the Great Financial Crisis. “The investors bailed out the market,” says Pinto. “There were nowhere near enough individual buyers to soak up the houses thrown on the market and going through foreclosure, despite the collapse in prices. Few potential buyers had sufficient credit. Investors bought tens of thousands of derelict homes sight unseen, many of them owned by the banks, and set a floor under the market.” Then following the pandemic, when the sharp drop in rates orchestrated to reboot the economy sent prices soaring, the buy-to-rent players boosted their portfolios once again, this time not because people didn’t have credit or were unemployed or cash-strapped, but since towering prices were pushing would-be buyers into long-term renters. That trend gave families suddenly unable to purchase but who still wanted that third bedroom and backyard the opportunity to live in a house while they waited to become homeowners.

Another advantage provided by institutional buyers, says Pinto: They sweep up rundown houses en masse, then invest heavily to fix roofs, rewire electrical systems, repair flooring, and install new appliances, all to win renters. He also cites a big misconception in the critics’ view of the industry. These housing investors aren’t only buyers. In fact, they’ve recently been selling slightly more houses than they’re acquiring.

A misconception about what’s making housing so expensive

Pinto notes that investors overall have long been big owners of single-family homes. But it’s small, mom-and-pop businesses that always dominated the market, and that’s the case today. The institutions play a minor role, though they contributed greatly as purchasers of last resort during the GFC and providers of sorely needed rentals in the pandemic. Today, over 12% of the nation’s stock of single-family houses is held by landlords owning 100 properties or less. The institutions, at 100-plus, account for just 1% of the total. In not a single county does a large investor harbor over 10% of the homes, and in 60% they own none at all. Atlanta, for example, has relatively huge investor presence at 4.2%, and Dallas and Houston also rank high at 2.6% and 2.2% respectively.

It’s especially informative to study the recent trend in purchases by the institutions—and it doesn’t show the kind of listing-crushing accumulation the president and others targeting the industry suggest. Pinto assembled data that runs for the 21 months ending in November 2025. He found that overall, investors large and small bought around one-quarter of all homes sold. But the share accumulated by the 100-plus club amounted to just 2%. Plus, their portfolios actually slipped since they sold more than they bought. Here’s the data: In that almost two-year period, large landlords acquired 178,000 single-family houses, and exited 184,000, for a net decline of 6,000. Despite all the criticism claiming that these alleged exploiters squeezed out regular folks looking to make the life-transforming leap, their holdings barely budged. Sean Dobson, CEO of the Amherst Group, an Austin investment firm that owns around 50,000 homes for rent, says the idea that the institutions compete with regular buyers is wrong. He notes that Amherst purchases homes that require significant rehab, typically costing $30,000 or more, and that it caters to consumers who can’t buy now due to tightened credit.

By Pinto’s estimate, the large buyers purchased around 40% of their newly acquired homes from developers who built new dwellings for them, often in bespoke communities conceived specifically for rental. The industry is as much about build-to-rent as fix-up to rent. For example, in 2023 Pretium Partners forged a pact to buy 4,000 single-family homes erected by D.R. Horton in such states as Georgia, Florida, Texas, and Arizona. Once again, these are additions to the nation’s housing stock that fulfill a need by enabling priced-out Americans to live in a roomy cape or ranch, say, instead of a cramped apartment. The necessity to rent effectively created the new house.

When rental markets soften and sale prices improve, the investors typically put a portion of the homes originally built for lease back on the market. That increases the roster of listings, the reverse of what the critics denounce as the institutions’ supply-hammering role. It’s a similar story for the fixer-uppers. Many of these homes are so dilapidated before the investors purchase them that they’re extremely difficult to sell, if they’re livable enough to find buyers at all. Once again, when the owner market rebounds, these older dwellings, now fully refurbished, frequently boomerang back as “for sale.” In the mid-2010s, it appears the investors were net sellers as the owner crowd stormed back in the recovery from the GFC.

