Every five years, the U.S. government releases an updated set of recommendations on healthy eating. This document, called the Dietary Guidelines for Americans, has served as the cornerstone of nutrition policy for almost half a century.

On Jan. 7, 2026, the Department of Health and Human Services and the Department of Agriculture released the 2025-2030 edition of the guidelines. The updated guidelines recommend that people consume more protein and fat, and less ultraprocessed foods.

These guidelines are the foundation for governmental nutritional programs – for example, they are used to determine which foods are covered by the Supplemental Nutrition Assistance Program, or SNAP, as well as how school lunches are prepared. Eldercare centers and child care centers use them when providing meals, as do clinical nutritionists working with patients to help them achieve a healthy diet. And because the guidelines are so scientifically rigorous, many countries around the world base their own nutritional guidelines on them.

I’m a nutrition scientist specializing in developing interventions for preventing obesity. Between 2022 and 2024 I served on the scientific advisory committee tasked with assessing the best available evidence on a wide range of topics in nutrition in order to inform federal officials in updating the guidelines.

But most of the committee’s recommendations were ignored in developing the latest dietary guidelines.

On the surface, these guidelines share a lot of similarities with the previous version, published in 2020, but they also have a few important differences. In my view, the process followed was different from the norm.

How are the Dietary Guidelines for Americans developed?

For each update, HHS and USDA establish a scientific advisory committee like the one I served on. Members with expertise in different aspects of nutrition are carefully selected and vetted. They then spend two years reviewing the latest scientific studies to assess evidence about specific nutrition-related questions – such as the relationship between saturated fats in foods and cardiovascular disease and what strategies are most effective for weight management.

For each question, the committee first prepares a protocol to answer it, identifies the most rigorous studies and synthesizes its findings, discussing the evidence extensively. It then produces specific recommendations about the topic for the HHS and USDA. At each step, the public and the scientific community are invited to provide comments, which the committee considers.

All this scientific information is put together in a massive report, which the federal agencies then use to create the updated guidelines, translating the expert recommendations for the public and health professionals.

A departure from the norm

The advisory committee I served on functioned as usual – our report was published in December 2024.

But the dietary guidelines released on Jan. 7 were mainly not based on that report. Instead, they were based on a different scientific report that was also published on Jan. 7. That report drew some material from ours but went through a completely different process.

It was created by a group of people who were not vetted in the usual way, and although they repeated some of the same questions we did, they also explored other topics that were chosen with no input from the wider community of nutrition researchers or from the public. It was not based on a publicly available protocol, with no input from the scientific community, and it’s unclear how and to what degree it was peer-reviewed.

The updated dietary guidelines were developed through a different process compared with the established methodology that’s been used to assess nutrition science behind the guidelines for many years.

