Business

5 stocks to buy—and 5 to avoid—if 2026 brings a downturn

Published

3 weeks agoon

By

Jace Porter

It’s getting frothy out there. Pick any stock market metric, whether it’s the Nasdaq’s closing price or a more technical measure like the Shiller P/E ratio, and the number will look unusually large. Throw in crazy AI valuations, for privately held startups and publicly traded stocks alike, and what we’re seeing looks a lot like a bubble.

Perhaps this time is different. But note that phrase served as the ironic title of an acclaimed 2011 book by economists Carmen Reinhart and Kenneth Rogoff—a work whose subtitle is “Eight Centuries of Financial Folly.” In any case, if you’re one of many looking at your swollen portfolio with a mix of glee and dread, it may be time to consider a rebalancing act.

This section of this year’s Investor’s Guide offers some ideas on how to go about that. We offer tips on how to play defense in the current stock market (spoiler: Candymakers are a sweet bet for sour times). We also devote some space to stocks that might be best held at arm’s length; whatever these companies’ ultimate fates might be, these aren’t the times or the prices at which to be a buyer. And for optimists, we have a preview of some buzzy rumored IPOs coming next year. Choppy markets can make for attractively priced debuts: Perhaps you will find the next UPS, which went public right before the dotcom bust, or Visa, which listed on the eve of the 2008 financial crisis. We’ll also weigh in on gold and Bitcoin.

In the wake of Warren Buffett penning his final letter to investors, it feels fitting to say his most famous adage applies like never before: Be greedy when others are fearful, and fearful when others are greedy.

Playing defense: Stocks for a slowdown

Jim Masturzo, chief investment officer of multi-asset strategies at investment manager Research Affiliates, says a good first step is to diversify beyond stocks to TIPS (Treasury Inflation-Protected Securities) or commodities like gold. When it comes to equities, Roger AliagaDiaz, Vanguard chief economist in the Americas, advises embracing value stocks—stocks whose prices are low relative to their earnings. Not all value stocks are created equal, of course. Here are some categories and names to consider that are likely to fare well in an economic downturn (prices are as of market close Nov. 13):

Consumer plays:Amy Arnott, a portfolio strategist at financial services firm Morningstar, says companies that produce staples like food and cleaning products are less correlated with broader economic trends. Stocks in this “consumer defensive” category include Colgate-Palmolive (CL, $79), which makes toothpaste and other household items. In addition to selling goods that consumers will buy in any economy, “Colgate is unique in the fact that they are very globally diversified,” says Erin Lash, Morningstar’s director of consumer equity research.

Lash is also a fan of Mondelez International (MDLZ, $57), a candy, food, and beverage company, in part because it derives more than 70% of its revenue outside North America. “Confectionery in particular remains an affordable indulgence for consumers,” she says.

You’ve still got your health: Stocks in the health care sector, another recession-resistant industry, are another way to buffer your portfolio from market shocks. David Trainer, CEO of investment research firm New Constructs, likes HCA Healthcare (HCA,$473), which operates around 190 hospitals and 150 other health care facilities in the U.S. and U.K. “Demand for health care is going up like crazy,” says Trainer, adding that this trend, combined with HCA’s more-than-decade-long history of notching consistent profits, makes it a strong, undervalued play.

Energy hogs: Once-boring energy stocks became buzzy owing to the AI sector’s insatiable need for power, which has produced record-high electricity demand. But even if the AI boom goes south, energy businesses aren’t as risky as they seem, says Masturzo of Research Affiliates, because overall demand for power remains strong.

MPLX (MPLX, $52) is an Ohio company that owns oil pipelines and fuel transportation facilities. “As long as people need energy, they’re going to transport it,” says Trainer. Its price/earnings ratio in mid-November was 11, much lower than the average of 31 among the S&P 500.

“Anti-AI”: Arnott, the strategist at Morningstar, says that if investors are worried about the overvaluation of AI stocks, they could look to Buffett. The business legend’s Berkshire Hathaway (BRK.B, $513) is a conglomerate that Arnott describes as “an anti-AI play.” The firm derives much of its income from sectors like energy, railroads, and insurance—services that will be very much in demand even if the AI bull market turns bearish.