As Pinto’s stats show, today the industry’s powerhouses are taking a middle stance by acquiring about the same volumes as they’re marking “for sale,” even tilting a bit toward lightening their portfolios. The ebb and flow that investors furnish by hatching rentals when demand for them is strong, then switching toward sales when buyers return, helps balance in the marketplace. “We are able to step in when consumers step out, says Dobson. “This serves as a shock absorber that reduces volatility across cycles.”

Here’s the clincher for Pinto: His research shows absolutely no relationship between the level of institutional ownership and the shortage of housing—the principal factor inflating prices—in the individual markets. Pinto studied the price increases in 150 metros from January 2012 to June 2025, and compared them to the degree of institutional ownership in each city. Many of the biggest jumps came in locales where the large landlords barely participated. Prices in Boise City, Idaho; Bend, Ore.; Modesto, Bakersfield, and Stockton, Calif.; Prescott Valley, Ariz.; Ocala, Fla.; and Austin, Texas, all rose between 165% and 270%, above to well above the national average, yet investors in each city held less than 1% of the homes. By contrast, metros featuring relatively large shares witnessed below-average price appreciation over that almost 13-year span, including Birmingham, San Antonio, Indianapolis, and Columbia, S.C. Memphis had the highest share of institutional rental homes among all the cities at 4.5%, yet home prices increased far less than the nation’s norm.

Pinto stresses that the focus on the big buyers obscures the real reasons for the affordability crisis and the structural solutions needed to fix it. “Institutions own 1% of the nation’s single-family housing stock, yet prices rose 154% from 2012 to 2025,” he says. “Institutional investors are not the root cause of rapid home price appreciation. America faces a shortage of 6 million homes because of restrictive land use practices and zoning regulations, and because of the Fed’s easy-money policy in the pandemic. In California, there’s a 15% housing shortage, the biggest in the country, and investors own under 1% of the homes. The solution is build a lot more houses. Big investors have nothing to do with how the housing shortage got created.”

So what will be the impact of barring large investors from adding to their portfolios? Keep in mind that they’re not increasing their stocks right now. So in the short term, the effect would be negligible. But if we suffer a sharp economic downturn, they won’t be able to jump in and provide the support to prevent a free fall in prices, their crucial function in the GFC. More low-income folks will get stuck in one-bedroom rentals instead of getting the chance to have a garden and separate bedrooms for mom and dad and the two preteens. And the investors won’t be around contributing the capital expenditures for fixing the flooring and replacing the bathrooms in the country’s most battered homes. Nor will any new manses they specially buy from developers to rent hit the marketplace when demand rises, and they can get a better deal selling than renting.

“I always worry about the unintended consequences of these kind of plans,” says Pinto. “And for this plan, they could easily be not even neutral but negative.” This could be a bad deal for America’s aspiring homebuyers and for folks shut out of home ownership for now who cherish the prospect of living in a house, even as a rental. Denying this vast demographic-in-waiting that option removes a step that brings them closer to the American Dream.

You may like

Business

CFOs move finance AI from pilots to deployment in 2026

Published

3 minutes agoon

January 13, 2026By

Jace Porter

Good morning. CFO confidence is on the upswing as 2026 begins, and digital transformation in finance has overtaken enterprise risk management as the top goal for the year ahead.

That’s a key finding of Deloitte’s latest CFO Signals Spotlight report, released this morning. Half of the finance chiefs surveyed named digital transformation as their foremost priority for 2026, followed by cash management optimization and capital allocation. The findings are based on a recent Q4 survey of 200 CFOs across industries at North American companies with at least $1 billion in annual revenue.

Steve Gallucci, global and U.S. leader of Deloitte’s CFO Program, told me the shift reflects how finance leaders are moving from exploration to execution when it comes to technology—particularly AI.

“Efficiency and productivity are certainly part of the equation,” Gallucci said. “But more broadly, we’ve been on this digital evolution for some time.”

