Business

It’s a sequel, it’s a remake, it’s a reboot: Lawyers grow wistful for old corporate rumbles as Paramount, Netflix fight for Warner

Corporate-law scholars say the bidding war for Warner Bros. Discovery has become a strange kind of legal nostalgia trip, dragging Paramount back to center stage for the first time in decadesand reviving vintage doctrines from Revlon to the “Cuban beer” defense as Netflix tries to lock up a once‑in‑a‑generation deal. What looks on the surface like a clean strategic bolt‑on for the world’s biggest streamer is, in the eyes of the experts who teach this stuff, a big-budget Hollywood legacy act, following in the footsteps of the takeover sagas that defined 20th-century Tinseltown.

Anyone who lived through the 1989 takeover that resulted in the landmark lawsuit Paramount Communications v. Time battle hears an echo. Back then, Time Inc. was trying to merge with Warner Communications when Paramount tried to blow up the deal with a rich hostile bid for Time itself, triggering a bidding war and a landmark Delaware ruling on when, and how, boards can say no. Of course, Time Warner emerged as a media powerhouse, reigning for decades before a 2000 tie-up with AOL that many consider to be the most disastrous merger in corporate history.

Anthony Sabino, a veteran legal practitioner and professor at St. John’s University in Queens, N.Y., who teaches those cases, called today’s fight “a sequel, not a reboot,” with Paramount, which is competing with Netflix to buy WBD, once again in the eye of a takeover hurricane. He pointed out that Paramount also fronted the 1994 Paramount v. QVC clash—also ultimately decided in Delaware—where Barry Diller’s QVC was rebuffed in favor of Sumner Redstone’s Viacomin a bid to buy Paramount, cementing the modernempire that has since mutated into Paramount Global and, as of 2024, Paramount Skydance.

The same brands and some of the same power players, from John Malone to Redstone’s successors, are back on the call sheet, only this time the battleground is streaming instead of cable and print. Diller himself agreed, telling The New York Times by email earlier this week, “yes, it is turning into a repeat.”

But the rapid turn of events that saw Netflix strike a binding deal worth $72 billion in equity (and nearly $83 billion including debt), only to see Paramount go public with an all-but hostile bid worth $77.9 billion in equity (and $108 billion including debt) has also brought a cosmetics name into the conversation, famous to corporate lawyers: Revlon.

The Revlon element

Named after the 1986 Delaware decision in Revlon v. MacAndrews & Forbes, the Revlon doctrine “governs sort of how you should behave when you’re selling [a] company, and it says you can’t favor, you can’t think about anything other than shareholder value,” according to Columbia law professor Dorothy Lund. She explained that in that deal, the hostile takeover of cosmetics firm Revlon by the famed financier Ronald Perelman in the mid-1980s, the Revlon CEO had a “deep personal antipathy” for Perelman and structured a deal with a different private equity buyer. Ultimately, the Delaware Supreme Court ruled that the board of Revlon, like every other company, has a “heightened responsibility to be an auctioneer and thinking about getting the best value for shareholders,” Lund said, “and what you can’t do is play favorites. Everything that you have to do has to be done in service of shareholder value.”

The announcement of the Netflix deal on Dec. 5 implied that Warner had made the best choice for shareholders by choosing the big-red streamer, but Paramount’s announcement the next business day, with a potentially higher bid, put the Revlon precedent in play, both Sabino and Lund explained. Paramount’s subsequent regulatory filing revealed what it claimed was a pattern of minimal engagement from major Warner stakeholders, including CEO David Zaslav and the so-called “cable cowboy” John Malone, who serves as chair emeritus, having stepped down from the board earlier this year while retaining significant stock. (Malone backed Diller and QVC in their ultimately unsuccessful 1994 bid for Paramount, as both Malone and Diller discussed in separate memoirs released in 2025.)