Don’t buy ’em now

In a frothy market all stocks are risky— and that’s doubly true for companies that may have soared too high in the recent boom, or that face harsh economic headwinds. Here are candidates to avoid, at least until business conditions revive or their prices come down to earth.

Circle (CRCL, $82) went public this summer in one of the most successful IPOs in history. That was then; now, the crypto firm is struggling to hold its value as interest rates, which directly impact Circle’s stablecoin revenue, are poised to decline. Circle’s share price is facing further pressure from the end of a lockup period for employee stock sales, and its ongoing struggle to control expenses.

Tesla (TSLA, $402) is on pace to record its worst year of profits since 2021. It’s also headed for a second straight year of shrinking sales in its car business. Still, the stock is trading at all-time highs. Why? Investors are likely betting that CEO Elon Musk will deliver on moonshot promises of self-driving cars and humanoid robots. Maybe Musk is worth his recently won $1 trillion pay package, but the likelihood of Tesla turbocharging its car sales in 2026 to match its current valuation seems out of this world.

Bears are sounding the alarm over inflated valuations for AI companies, and there’s perhaps no purer publicly traded AI play than CoreWeave (CRWV, $78). The company operates data centers across the U.S. and sells computing capacity to Microsoft, Google, and OpenAI. CoreWeave “is the poster child of the AI infrastructure bubble,” Kerrisdale Capital, an investment management firm shorting the company’s stock, wrote in September. The core of CoreWeave’s risk lies with its liabilities: To finance the construction of its data centers, it has incurred billions in debt and taken on hefty lease obligations. Can it juice its revenue to outpace that tsunami of liabilities?

Two words: prediction markets. That describes the business of upstarts Kalshi and Polymarket, which made their names offering odds on U.S. politics, but are fast expanding to other categories—including sports betting. This has left DraftKings (DKNG, $30) one of the most popular online sportsbooks, on its back foot. “Analysts are downplaying the tectonic shift that we believe is occurring in the sports betting market and DKNG,” wrote short-seller Spruce Point Capital Management in an October report.

After President Trump unveiled a sweeping set of tariffs on what he termed “Liberation Day,” swaths of companies saw their share prices tumble. Many have since recovered, but Deere (DE, $473), the venerable maker of John Deere agricultural and construction machinery, has continued to struggle. For the first three quarters of 2025, the company reported year-over-year decreases in net sales, and it’s been wrestling with the impact as trade wars play havoc with American farm exports—not a good sign for tractor sales.

IPOs to watch for in 2026

If 2024 amounted to an IPO drought, the 2025 IPO market has been more like a persistent drizzle. That, more or less, bodes well for an even steadier stream of public debuts in 2026.

“The IPO market is not closed,” says Merritt Hummer, partner at Bain Capital Ventures. “It’s just curated, and I think that’ll continue to be the case.