In recent years, as advanced technologies like agentic AI burst onto the scene, boards and C-suite leaders have shown increasing interest. Finance chiefs took a cautious approach to implementing these tools. Deloitte’s Finance Trends report finds that finance leaders are now influencing enterprise strategy, driving cost optimization, advancing digital transformation, and building tech-enabled teams.

Last year, many companies focused on testing, creating use cases, and developing comfort with AI, Gallucci noted. But according to the Q4 survey, 87% of CFOs said AI will be extremely or very important to how their finance departments operate in 2026.

“What we’re seeing in some of the answers to the Q4 survey questions is that continued evolution,” Gallucci said. Finance leaders are taking a more deliberate, enterprise-wide approach to transformation and AI is accelerating that commitment, he added.

The report outlines six key areas CFOs plan to prioritize this year: Leveraging digital tools to transform finance operations; going all in on AI; embedding AI agents directly into finance workflows; keeping close watch on changes in buyer behavior; tapping internal talent to manage costs; and exploring more deal-making opportunities.

CFOs also appear focused on redeploying existing finance talent to work alongside AI-driven systems. About half of respondents said their organizations plan to hire or promote internally to help keep worker costs in line for 2026.

As CFOs and finance leaders lean into digital transformation, there’s an expectation that they’re going to have to reskill their existing talent, Gallucci said.

“We’re not seeing a decline in the number of finance professionals as a result of investments in technology and AI,” he said. But as leaders look to the future—both in finance and across the broader enterprise—they are increasingly focused on boosting productivity through technology and combining those tools with the skills of their existing workforce and an agentic digital workforce, he explained.

Competition and consumer dynamics add pressure

While technology transformation tops the agenda, competitive pressure remains a driving force. About half of CFOs cited rising competition as having the biggest impact on their companies, followed closely by shifts in customer behavior and demographics.

Competitive pressures are always near the top of CFOs’ minds, Gallucci said. But what’s different now is how they’re responding—looking across industries to see how others are using AI and digital tools, and applying those lessons quickly, he said.

Gallucci also pointed to evolving consumer demand as a key factor to watch, particularly as major banks and retailers release their fourth-quarter earnings.

There’s evidence of a K-shaped economy, he added. “CFOs are paying close attention to what that means for growth, pricing, and investment strategy.”

Sheryl Estrada

sheryl.estrada@fortune.com

Leaderboard

Clare Kennedy was appointed CFO of Spencer Stuart, a global advisory firm, effective Jan. 12. Kennedy succeeds Christine Laurens as part of a planned succession and in support of Laurens’ retirement from full-time executive work. Kennedy, who is based in London, joins Spencer Stuart from Maples Group, an international advisory firm, where she served as global chief operating officer. She joined Maples Group from Freshfields, an international law firm, where she served as its global CFO. Kennedy previously spent 18 years at Linklaters, an international law firm, where she held a variety of senior finance and commercial leadership roles. She began her career at Arthur Andersen and EY as a chartered accountant, specializing in tax.

Gillian Munson was appointed CFO of Duolingo, Inc. (NASDAQ: DUOL), a mobile learning platform, effective Feb. 23. Matt Skaruppa will step down after nearly six years with the company; he will remain CFO until Munson starts her new role, at which time he will assume an advisory role. Munson assumes the CFO role after serving on the Duolingo board of directors since 2019 as chair of the audit, risk and compliance committee. She was most recently the CFO of Vimeo and previously held CFO positions at Iora Health, Inc. and XO Group Inc.

Big Deal

A joint statement on Monday from tech giants Apple and Google announced that they have entered into a multi-year collaboration under which the next generation of Apple Foundation Models will be based on Google’s Gemini models and cloud technology. These models are said to power future Apple Intelligence features, including a more personalized Siri coming this year.

The tech giants stated: “After careful evaluation, Apple determined that Google’s AI technology provides the most capable foundation for Apple Foundation Models and is excited about the innovative new experiences it will unlock for Apple users. Apple Intelligence will continue to run on Apple devices and Private Cloud Compute, while maintaining Apple’s industry-leading privacy standards.”