What’s new in the 2025-2030 guidelines

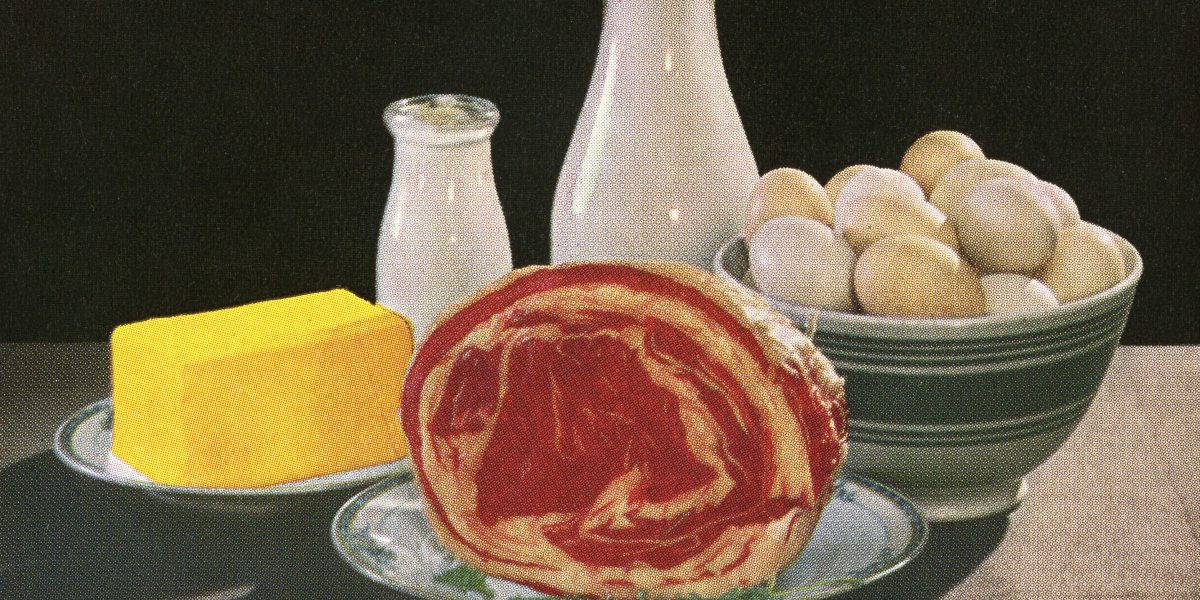

Many of the recommendations in the 2020 guidelines and the ones released on Jan. 7 are broadly the same: that Americans should consume three servings of vegetables, two servings of fruits and three servings of dairy products per day, as well as replacing refined grains with whole grains, and limiting intake of sugar and sodium.

The main differences relate to recommendations about protein and dairy products.

The 2020 guidelines recommended that Americans focus on protein such as poultry and other lean meats, seafood, eggs, legumes, nuts and seeds. The updated version instead emphasizes eating protein at every meal from different protein sources – not specifically lean ones.

The most recent guidelines also recommend a higher amount of protein – specifically 1.2 to 1.6 grams of protein per kilogram of body weight per day, up from 0.8 grams per kilogram of body weight recommended in the Dietary Reference Intakes for the U.S, the official guidelines for nutrient recommendations. Recommending a higher protein intake goes beyond the mission of the dietary guidelines.

Also, the updated dietary guidelines now recommend full-fat dairy products, rather than low-fat ones as they did previously. But in my view, this recommendation isn’t practical, because it doesn’t raise the level of recommended saturated fat, which remains at 10%. To understand how this would work in practice, I roughly translated these recommendations into a typical menu based on my weight and calorie requirements. These changes would raise my saturated fat consumption well above this limit, so the messages are inconsistent. https://www.youtube.com/embed/zo-f0j1E_jY?wmode=transparent&start=0 The 2025-2030 Dietary Guidelines for Americans recommend more protein and suggest consuming full-fat rather than low-fat dairy – a departure from previous versions.

Naming ultraprocessed foods

Another difference is that the new recommendations specifically call out avoiding ultraprocessed foods. The previous guidelines did not explicitly name ultraprocessed foods but instead recommended consuming nutrient-dense foods, which means foods that have a lot of nutrients while also having relatively few calories. That is, in essence, less processed or whole foods.

Food scientists still lack a solid definition of ultraprocessed foods. Our committee actually spent a long time discussing this, and the Food and Drug Administration is currently working on creating a clear definition of the term that can guide research and policy.

Also, solid research on ultraprocessed foods has been limited. Most studies available for our review took a snapshot of people’s eating habits but didn’t track their effects over a long time or compare groups in randomized controlled trials, the gold-standard research method.

That’s changing, however. The committee did its assessment two years ago, but evidence linking ultraprocessed foods to chronic diseases is getting stronger.

Can Americans trust the science behind the 2025-2030 guidelines?

In my view, some of the changes in the 2025-2030 guidelines, such as limiting ultraprocessed foods, are beneficial. But the problem is that it’s not possible to determine whether the necessary scientific rigor was applied in developing them.

Much of the research on saturated fat consumption is still unsettled and controversial. That’s why it’s important to have a systematic and transparent process for evaluating the research, with input from experts with multiple perspectives who review the entire body of research published about a particular topic.

If you don’t do it properly, you can select the evidence that you prefer. That makes it easy for bias to creep in.

Cristina Palacios, Professor and Chair of Dietetics and Nutrition, Florida International University

This article is republished from The Conversation under a Creative Commons license. Read the original article.

Politics8 years ago

Politics8 years ago

Entertainment8 years ago

Entertainment8 years ago

Politics8 years ago

Politics8 years ago

Entertainment8 years ago

Entertainment8 years ago

Politics8 years ago

Politics8 years ago

Entertainment8 years ago

Entertainment8 years ago

Business8 years ago

Business8 years ago

Tech8 years ago

Tech8 years ago