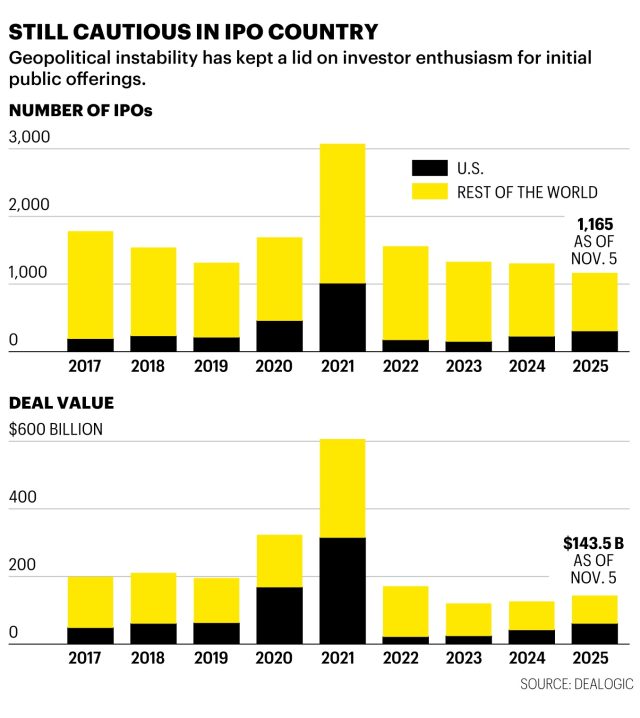

That cautious but decidedly positive sentiment is a bigger deal than it may appear on the surface. After IPOs soared in 2021 amid near-zero interest rates and stay-athome investor mania, the past few years have been muted. According to Dealogic, there were 1,010 IPOs in the U.S. in 2021, including marquee brands like Rivian, Bumble, and Robinhood. Over the next three years, however, the market collectively mustered only 546 more public offerings, with just a handful of big names in the mix.

Then came 2025, which through Q3 has seen more than 300 U.S. IPOs, including blockbuster debuts from CoreWeave, Circle, and Figma. It was a decent but not great year in the view of market watchers, but they’re bullish on 2026. “Everything is set up for a much more positive year, because multiples are still pretty strong for tech in the public markets,” says Kyle Stanford, PitchBook director of research for U.S. venture capital.

Geopolitical instability has fueled post-2021 stagnation in the IPO market, as have higher interest rates. But that stagnation means the bench for potential venture-backed IPOs runs deep with companies that have been biding their time.

There are obvious giants waiting in the 2026 wings, the most notable of which is Databricks, a cloud platform for AI and data analytics valued north of $100 billion. Long discussed as an inevitable public company, Databricks has a key advantage that will be essential for any company looking to go public at a premium: an AI angle.

“Anything with an AI story is getting a premium,” says Mary D’Onofrio, Crosslink Capital partner. “Databricks, for example, had $4 billion of run rate revenue, and AI products were providing $1 billion of it…Anything that can touch on AI, which tugs on the purse strings and the willingness to buy of customers, suggests ongoing growth.”

This is equally true for other names attracting IPO buzz, including Canva, which in 2024 acquired Leonardo.ai, leveraging the startup to launch new AI-flavored products. (The successful IPO of fellow design unicorn Figma is being cited as evidence of Canva’s readiness.) There’s also Deel, an HR platform valued at around $17 billion, which makes its AI case by investing in automation. (Notably, none of these companies are making the kinds of massive infrastructure investments that have some industry watchers worried about an AI bubble.)

All this AI talk evokes the question: What about OpenAI? It’s not impossible, but most watchers think OpenAI won’t take the leap into public markets until 2027.

Meanwhile, the most underrated IPO story of 2026 could very well be fintech. This year saw the likes of Chime, Klarna, and Circle go public, and unicorns like Plaid and Rapyd are rumored to be waiting in the wings.

“Chime and Circle showed that fintechs with clear profitability paths can perform well, and that gave the market confidence again,” says Aditi Maliwal, Upfront Ventures general partner and early Chime investor. “‘Profitability’ wasn’t a word anyone was using in the 2012 to 2019 runup. And now it’s the most important term we talk about and are thinking about for next year.”

Others tech firms to watch out for: cybersecurity company 1Password, fleet management software provider Motive, and fitness tracking app Strava.

But a word of caution: A host of factors could rain on this parade. PitchBook’s Stanford doesn’t expect a recession, but says that if one materialized it would stymie the IPO pipeline. And then there are the unpredictable dynamics of the AI boom. David Chen, Morgan Stanley’s head of global technology investment banking, thinks much of the current hype will create serious long-term value. But not every AI-fueled rise will live up to that hype.

“It kind of reminds me of when I started in this industry in 1999,” Chen says. “If expectations aren’t met…you’ll have a lessening of interest temporarily, which always happens in tech. There are always winners and losers.”

Can gold and Bitcoin sustain their runs?

Gold has always been the ultimate safe haven in times of economic trouble. But these days, a growing number of market watchers say investors should opt instead for digital gold—a popular nickname for Bitcoin. Owing to the rules governing its creation, there will only ever be 21 million Bitcoins in circulation, which is a big reason fans say it should be treated as a permanent store of value, just like the famous yellow metal. “It’s the only place you can go that’s independent from government inflation,” says David Pakman, a managing partner at the venture capital firm CoinFund. “It’s the kind of asset you’ll hand down to your kids—you must own it.”