Google and others took the early lead in the AI race, while Apple’s iPhone has lagged rivals on some AI features. Following earlier AI missteps, the Cupertino, Calif.-based company acknowledged last year that a major Siri upgrade would not arrive until sometime in 2026.

“This is what the Street has been waiting for with the elephant in the room for Cupertino revolving around its invisible AI strategy, but we believe this is an incremental positive to both AAPL and GOOGL,” Wedbush Securities analysts wrote in a Monday note on the Apple–Google partnership. Wedbush maintains an Outperform rating on Apple and continues to target a $350 price for the stock.

Going deeper

“Trump threatens to keep ‘too cute’ Exxon out of Venezuela after CEO provides reality check on ‘uninvestable’ industry” is a Fortune article by Jordan Blum.

Blum writes: “As other oil executives lavished President Trump with praise at the White House, Exxon Mobil CEO Darren Woods bluntly said the Venezuelan oil industry is currently ‘uninvestable,’ and that major reforms are required before even considering committing the many billions of dollars required to revitalize the country’s dilapidated crude business. Read the complete article here.

Overheard

“Buying a movie studio is hardly buying secure, hard assets.”

—Jeffrey Sonnenfeld, Yale professor and founder of the Yale Chief Executive Leadership Institute, and Stephen Henriques, a senior research fellow, write in a Fortune opinion piece titled “A Cautionary Hollywood Tale: The Ellisons’ Lose-Lose Paramount Positioning” regarding the multiple bids for Warner Bros. Discovery.

Business

Wall Street expects Trump’s Fed plot to ‘backfire’ spectacularly—perhaps even shutting the door more firmly on rate cuts

Published

34 minutes agoon

January 13, 2026By

Jace Porter

The Oval Office’s plan to force the Fed into submission is unlikely to work, Wall Street believes. In fact, they fear it may backfire so spectacularly that interest rate cuts which would have happened under Powell will be nixed as the central bank asserts its independence.

Over the weekend, Fed chairman Jerome Powell confirmed the Department of Justice had served the Federal Reserve with grand jury subpoenas relating to his Senate Banking Testimony on the renovation of Fed buildings.

It was a move that realists may have seen coming—after all, Trump has already levelled legal threats against other members of the rate-setting Federal Open Market Committee (FOMC)—but is unprecedented nonetheless. It comes after a year of lobbying by Trump, who wants the FOMC to cut the base rate to foster economic activity and reduce borrowing costs, regardless of the inflation risk.

Throughout 2025, Powell attempted to avoid the political melee, even when Trump threatened to fire him multiple times. The FOMC did deliver rate cuts, though clearly not quickly enough for Trump. The resulting escalation from the White House is further proof of political intervention into the legally independent Fed, analysts and investors agree.

However, Trump may not have banked on the fact that the FOMC (even under a new Fed chair this year) might want to make a point of that independence, and go to lengths to demonstrate it. As UBS’s Paul Donovan told clients this morning: “Any nominee from U.S. President Trump is likely to have to place additional emphasis on their independence to try and prove they are above politics. This might impact future policy decisions.”

As Bernard Yaros, lead U.S. economist for Oxford Economics, observed in a note yesterday: “The criminal investigation … could even backfire by making officials more reluctant to cut rates in the coming months and years.”

But there’s also another unexpected fallout which Trump is unlikely to enjoy: Powell may choose to stay on as a bastion of independence after a new Fed chairman is nominated. While his time as Fed chairman expires this year, his term on the Board of Governors does not expire until 2028. “If Powell was looking for a reason to stay on as a Governor … this could be one,” noted Deutsche Bank’s Jim Reid this morning. “It’s very unusual to stay on but [former Fed Chairman Marriner] Eccles did so in 1948 for 3.5 years to help protect and secure Fed independence after the Treasury were trying to fund large post war time debts.”

