President Donald Trump has assured the people of Venezuela that his undertaking to restore the country’s oil infrastructure will be mutually beneficial to both them and the U.S.

Ricardo Hausmann, professor of the practice of international political economy at the Harvard Kennedy School, isn’t convinced.

“There’s a reason why there’s no profit motive in government,” Hausmann told Fortune, referring to the U.S. controlling the Venezuelan oil market. “Profit motive in government is what we call corruption.”

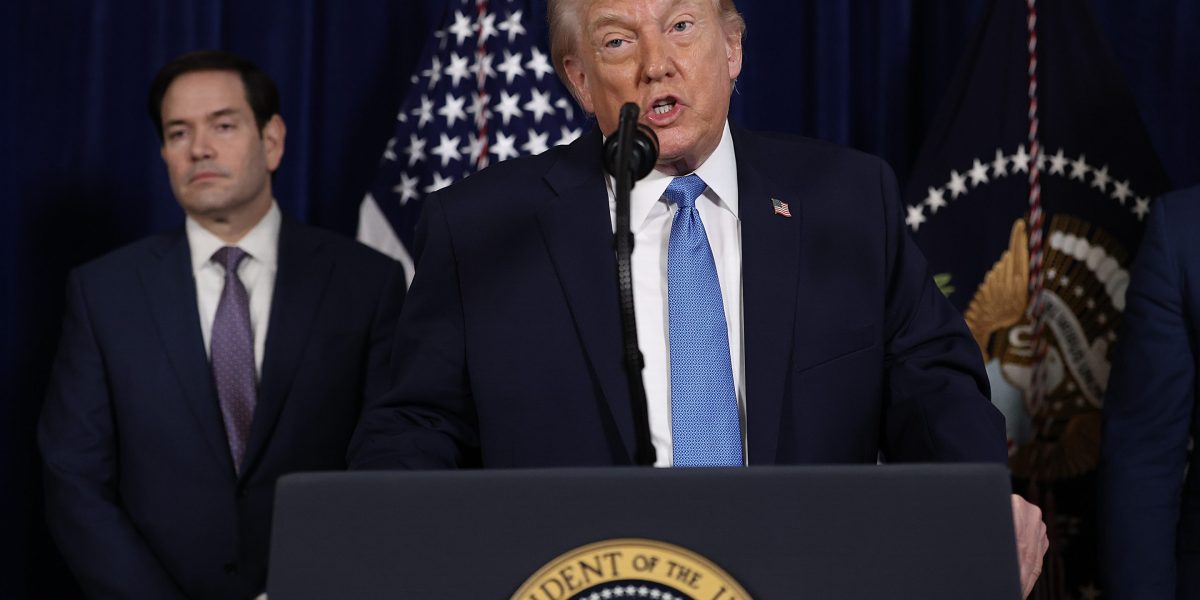

Trump has unveiled lofty plans to revive Venezuela’s troubled oil industry, just days after U.S. forces captured Venezuelan leader Nicolas Maduro over the weekend. The White House explicitly said Maduro’s arrest—and the U.S.’s subsequent takeover of some of the country’s affairs—was an effort to dominate the Western Hemisphere, invoking the 19th century Monroe Doctrine to justify intervention in Venezuela. Venezuela is home to the world’s largest proven crude oil reserves.

“This is one of the countless good energy deals President Trump has brokered to restore American energy dominance that will benefit the American people, American energy companies, and the Venezuelan people,” White House spokesperson Taylor Rogers told Fortune in a statement.

The president said he will control the country and its oil market for years, reportedly meeting with U.S. oil company executives to discuss Venezuela’ s oil industry. On Tuesday, he announced Venezuela’s interim leadership would provide the U.S. with 30 million to 50 million barrels of oil, the proceeds from which would be sold at market rates, not discounted rates, and distributed to both the U.S. and Venezuela. The proceeds will go into U.S.-controlled bank accounts overseen by Trump, according to the White House.

“We will rebuild it in a very profitable way,” Trump said in an interview with the New York Times on Thursday. “We’re going to be using oil, and we’re going to be taking oil. We’re getting oil prices down, and we’re going to be giving money to Venezuela, which they desperately need.”

Trump’s government capitalism

Trump’s industry interventions and turn to state capitalism have become the hallmark of his second term: In August 2025, the U.S. government secured a 10% stake in Intel, becoming the largest shareholder of the struggling chipmaker. Earlier that month, Nvidia and AMD made a deal with the U.S. government to share 15% of revenue from chip sales to China.

These kinds of large-scale agreements are not only rare, but in the case of Nvidia and AMD, unprecedented and potentially unconstitutional according to some legal experts, as the U.S. Constitution prohibits duties on exports.

Hausmann, who served as the Venezuelan minister of planning from 1992 to 1993, argued Trump’s heavy hand in market affairs is counter to the purpose of government, which is not supposed to make money, but rather provide stability and policy that allow businesses to thrive.