It’s clear many people agree with Pakman, based on Bitcoin hitting a record-high price of around $125,000 in October, and seeing its market cap swell to over $2 trillion. The World Gold Council and prominent goldbugs, who used to ignore Bitcoin, now regularly denounce it, recognizing competition.

Does this mean gold’s days as the safest of assets are numbered? Hardly. As of November, Bitcoin’s market cap was only around 7% of the total value of all above-ground gold. What’s more, gold has been on an unprecedented tear this year, hitting $3,000 an ounce for the first time in March, and $4,000 less than six months later.

The eye-popping runs have left goldbugs and Bitcoin believers ecstatic. But Mike McGlone, a senior commodities strategist with Bloomberg Intelligence, says he is experiencing a different emotion. He describes himself as “frightened” by the soaring prices of numerous commodities, including gold, and believes a major correction is coming that could see the price of the yellow metal drop 25% or more.

McGlone says he is especially skeptical of Bitcoin’s trajectory after attending an investing summit in Naples where he witnessed people stand and clap whenever someone mentioned the cryptocurrency. “This is classic peak market stuff,” he warned, predicting that Bitcoin could fall to around $50,000 in the coming year.

Indeed, there are signs that the crypto rally, fueled by the launch of Bitcoin ETFs and the Trump administration’s favorable regulatory policies, is running out of gas. In early November, the currency dipped below the $100,000 mark and has since floated closer to that level than to its all-time high. Pakman, though, is taking the long view. “It’s just the greatest asset ever created,” he said. “Bitcoin has performed better than any asset over 11 of the last 14 years. —Jeff John Roberts

This article appears in the December 2025/January 2026 issue of Fortune with the headline “What to buy, and not buy, in 2026.”

You may like

Business

Student Beans made him a millionaire, a heart condition made this millennial founder rethink life

Published

44 minutes agoon

December 11, 2025By

Jace Porter

Today, we meet James Eder, the 42-year-old cofounder of Student Beans (a discount coupon company targeting the college crowd), who is now a work-life coach splitting his time between London and the French Alps, and author of The Collision Code.

Eder was inspired to build Student Beans in 2005 after organising his university’s summer ball—a party for over 600 students where he was responsible for sponsorship. Seeing how much brands wanted access to students—and how much students loved a deal—sparked the idea.

“My calls to big brands led to me asking for samples and raffle prizes,” Eder recalls to Fortune. “Soon, my student hall bedroom was filled with condoms from Durex, Jelly Belly Jelly Beans, Coffee from Starbucks, Pot Noodles and Lush soaps that made it fragrant for months after.”

At the same time, Eder was working as a brand manager for Yell, where he says he’d already worked with more than 30 brands. A business plan assignment in his degree became the perfect place to shape the concept.

So after graduating, he and his older brother—who worked at an investment bank and had his own side hustle, selling titanium power on Ebay—bootstrapped what became one of the U.K.’s defining student platforms, with a £3,000 loan.

Over 15,000 students signed up to get exclusive discount vouchers from over 200 local businesses in its first year. By year three, Student Beans had 150,000 users. And today? It’s rebranded as Pion, works with over 3,500 brands from Gymshark to Uber, with over 5 million customers in more than 100 countries.

While Eder still holds a 35% stake in the £30-million-a-year turnover company, he walked away from day-to-day operations 10 years ago to pursue another idea: A location-based rival to LinkedIn called Causr, where you’d be able to see professionals nearby and connect.

But despite raising £500,000 and attracting 3,000 users, Eder’s second startup collapsed. A heart condition diagnosis forced him to rethink everything.

Having a defibrillator implanted in his chest quietly reshaped how he approaches purpose, work, and the limited resource none of us get back: time.

Today, Eder spends up to half the year in Méribel. He skis most mornings, and is fresh off the launch of The Collision Code—his book, which hit No. 1 on Amazon’s “Most Gifted” list and has already raised more than £8,500 for heart-health charities.

Yet even with the mountain air and flexible schedule, he says the real “good life” is less about escape, and more about learning how to design a life you don’t need to run away from.