An unpopular plan

Investors might have hoped Trump had learned his lesson when it came to meddling with the Fed: When he threatened to fire Powell earlier this year, markets shifted uneasily, and the Republican president was forced into a swift U-turn.

According to reports, the action taken this week hasn’t been hugely popular within the White House. Axios reported today, citing two anonymous sources, that Treasury Secretary Scott Bessent told the president that the investigation “made a mess,” which could be bad for financial markets.

Even if the chips fall in favor of President Trump and he successfully ousts both Powell and Governor Lisa Cook, as well as managing to insert a dovish Fed chairman at the head of the table, there’s still an economic fallout to be dealt with. This could include a weaker dollar, a steeper yield curve, and higher long-term inflation expectations, according to Thierry Wizman, global FX and rates strategist at Macquarie Group. If Trump succeeds, “it may result in a Fed that will be more pliant with respect to those White House wishes, especially if Congress concedes its role. That means a Fed that keeps interest rates lower than they otherwise would be.”

This means that inflation, held in check by higher rates, may increase in the longer view and, as such, “nominal assets, such as fixed-coupon long-term bonds, will look less attractive as stores of real value.”

This story was originally featured on Fortune.com

Business

Is Powell’s Fed head independence dead? Trump outfoxes himself this time

Published

1 hour agoon

January 13, 2026By

Jace Porter

The only surprising quality regarding President Trump unleashing federal investigators to prepare potential prosecution criminal charges against the highly respected Federal Reserve Chairman Jay Powell — a Trump appointee himself — is that anyone is surprised by this news.

Financial markets initially dropped before rebounding as investors blew off Trump’s Justice Department move as the flailing bluster of a lame duck and a fissure opened in the GOP, with open concern about the sacred independence of the DOJ as well as of the Federal Reserve.

For example, prominent Republican Sen. Thom Tillis, of the Senate Banking Committee, asserted that “It is now the independence and credibility of the Department of Justice that are in question.”

Similarly, Republican Rep. French Hill, chairman of the House Financial Services committee, called this investigation “an unnecessary distraction that could undermine this Administration and sound monetary decisions.”

Even Trump’s own Treasury Secretary, Scott Bessent, challenged Trump on his “revenge probe” of Powell.

The sequential, dramatic waves of prosecutions against such officials as Trump’s former National Security Advisor John Bolton, former FBI chiefs James Comey and Christopher Wray, New York Attorney General Letitia James, former CIA chief John Brennan, Federal Reserve Governor Lisa Cook, former Homeland Security official Miles Taylor, Sen. Adam Schiff, cybersecurity chief Christoper Krebs, and former special counsel Jack Smith, among others, is alarming. As Trump’s Truth Social messaging shows, he has personally directed such prosecutions, showing a weaponization of the judiciary against perceived political enemies. Some critics see this as the impulsive emotional fits of the crazed Queen of Hearts from Alice in Wonderland, screaming “off with their heads” regarding any who displease her. However, what is missed is that these moves are far more deliberate actions, part of a larger tactical pattern.

The charges against Powell — that he lied to Congress due to building renovation costs overruns — is ludicrous and such charges will surely be dismissed in court. The alleged 40% cost overruns may be true but they are not criminal. let alone reckless. The actual Fed renovations are costing $2.5 billion, which is 40% overbudget due to cost inflation, but Trump admitted last month that his own East Wing demolition and construction of a new White House ballroom has ballooned to 200% over budget. This is truly stunning as this project was only six months ago and Trump should know how to estimate construction accurately as a builder himself.

These costs are not out of line, given that this is the first comprehensive renovation in the 90 years since the Marriner Eccles building was built in 1937. By contrast, the nearby Hart, Russell, and Dirksen Senate Office buildings and the Cannon House Office building have continuously undergone massive renovations over the decades.