While Lund said that she doesn’t personally think there’s a strong Revlon claim quite yet, “I think the board has to be really careful what they do in the coming weeks,” because the Warner Bros. Discovery board can’t appear to be playing favorites for personal reasons. “Now the tricky thing is going to be, clearly everybody’s got money left on the table, right?” Lund noted that Paramount has indicated that its $30-per-share offer is not its last and best offer, while Netflix also has room to go up. “Now the board is in this tricky position of trying to engineer this deal to get the most value for shareholders.” They might well be compelled under their Revlon duty to either go back to Netflix and say they need a higher bid or go back to Paramount and take its bid seriously.

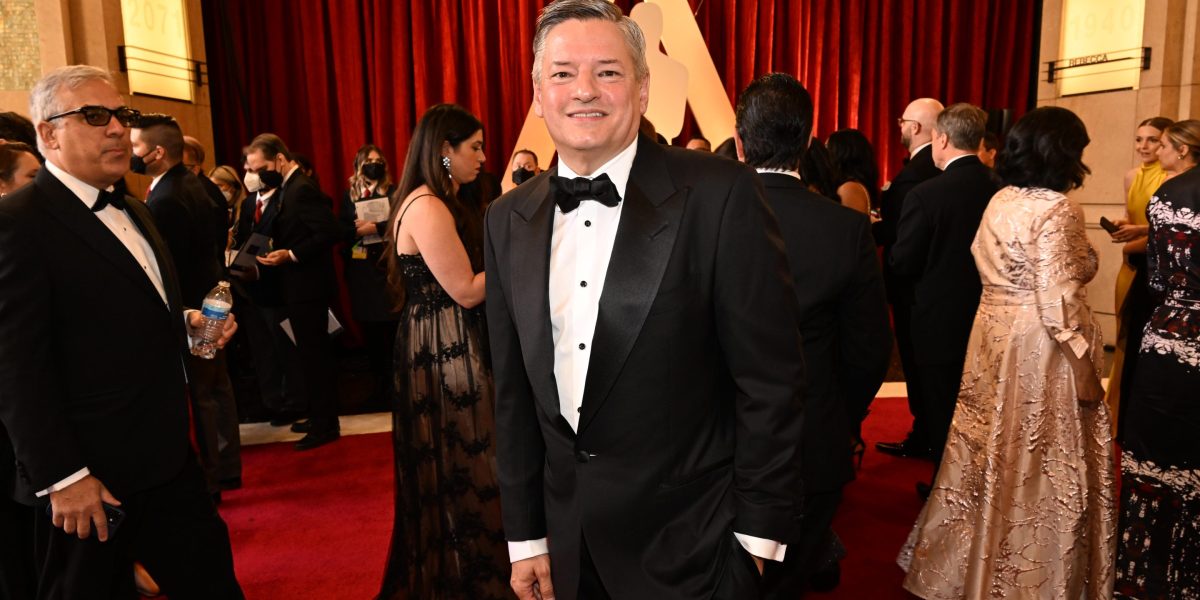

Lund said that the two-way fight between Paramount and Netflix is almost a fact pattern ripped from one of her exam books, with Paramount’s David Ellison effectively accusing CEO David Zaslav and the Warner board of violating their Revlon duties by favoring a more complex, slower Netflix package over a simple all‑cash offer. Lund also raised the Paramount vs. Time precedent, which was essentially about the choice of a merger partner on cultural rather than financial grounds. “You can’t say, ‘Well, I just like the culture,” which was an argument in that deal where one bidder was seen as more likely to preserve the Time culture. Boards can discount a higher price only for concrete reasons like firmer financing or cleaner regulatory paths, not because they like a bidder’s vibe, in other words. This is on display between Netflix, Warner and Paramount, with Ted Sarandos and David Zaslav reported to be on friendly terms, and Paramount’s regulatory filings suggesting a frosty distance between Zaslav and Ellison.

The clash of personalities is part of why experts lick their lips over media megamergers. “These are media personalities,” Sabino said, “and these folks are very powerful individuals … these are fantastically successful folks. And they don’t like it when you say no.”