The finances

What’s been your best-ever investment?

The best investment I ever made was £400 on a three-day personal development programme called The Landmark Forum in 2009. A friend invited me to an introductory evening. I was sceptical, but I also knew I had nothing to lose. At the very least, I thought it would be three days of reflection, learning about myself and meeting new people.

But it helped me understand how I operate, why I behave the way I do and which beliefs were holding me back. It shifted how I showed up for myself and for others. It gave me the confidence to speak up, build meaningful relationships and say yes to opportunities that scared me. Everything I have done since, from founding companies to writing my book The Collision Code, traces back to the moment I decided to invest in myself.

Once I became a qualified coach, these stepping stones enabled me to design a life that means I live in the French Alps up to six months of the year, enjoying the mountain air and skiing whilst balancing my clients and health.

And the worst?

My second startup, Causr. I raised £150,000, registered for VAT (value added tax) and qualified for R&D tax credits, which brought the total investment closer to £200,000. I also invested three years of my life. We built an app for both Apple and Android and attracted around 3,000 users, but engagement was almost non-existent.

I thought with the success behind me, having built Student Beans, I was so confident the world needed this and I could make this work. But I made the mistake of moving too fast. The moment the funding landed, I felt pressure to spend it and scale immediately. If I could go back, I would have continued testing, validating and learning with a much smaller audience before committing to a full build.

What are your living arrangements like?

I’m fortunate to spend time in between London, Kentish Town, in an old converted school with floor-to-ceiling windows, and a roof terrace that gets the sun for most of the day. I moved there when we relocated the Student Beans offices to Kentish Town and when I was there day-to-day it was just a ten-minute walking commute.

For almost half the rest of the year I’ve chosen to live in the French Alps in a beautiful studio apartment just above Meribel Centre in one of the best and largest ski areas of the world, The Three Valleys. I first fell in love with the mountains, skiing in the same area at around four or five. When I was diagnosed with my heart condition, it was a dream to be able to go back there and make this happen. I feel like I’ve got the perfect balance of the buzz of London and having everything on my doorstep, then mountain escape.

What’s in your wallet?

I never carry any cash. I have two default bank cards I use: The Virgin Atlantic Credit card which affords me to travel regularly in premium and upperclass, or my Revolut, which offers such convenience for different currencies whilst travelling and a brilliant interface.

Do you invest in shares?

I used an advisor for a number of years, making sure I benefited from the ISA tax-free allowances (similar to a Roth IRA in the U.S.). The most fantastic thing I did was invest in a money coach. For the first time, I understood how it works, what a bull and bear market is, what a tracker fund is … I now manage my funds and use Vanguard and Interactive Investor to do the work. I also invest in premium bonds, which are also tax-free investments.

What personal finance advice would you give your 20-year-old self?

I would emphasise the importance of monthly contributions, however small and maximising the tax-free ISA allowances as much as possible.

What’s the one subscription you can’t live without?

My EasyJet Plus subscription. Due to most of my European travel being short-haul with the majority served by EasyJet, it’s a useful perk—priority security, speedy boarding, seat selection and extra handheld luggage.

What’s your most ridiculous ongoing expense?

I don’t have ridiculous ongoing expenses, but I make up for it with travel. Most of my outgoings are on destination travel and related expenses. My annual ski pass for those who don’t ski might be questionable.

Courtesy of James Eder

The Necessities

How do you get your daily coffee fix?

I don’t drink coffee. I never got into it. My weakness is hot chocolate with cream, which I usually drink daily during the winter in the Alps, and it ranges in price from €5 to €10—so a habit of up to €40 a week.

What about eating on the go?

My go-to when I’m in the U.K. is PizzaExpress and Wagamama, reasonably priced and quick eats. I usually eat out three to four times a week. If I’m in town and in between meetings a Pret-A-Manger is a frequent destination. For meetings, I will often be at The Ivy, The Granary Square Brasserie in Kings Cross, The Wolseley or The Delaunay. Novikov or Sketch are also favourites.

Where do you buy groceries?

When I’m in London, I’ll grab food on the way home from being out—a stir fry, or salmon. In France, I do a weekly shop from Carrefour and feel like I have a better balanced diet as I have more time to spend planning and in the kitchen. It’s just a different way of living.