Plus, regardless of the nature of these common cost overruns, not a penny of this is from U.S. taxpayer funds. The Fed is funding these renovations out of its own budget as the Fed is entirely operationally self-sufficient, funded primarily by its own investment income on the U.S. Treasury bonds it owns.

Trump’s attempted ambush of Powell on national TV this summer, during a tour of the construction site, backfired, with Powell correcting and embarrassing him. Trump’s false statement that the renovations had ballooned to $3.1 billion was shown to incorrectly include a separate, already-completed renovation of a different building.

On the surface, Trump is angry that the Federal Reserve is not cutting rates faster and further and that is how chairman Powell explains why he is being targeted as he complained: “This new threat is not about my testimony last June or about the renovation of the Federal Reserve buildings. … Those are pretexts. The threat of criminal charges is a consequence of the Federal Reserve setting interest rates based on our best assessment of what will serve the public, rather than following the preferences of the President.”

Fully 71% of the 200 CEOs at my recent Yale CEO Summit complained that Trump had already eroded the independence of the Federal Reserve via actions from his administration, and 81% stated that they prefer Governor Chris Waller as Powell’s prospective successor when the chairman’s term ends this spring, presuming he will fortify Fed independence.

So, if this lawfare attack is not an impulsive tantrum, what is the strategic rationale? Like Trump’s false assertion this month that the attack on Venezuela was driven by the advance interest of U.S. oil producers, which they soundly denied, claiming Venezuela was “uninvestable,” this was more of Trump’s diversionary maneuvering. In my new book, Trump’s Ten Commandments (Simon & Schuster), I label this his “Wall of Sound” tactic to change the public narrative from his faltering polling with Gallup’s end of year national survey reporting only 36% of the nation approving and the Economist/YouGov finding that 57% disapprove. Even over half of MAGA/Trump voters don’t support Trump on his handling of the Epstein files and affordability and healthcare. His ICE/immigration tactics have plummeted 30% in recent polling.

But Trump has succeeded in his mission of getting every media outlet to drop their 24/7 hammering on his weaknesses on salient domestic policies. Plus, he is pulling three other levers in this Fed/Powell diversionary maneuver — he invokes his “hub & spoke” leadership model where there are no independent agencies of control, his crushing of adversaries with selective retribution, and his deft manipulation of the classic mass communication propaganda tool “sleeper effect” where a false message is repeated in an unrelenting determined way and eventually gets traction.

These are four of the 10 tools in Trump’s tool kit that I label his “Ten Commandments.” He selects them deliberately and not truly impulsively despite his bravado. Trump is far from tone deaf or foolish. He is dumb as a fox, but even foxes, generally symbol of intelligence and slyness, become victims of their own presumed cleverness.

The opinions expressed in Fortune.com commentary pieces are solely the views of their authors and do not necessarily reflect the opinions and beliefs of Fortune.

This story was originally featured on Fortune.com

CFOs move finance AI from pilots to deployment in 2026

San Francisco Drunk Woman Off The Hook for Public Intoxication

“Pitti Uomo ushers in the year of Made in Italy and recovery,” says politician Adolfo Urso at its opening

Trending

-

Politics8 years ago

Politics8 years agoCongress rolls out ‘Better Deal,’ new economic agenda

-

Entertainment8 years ago

Entertainment8 years agoNew Season 8 Walking Dead trailer flashes forward in time

-

Politics8 years ago

Politics8 years agoPoll: Virginia governor’s race in dead heat

-

Politics8 years ago

Politics8 years agoIllinois’ financial crisis could bring the state to a halt

-

Entertainment8 years ago

Entertainment8 years agoThe final 6 ‘Game of Thrones’ episodes might feel like a full season

-

Entertainment8 years ago

Entertainment8 years agoMeet Superman’s grandfather in new trailer for Krypton

-

Business8 years ago

Business8 years ago6 Stunning new co-working spaces around the globe

-

Tech8 years ago

Tech8 years agoHulu hires Google marketing veteran Kelly Campbell as CMO