It’s not what you know, or even who you know. According to Cisco’s new U.K. chief, your next promotion might hinge on your attitude.

“You cannot teach positive attitudes and engagement and energy,” Sarah Walker tells Fortune. That’s the No. 1 green-flag trait she keeps an eye out for when hiring or looking to promote from within—and she says it outweighs what’s on your resume, especially early in your career.

The 45-year-old boss spent 25 years climbing the ranks at the Fortune 500 Europe telecommunications giant BT. In that time, Walker went from joining the sales team at the £14.21 billion British ($17.7 billion) legacy brand to leaving as its director of corporate and public sector. Following a micro-retirement, she joined Cisco as managing director before being promoted to lead its U.K. and Ireland arm just two years later.

Now that she calls the shots, the CEO’s go-to choice for her team is always the upbeat, eager-to-learn worker.

“It’s more about the person first and foremost than it is about skills or experience,” she adds.

Skills become more important with experience—but it always pays to be positive and humble

“I always try and distinguish between the things that can be taught and learnt and the things that are just inherent in somebody,” Walker says, adding that skills become more important as you climb the ladder and enter more specialist roles.

Even then, she says someone with a great attitude and willingness to learn can still bag a role over someone more experienced if they can be developed into the role.

“You don’t need to be the finished article to be promoted, but we need to know that you are in a position where within a reasonable timeframe, you’ll have invested the time to upskill and develop—so I say to people, be very focused on who you are first and foremost, because that’s the bit that makes you stand out, and can’t be taught and will be a differentiator,” she adds.

But no matter how junior—or senior—you are, she still thinks a bad attitude will make you stand out for all the wrong reasons.

“I can’t stand arrogance. Be confident, but have a level of humility,” Walker warns. “You can’t rest on your laurels because you’ve done something well in the past, you need to be thinking about what’s the next great thing that you’ll do?”

“Even at my level, you have to be open to the fact that there’s lots more yet to learn and grow and adapt,” she concludes. “I always know that I’m only as good as the last good thing that I’ve done, and I’ll only continue to be good if I continue to do good things.”

An ’embarrassing’ amount of your success in your 20s depends on your attitude, Jassy echoes

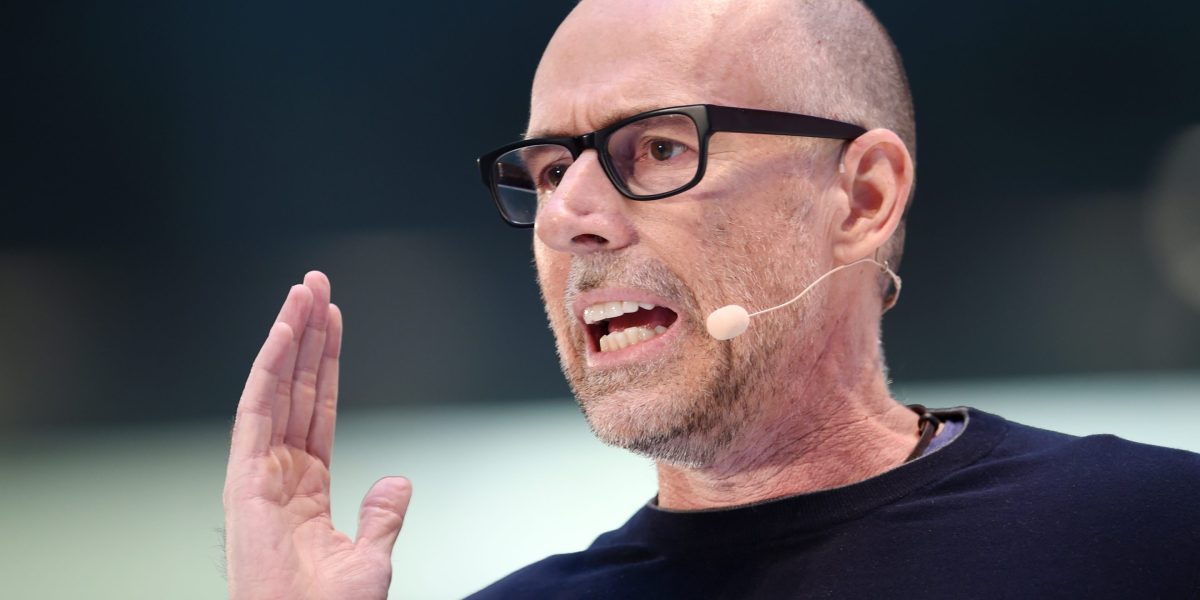

Walker’s not the only CEO to reveal that it’s not a ritzy college degree or being the best networker that will make you stand out at the start of your career—but a positive attitude. Amazon CEO Andy Jassy has said that an “embarrassing amount of how well you do, particularly in your twenties” depends on it.

Even Walker’s predecessor, David Meads previously echoed to Fortune that “EQ is at least as important as IQ.” The now MEA chief at Cisco stressed that he sees “no difference in terms of the capability” from talent with or without a degree while adding that qualifications hold even less weight in external-facing roles.

“You need that EQ to be able to read the room and understand what’s being said by what’s not being said.”

In the end, numerous leaders, including Pret and Kurt Geiger’s CEOs, have stressed that being nice to their boss and coworkers was one of the biggest determining factors in their success.

As Maya Angelou famously said: “People will forget what you said, people will forget what you did, but people will never forget how you made them feel.” And ultimately, the same is true for hiring managers and those with promotion powers.

A version of this story originally published on Fortune.com on January 30, 2025.

Politics8 years ago

Politics8 years ago

Entertainment8 years ago

Entertainment8 years ago

Politics8 years ago

Politics8 years ago

Entertainment8 years ago

Entertainment8 years ago

Politics8 years ago

Politics8 years ago

Entertainment8 years ago

Entertainment8 years ago

Business8 years ago

Business8 years ago

Tech8 years ago

Tech8 years ago