What’s a typical work outfit for you?

I’m usually in jeans from Citizens of Humanity with a shirt and a tailored jacket, polished but relaxed. Day-to-day, I’ve been leaning more casual and think Uniqlo is great for quality basics. I budget up to £1,000 a year on clothes and focus on things I’ll wear again and again.

The Treats

Are you the proud owner of any tech gadgets?

My Apple Watch has been a game-changer. I originally got it with my Vitality Health Care insurance plan and it has helped me identify when I had a change in heart rhythm as well as give me more confidence in exercising.

The one gadget that I think would really improve the quality of my life is a kitchen robot. Of course, there are private chefs, but the idea of having something in my kitchen that can cook with anything is wild.

How do you unwind from the top job?

What’s your take on work-life balance at the top?

In the early days of Student Beans, I was definitely working for over 12 hours a day and felt like I was always on. That was the same at Causr. Since I’m now a coach and author, work ebbs and flows.

Some days I’m out first thing for a breakfast meeting, working through the day, having an interview, doing a photo shoot, a lunch appointment, writing content, speaking at an event, recording a podcast and out for dinner. My take on work-life balance is to reframe it as being about life and whether you’re enjoying it or not.

How do you treat yourself when you get a promotion?

Because I have always worked for myself, promotions were never my milestone. Instead, I celebrated big moments like signing a major client, or raising investment. Those were the times I treated myself to something special. I love the art in my flat and choosing pieces that connect to a memory makes them even more meaningful. One of my favourites is an original limited edition Paul Kenton print of London and the Thames.

How many days annual leave do you take a year?

Whenever I am in France, it naturally feels like a holiday even though I am working. On top of that, I actively take around three months each year to travel and explore.

Take us on holiday with you, where did you go this year?

When I go on the heart transplant list, I’ll need to be within four hours of Cambridge and the transplant hospital at all times, so it’s made me focus on making the most of travelling.

I started 2025 in France, in March, visiting Tignes, another ski resort where I was a social host on European Snow Pride, a week-long gay festival. In April, I went to Gran Canaria for a few days. From there, I flew to Geneva and visited Meribel to get the keys to my new apartment, followed by a few days in Paris for my birthday. I spent a couple of weeks in Sardinia, including a sailing trip on a catamaran around Sardinia and Corsica. I then went to Wales for The Do Lectures, a few days of glamping with a community of over a hundred inspiring people.

Business

Google DeepMind agrees to sweeping partnership with the U.K. government

Published

9 hours agoon

December 10, 2025By

Jace Porter

AI lab GoogleDeepMind announced a major new partnership with the U.K. government Wednesday, pledging to accelerate breakthroughs in materials science and clean energy, including nuclear fusion, as well as conducting joint research on the societal impacts of AI and on ways to make AI decision-making more interpretable and safer.

As part of the partnership, Google DeepMind said it would open its first automated research laboratory in the U.K. in 2026. That lab will focus on discovering advanced materials including superconductors that can carry electricity with zero resistance. The facility will be fully integrated with Google’s Gemini AI models. Gemini will serve as a kind of scientific brain for the lab, which will also use robotics to synthesize and characterize hundreds of materials per day, significantly accelerating the timeline for transformative discoveries.

The company will also work with the U.K. government and other U.K.-based scientists on trying to make breakthroughs in nuclear fusion, potentially paving the way for cheaper, cleaner energy. Fusion reactions should produce abundant power while producing little to no nuclear waste, but such reactions have proved to be very difficult to sustain or scale up.

Additionally, Google DeepMind is expanding its research alliance with the government-run U.K. AI Security Institute to explore methods for discovering how large language models and other complex neural network-based AI models arrive at decisions. The partnership will also involve joint research into the societal impacts of AI, such as the effect AI deployment is likely to have on the labor market and the impact increased use of AI chatbots may have on mental health.

British Prime Minister Keir Starmer said in a statement that the partnership would “make sure we harness developments in AI for public good so that everyone feels the benefits.”