Paul Nary, an assistant professor of management who teaches M&A and tracks dozens of mega‑deals at the Wharton School of Business, said “this is like my equivalent of a Super Bowl.” He highlighted the strange appeal that media assets tend to have over time, citing the mix of egos and what are perceived to be “marquee assets.” Speaking to the likely legal challenges involving Revlon and Time that will likely emerge between these two offers, Nary said a valuation dispute will be key. He said the Netflix and Paramount offers are close to each other, “depending on how much you assess the equity components, how you assess the value of the spin-out and all of these other things.”

The value of the spin-out, a company to be known as Discovery Global, stands to be much debated over the coming months, maybe even in court, but at least one analyst has put a number on the assets that Paramount wants to buy—and Netflix doesn’t, explaining the valuation gap. Bank of America Research analyst Jessica Reif Ehrlich and her team released a note on Dec. 7, after the Netflix deal and before the Paramount offer, estimating Netflix’s deal as worth more than $30 per share to WBD shareholders. Ehrlich’s team calculated Discovery Global as being worth roughly $3 per share, which would make Netflix’s $27.75-per-share offer richer than Paramount’s. But if Discovery Global was worth $4 per share, then Paramount’s deal could be seen as richer.

Cuban beer, Jewish dentists, and Gulf cash

Sabino argued that this case promises to recall even some more esoteric defenses, deep cuts like thetitles buried inside the Netflix library. He mentioned the “Jewish dentist” defense—a case from the 1970s where opponents of a deal warned that Jewish clients might shun a dental‑supply firm if a Kuwait-based investment vehicle succeeded.

There was also the less successful “Cuban beer” defense that Sabino characterized as a variation of “Jewish dentist.” It arose in 2008 when InBev, aglobal beer conglomerate based in Belgium, tried to acquire the iconic American beer company Anheuser-Busch. Through a subsidiary, InBev had operations in Cuba, and Anheuser-Busch tried to raise these as a concern as it attempted to keep its independence. Sabino told Reuters at the time that it was a “brilliant but desperate move,” and AB InBev was ultimately formed out of the historic $107 billion merger.

The connection to these deals, of course, is the Middle Eastern funding component of the Paramount bid for WBD. Valued at $24 billion, the Middle Eastern backing was facilitated in part by Jared Kushner, President Trump’s son-in-law, and Sabino said he expects someone to ask whether Americans will ultimately really want Middle Eastern sovereign funds holding big stakes in a Hollywood, even though David Ellison claims that those stakes won’t involve any governance rights. Analyst Rich Greenfield of LightShed Partners challenged Ellison about this directly on a conference call about Paramount’s bid: “Just wondering if you could give us any color on why they’re investing so much with no governance, right? Like what’s the — is there any rationale you can provide?”

Ellison responded to Greenfield that the compelling “industrial logic” would create a company generating a lot of cash flow immediately. “When you look at that from a returns perspective, it’s incredibly attractive to—obviously, to all shareholders. And from that standpoint, I think that’s why our partners obviously are here.”

Referring to the Middle Eastern and Kushner-adjacent aspects of this story being different from the legal textbooks, Lund said “there are aspects of this that feel like a throwback, and there’s aspects of this that just feel so 2025.”

“Under Revlon,” she said, “you have to think about what’s going to create shareholder value. You think that would be a politically neutral thing, right? But when you have a president that’s out there saying, I’ve got a perspective on this, and I’m going to be involved in this, and that’s going to affect regulatory clearance. Now, all of a sudden, you have to worry about that whole political aspect of it as a part of your Revlon duty. And that’s very new.” Lund said dealmakers are confronting political entanglements that they haven’t had to confront before.

Sabino, by contrast, downplayed the political aspect as “overblown,” arguing that both offers ultimately turn on money and law, not party ties. “I think politics has very little to do with it, okay? Because again, the bottom line is, this is business. This is about money, okay?” The president, Sabino added, is a “very energetic guy” who “says a lot of stuff.” At the end of the day, Sabino said, he thinks Revlon and Time and shareholder value will win out, with Sarandos, Ellison and Warner, regardless of their political persuasion, playing M&A hardball. “These folks are deadly serious.”

Editor’s note: The author worked for Netflix from June 2024 through July 2025.