In the case of Venezuela, Hausmann said, Trump’s prioritization of extracting oil for a short-term profit is not just a philosophical misalignment with his vision of government; it’s plain a bad idea.

“Having a policy because you want to make money, you’re going to be dramatically disappointed in any scenario you want to imagine,” Hausmann said. “If you want Venezuela to recover, money is going to go into Venezuela, not out of Venezuela. Venezuela is going to need to attract resources. It’s not [that] resources are going to go away.”

Trump told Fox News’ Sean Hannity this week that oil companies would need to spend at least $100 billion to revive Venezuela’s oil industry.

The state of Venezuelan oil

Hausmann noted that Trump’s strategy of leveraging oil to return Venezuela to economic prosperity is futile without restoring democratic leadership to the country, which can implement credible policy to stabilize the oil industry.

When Maduro took power in Venezuela in 2013, Venezuelans were about four times wealthier than today; Venezuela was the richest country in South America in 2001. These periods of wealth aligned with higher oil production, which has since atrophied. When Hugo Chavez became president in 1999, Venezuela was producing around 3.5 million barrels of oil daily. Today, that total is around 1 million barrels per day.

Economists and public policy thinkers attribute this precipitous drop to the breakdown of the country’s oil infrastructure following decades of mismanagement, corruption, and U.S. sanctions. Chavez, for example, fired about 10,000 employees of state-owned oil giant Petróleos de Venezuela S.A. (PDVSA) in 2003 for participating in a two-month strike. PDVSA’s revenue would collapse about a decade later.

Analysts said Trump’s proposed solution of giving U.S. oil companies access to Venezuela to repair the infrastructure (and granting the U.S. access to 30% of the world’s oil reserves) is an expensive endeavor costing at least $10 billion annually for several years. Beyond repairing infrastructure, those companies will need to commit to the more-expensive extraction of heavy crude oil that makes up the vast majority of what is found in Venezuela’s Orinoco Belt.

The steep costs of rebuilding the oil industry means U.S. companies are going to need assurance that their investments will be worth it, Miguel Tinker Salas, a professor emeritus of history at Pamona College and author of The Enduring Legacy: Oil, Culture, and Society in Venezuela, told Fortune.

“I don’t think any large U.S. major company is going to want to invest without a series of guarantees, because you’re talking about billions of dollars of investment,” Tinker Salas said. “This is an investment for the long term, not for the short term.”

Hausmann suggested that one way for private oil companies to be lured to Venezuela—particularly when they have easier access to large oil reserves in Guyana and Namibia—is to address why the infrastructure of the industry decayed in the first place.

“These are self-inflicted wounds. If you want to recover oil, you need to go back to rule of law,” he said. “Let’s be very mechanical: You need to change the hydrocarbons law. And to change the hydrocarbons law, you need a congress that people think is legitimate.”

Hausmann’s vision for a Venezuelan future

The hydrocarbon laws to which Hausmann is referring originated in 1943, outlining that foreign oil companies must pay Venezuela 50% of their oil profits, a price companies were willing to pay to have access to the country’s massive reserves.

After PDVSA was established in 1976, foreign oil companies were able to partner with the state-owned giant, but at a steep cost: a 60% equity stake in their joint ventures. Chavez delivered a death knell to the industry decades later, according to Hausmann, seizing and nationalizing the assets of U.S. oil companies like ConocoPhillips and Exxon Mobil, which then left the country. Today, only Chevron, under a special U.S. license, continues to do business in Venezuela.

Venezuelan opposition leader María Corina Machado previously expressed intent to reform these hydrocarbon laws to increase foreign investment by getting rid of ownership restrictions. But Trump seems unlikely to give power to Venezuela’s popular political figures. He said Machado lacked the support necessary to lead the country, despite evidence of widespread backing for her and Edmundo González, who ran against Maduro in the 2024 election. Maduro’s vice president, Delcy Rodríguez, is Venezuela’s interim leader.

Hausmann said U.S. oil companies are aware of the political instabilities within Venezuela, another factor that may inform their decision to not immediately invest in the country. However, the economist also indicated that while Venezuela’s 303 billion barrels of oil in reserves make oil an obvious industry to expand, it’s not all the country has to offer. He suggests that if a democratic leader can come into power, Venezuela can invest more heavily in its other industries, such as tourism and its Caroni River, from which it derives 64% of its hydroelectric capacity.

“Venezuela has become much, much bigger than its oil, and Venezuela has an enormous potential in many other things,” Hausmann said. “You might say that the easiest thing would be oil, but even oil is not that simple.”

Politics8 years ago

Politics8 years ago

Entertainment8 years ago

Entertainment8 years ago

Politics8 years ago

Politics8 years ago

Entertainment8 years ago

Entertainment8 years ago

Politics8 years ago

Politics8 years ago

Entertainment8 years ago

Entertainment8 years ago

Business8 years ago

Business8 years ago

Tech8 years ago

Tech8 years ago