“That means using AI to tackle everyday challenges like cutting energy bills thanks to cheaper, greener energy and making our public services more efficient so that taxpayers’ money is spent on what matters most to people,” Starmer said.

Google DeepMind cofounder and CEO Demis Hassabis said in a statement that AI has “incredible potential to drive a new era of scientific discovery and improve everyday life.”

As part of the partnership, British scientists will receive priority access to Google DeepMind’s advanced AI tools, including AlphaGenome for DNA sequencing; AlphaEvolve for designing algorithms; DeepMind’s WeatherNext weather forecasting models; and its new AI co-scientist, a multi-agent system that acts as a virtual research collaborator.

DeepMind was founded in London in 2010 and is still headquartered there; it was acquired by Google in 2014.

Gemini’s U.K. footprint expands

The collaboration also includes potential development of AI systems for education and government services. Google DeepMind will explore creating a version of Gemini tailored to England’s national curriculum to help teachers reduce administrative workloads. A pilot program in Northern Ireland showed that Gemini helped save teachers an average of 10 hours per week, according to the U.K. government.

For public services, the U.K. government’s AI Incubator team is trialing Extract, a Gemini-powered tool that converts old planning documents into digital data in 40 seconds, compared to the current two-hour process.

The expanded research partnership with the U.K. AI Security Institute will focus on three areas, the government and DeepMind said: developing techniques to monitor AI systems’ so-called “chain of thought”—the reasoning steps an AI model takes to arrive at an answer; studying the social and emotional impacts of AI systems; and exploring how AI will affect employment.

U.K. AISI currently tests the safety of frontier AI models, including those from Google DeepMind and a number of other AI labs, under voluntary agreements. But the new research collaboration could potentially raise concerns about whether the U.K. AISI will remain objective in its testing of its now-partner’s models.

In response to a question on this from Fortune, William Isaac, principal scientist and director of responsibility at Google DeepMind, did not directly address the issue of how the partnership might affect the U.K. AISI’s objectivity. But he said the new research agreement puts in place “a separate kind of relationship from other points of interaction.” He also said the new partnership was focused on “question on the horizon” rather than present models, and that the researchers would publish the results of their work for anyone to review.

Isaac said there is no financial or commercial exchange as part of the research partnership, with both sides contributing people and research resources.

“We’re excited to announce that we’re going to be deepening our partnership with the U.K. AISI to really focus on exploring, really the frontier research questions that we believe are going to be important for ensuring that we have safe and responsible development,” he said.

He said the partnership will produce publicly accessible research focused on foundational questions—such as how AI impacts jobs or how talking to chatbots effects mental health—rather than policy-specific recommendations, though the findings could influence how businesses and policymakers think about AI and how to regulate it.

“We want the research to be meaningful and provide insights,” Isaac said.

Isaac described the U.K. AISI as “the crown jewel of all of the safety institutes” globally and said deepening the partnership “sends a really strong signal” about the importance of engaging responsibly as AI systems become more widely adopted.

The partnership also includes expanded collaboration on AI-enhanced approaches to cybersecurity. This will include the U.K. government exploring the sue of tools like Big Sleep, an AI agent developed by Google that autonomously hunts for previously unknown “Zero Day” cybersecurity exploits, and CodeMender, another AI agent that can search for and then automatically patch security vulnerabilities in open source software.

British Technology Secretary Liz Kendall is visiting San Francisco this week to further the U.K.-U.S. Tech Prosperity Deal, which was agreed to during U.S. President Trump’s state visit to the U.K. in September. In November alone, the British government said the pact helped secure more than $32.4 billion of private investment committed to the U.K tech sector.

The Google-U.K. partnership builds on a £5 billion ($6.7 billion) investment commitment from Google made earlier this year to support U.K. AI infrastructure and research, and to help modernize government IT systems.

The British government also said collaboration supports its AI Opportunities Action Plan and its £137 million AI for Science Strategy, which aims to position the UK as a global leader in AI-driven research.

Business

49-year-old Democrat who owns a gourmet olive oil store swipes another historically Republican district from Trump and Republicans

Published

10 hours agoon

December 10, 2025By

Jace Porter

Democrat Eric Gisler claimed an upset victory Tuesday in a special election in a historically Republican Georgia state House district.

Gisler said he was the winner of the contest, in which he was leading Republican Mack “Dutch” Guest by about 200 votes out of more than 11,000 in final unofficial returns.

Robert Sinners, a spokesperson with the secretary of state’s office, said there could be a few provisional ballots left before the tally is finalized.

“I think we had the right message for the time,” Gisler told The Associated Press in a phone interview. He credited his win to Democratic enthusiasm but also said some Republicans were looking for a change.

“A lot of what I would call traditional conservatives held their nose and voted Republican last year on the promise of low prices and whatever else they were selling,” Gisler said. “But they hadn’t received that.”

Guest did not immediately respond to a text message seeking comment late Tuesday.

Democrats have seen a number of electoral successes in 2025 as the party’s voters have been eager to express dissatisfaction with Republican President Donald Trump.

In Georgia in November, they romped to two blowouts in statewide special elections for the Public Service Commission, unseating two incumbent Republicans in campaigns driven by discontent over rising electricity costs.

Nationwide, Democrats won governor’s races by broad margins in Virginia and New Jersey. On Tuesday a Democrat defeated a Trump-endorsed Republican in the officially nonpartisan race for Miami mayor, becoming the first from his party to win the post in nearly 30 years.

Democrats have also performed strongly in some races they lost, such as a Tennessee U.S. House race last week and a Georgia state Senate race in September.

Republicans remain firmly in control of the Georgia House, but their majority is likely fall to 99-81 when lawmakers return in January. Also Tuesday, voters in a second, heavily Republican district in Atlanta’s northwest suburbs sent Republican Bill Fincher and Democrat Scott Sanders to a Jan. 6 runoff to fill a vacancy created when Rep. Mandi Ballinger died.

The GOP majority is down from 119 Republicans in 2015. It would be the first time the GOP holds fewer than 100 seats in the lower chamber since 2005, when they won control for the first time since Reconstruction.

The race between Gisler and Guest in House District 121 in the Athens area northeast of Atlanta was held to replace Republican Marcus Wiedower, who was in the seat since 2018 but resigned in the middle of this term to focus on business interests.

Most of the district is in Oconee County, a Republican suburb of Athens, reaching into heavily Democratic Athens-Clarke County. Republicans gerrymandered Athens-Clarke to include one strongly Democratic district, parceling out the rest of the county into three seats intended to be Republican.

Gisler ran against Wiedower in 2024, losing 61% to 39%. This year was Guest’s first time running for office.

A Democrat briefly won control of the district in a 2017 special election but lost to Wiedower in 2018.

Gisler, a 49-year-old Watkinsville resident, works for an insurance technology company and owns a gourmet olive oil store. He campaigned on improving health care, increasing affordability and reinvesting Georgia’s surplus funds

Guest is the president of a trucking company and touted his community ties, promising to improve public safety and cut taxes. He was endorsed by Republican Gov. Brian Kemp, an Athens native, and raised far more in campaign contributions than Gisler.

Sunburn — The morning read of what’s hot in Florida politics — 12.11.25

Former NBA Player Isaiah Rider Arrested After Allegedly Violating Protective Order

Save Your Wardrobe, Fairly Made link-up to help brands meet next-gen eco requirements

Trending

-

Politics8 years ago

Politics8 years agoCongress rolls out ‘Better Deal,’ new economic agenda

-

Entertainment8 years ago

Entertainment8 years agoNew Season 8 Walking Dead trailer flashes forward in time

-

Politics8 years ago

Politics8 years agoPoll: Virginia governor’s race in dead heat

-

Entertainment8 years ago

Entertainment8 years agoThe final 6 ‘Game of Thrones’ episodes might feel like a full season

-

Entertainment8 years ago

Entertainment8 years agoMeet Superman’s grandfather in new trailer for Krypton

-

Politics8 years ago

Politics8 years agoIllinois’ financial crisis could bring the state to a halt

-

Business8 years ago

Business8 years ago6 Stunning new co-working spaces around the globe

-

Tech8 years ago

Tech8 years agoHulu hires Google marketing veteran Kelly Campbell as CMO